Beating the S&P 500 Is Hard! Here Is How Our ETF Did It.

2022 proved to be a particularly challenging year for investors across the world. The S&P 500 closed 18.51% down despite a relatively good fourth quarter. In that context, many investors could have found solace in the fact that their investment at least outperformed the market. Unfortunately, this would not have been the case for many of them. As highlighted semiannually by the SPIVA scorecard, the majority of active managers underperform their benchmark over the medium to long term, and this is particularly true for U.S. equities. In the U.S., 9.97% of funds outperformed the S&P 500 after fees over the last 10 years, and 15.5% did so over the last five years. So, what could explain such poor results, and how could investors go about finding the diamond in the rough that will deliver this elusive outperformance?

Are Markets Too Efficient?

One often-mentioned explanation for the difficulties of active managers is the increasing efficiency of markets across the world and in the U.S. in particular. However, academics have demonstrated once and again that systematically investing in factor portfolios would have outperformed the market over the long term. Investing in high-dividend stocks, high-quality stocks or cheap stocks in a systematic manner should, we believe, give managers one of the keys to outperforming the market. It is worth noting that academic research has shown that the historical outperformance yielded by such factor investing strategies has not meaningfully decreased since their discoveries, even if markets have become more efficient. Of course, “systematic” is the keyword in this approach, and this is where active fund managers may be struggling.

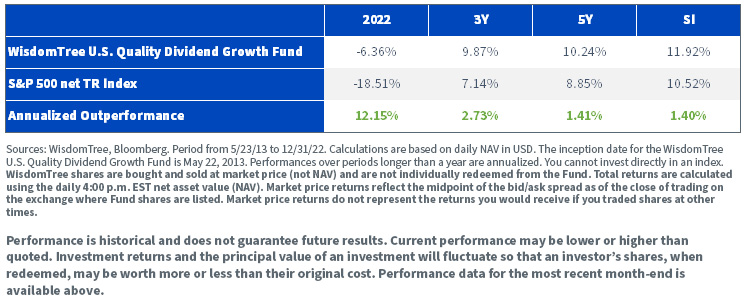

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) is a good example of how using this decade-long research can help investors seeking to outperform the S&P 500. Our ETF has outperformed since its inception in May 2013 and in many periods since then, as highlighted in figure 1 (5Y, 3Y, 2022). We believe one of the reasons for this success is that the ETF’s investment process is rooted in this academic literature and focuses on a systematic selection of a diversified basket of highly profitable companies with solid dividend-paying credentials, leaning heavily into the quality and high-dividend factors.

Figure 1: Historical Annualized Outperformance of DGRW vs. the S&P 500

Click here for the most current month-end and standardized performance.

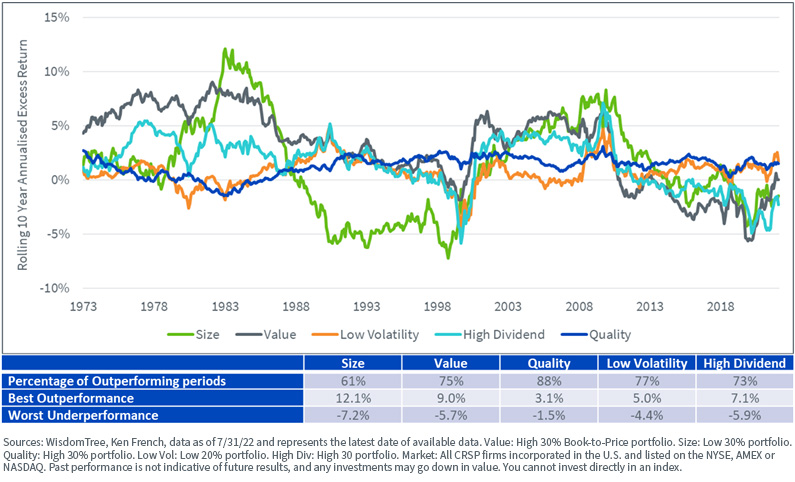

Of course, factors are not infallible, either. They do not outperform the market every single day or even every single year. While they tend to outperform over the long term, they also tend to ebb and flow between periods of relative underperformance and outperformance, depending on the cycle. But strategically, some factors exhibit higher consistency than others. This is the case for quality, which tends to outperform the most consistently with the lowest volatility, as shown in figure 2.

Figure 2: Historically, Quality Has Delivered the Most Consistent Outperformance over 10-Year Periods

Over rolling 10-year periods, we can see that the quality factor has exhibited outperformance most often (88% of the time versus the market) and has the smallest “worst underperformance” number of all factors. It suggests that quality is a true “all-weather” factor, and that is the reason why WisdomTree decided to build its “core” equity exposure ETF around that specific factor with the success I just described.

Is There a Tech Curse in the U.S.?

Another often-mentioned explanation is that the U.S. market is increasingly concentrated in large-cap tech stocks and active managers suffer from underinvestment in those stocks. This would imply that it is not possible to outperform the S&P 500 without taking even bigger bets on tech stocks and, in particular, non-dividend-paying tech stocks like Amazon, Tesla, Meta and Alphabet. Extending this premise further, it is possible to wonder if only growth strategies have any chance to outperform in the U.S. Isn’t the incredible run of growth versus value over the last 10 years proof of that?

DGRW is a great example to show that neither of those things is, in fact, fundamentally true.

- First of all, the ETF focuses on dividend-paying, dividend-growing stocks, meaning that it does not invest in companies that don’t pay a dividend. This means no investment in Amazon or the like. The average weight of Information Technology in the ETF in the last three years was 24.2%: i.e., under-weight to the 27.1% of the S&P 500.

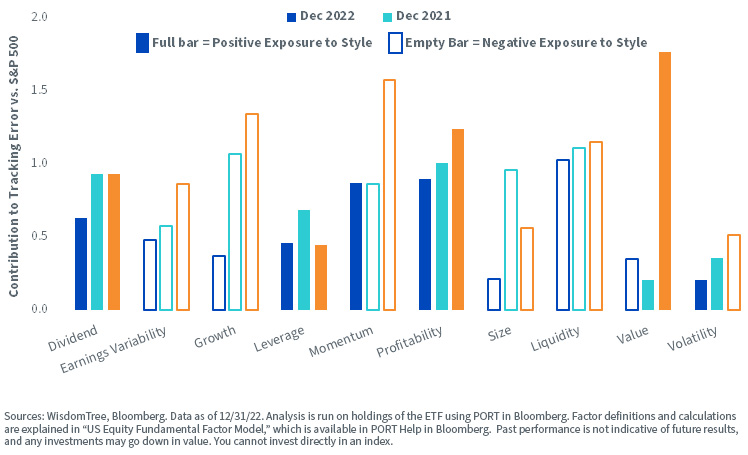

- Furthermore, the ETF has been consistently positively exposed to the high dividend factor and negatively exposed to the growth factor, as illustrated in figure 3.

Both of these facts did not stop the ETF from outperforming its benchmark over the medium to long term, as illustrated in figure 1.

Figure 3: Factor Exposure of Returns in Excess of the S&P 500 over Time

Do Highly Profitable Companies Rule the Market?

A final, intriguing explanation comes from a paper published in 2018 by Professor Hendrik Bessembinder that shows that only around 4% of stocks explain the totality of the excess wealth created by U.S. equities between 1926 to 2016. In other words, a handful of the most successful companies create most of the outperformance. Looking back at which companies those are, we find Apple, Microsoft, General Electrics, IBM and so on. This, again, would speak to an approach where the focus is on companies that are growing, profitable and high quality, leaning into the main principles that WisdomTree uses with its quality dividend growth strategies.

What Is the Conclusion Then?

Whatever the reason for the failings of active managers when it comes to delivering consistent outperformance, at WisdomTree, we believe a robust, research-driven, systematic investment process focusing on high-quality stocks is the cornerstone of an equity portfolio and the key to building resilient portfolios that can help investors build wealth over the long term and weather the inevitable storms along the way.

The ETF’s portfolio is constructed around 300 dividend payers with the best-combined rank of earnings growth, return on equity and return on assets within a universe of companies with sustainable dividend policies. Stocks are also risk-tested using a proprietary risk screen (composite risk score), which uses quality and momentum metrics to rank companies and screen out the riskiest companies and potential value traps. Each company is then weighted based on its cash dividend paid (market capitalization x dividend yield), which introduces valuation discipline into the portfolio. Those steps, in combination, deliver a thoughtfully blended exposure to quality and high dividend. We believe the outperforming track record of the WisdomTree U.S. Quality Dividend Growth Fund over the last nine and a half years is a testament to that.

Looking forward to 2023, recession risk continues to hang over the market like the sword of Damocles. The International Monetary Fund (IMF) is warning of a recession in the U.S., a deep slowdown in Europe and a drawn-out recession in the United Kingdom. While inflation has shown signs of easing, we expect central banks to remain hawkish around the globe as inflation is still very meaningfully above targets. With markets facing many of the same issues in 2023 that they faced in the second half of 2022, it looks like resilient investments that tilt to the quality and high dividend factors that have done particularly well in 2022 could continue to benefit.

1 Source: S&P, SPIVA Report, as of 6/30/22.

2 Hendrik (Hank) Bessembinder, “Do Stocks Outperform Treasury Bills?” Journal of Financial Economics (JFE), Forthcoming, 5/28/18. Available at SSRN: https://ssrn.com/abstract=2900447 or http://dx.doi.org/10.2139/ssrn.2900447

Important Risks and Disclosures Related to This Article

Click here for a full list of DGRW’s Fund holdings. Holdings are subject to change and risk.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

For definitions of terms in the charts above, please visit the glossary.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.