WisdomTree 101: Primer on Real Yields

If investors are looking for a single catalyst to explain capital markets (and flows) in 2022, our best answer would be the dramatic shift in U.S. real yields. In part two of our market monitor series, we explain the underlying calculations and drivers of changes in real yields to better equip investors to navigate markets going forward and what may lay ahead.

Nominal vs. Real

In part one of our market monitor series, we discussed the U.S. yield curve and current yields available by investing in various forms of fixed income. When you hear someone speaking about interest rates, most often, they are referring to nominal or non-inflation-adjusted rates. Interest rates quoted net of inflation are “real” yields, given that they attempt to show the “real” level of compensation.

Consider an investment in a 5-Year U.S. Treasury bond.

Let’s say an investor receives 4% interest per year over the life of the investment. While the nominal returns on this investment are 4%, if inflation were positive over the period, the real return would be lower due to the erosion in purchasing power. If inflation averaged 4% over the life of the investment, real returns would actually be zero, given that the nominal returns were offset by a corresponding increase in the inflation rate.

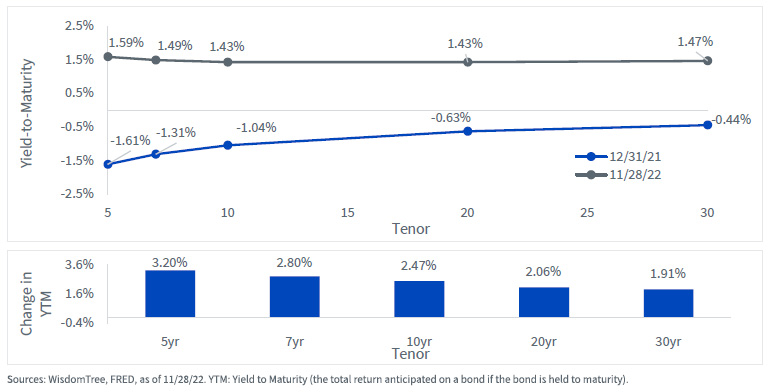

As we show below (and in our daily market monitor), real yields can be directly observed from the Treasury Inflation-Protected Securities (TIPS) yield curve. This is because TIPS yields are quoted in real terms, i.e., nominal yields minus the expected inflation rate. As you can see, TIPS yields went from being negative across most tenors of the yield curve to firmly positive. Negative real yields indicate that investors are actually experiencing periods of negative returns net of inflation.

Treasury Inflation-Protected Securities (TIPS) Yield Curve

Market Implications

As noted in the introduction, this dramatic shift in real yields has been huge for financial markets. Rate hikes and the Fed’s increasingly aggressive tightening stance played a key role in the rise in real yields, resulting in the real yield curve turning positive across all tenors.

This also helps explain why the U.S. dollar has appreciated so dramatically versus almost every foreign currency in 2022. In many countries, short-term rates remain much lower than in the U.S. The fact that investors can now derive positive carry net of inflation makes these assets more attractive, thus causing demand for them to increase. This demand for U.S. dollar-denominated assets versus foreign assets can lead to increases in the value of the U.S. dollar.

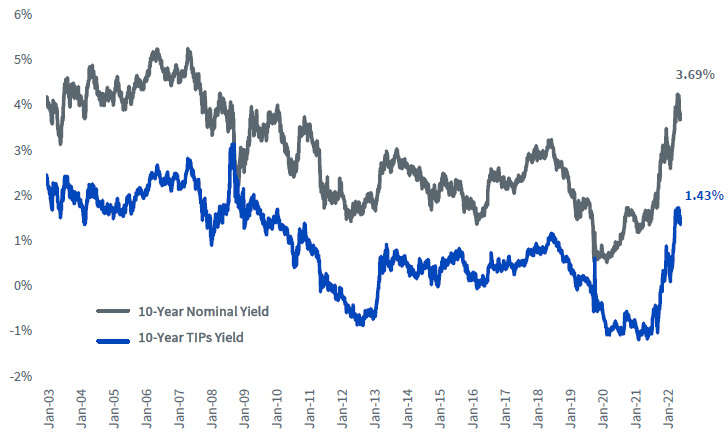

10-Year Nominal vs. Real Yields – 1/2/03–11/28/22

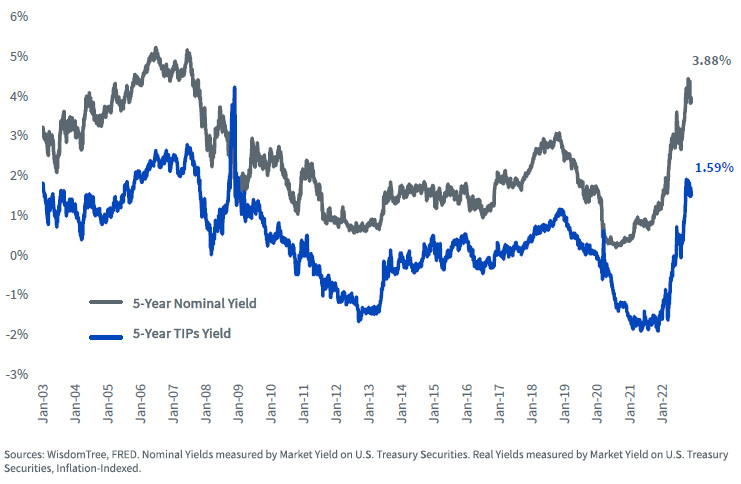

5-Year Nominal vs. Real Yields – 1/2/03–11/28/22

As we show in the above charts, real yields have increased to levels not seen since 2008 in both the 5-Year and 10-Year tenors. We view this trend to multi-decade highs as being important not only for contextualizing real yields versus other markets but also versus their history. The sharp increases this year have also contributed to the dramatic swings we’ve seen in global currency and interest rate markets.

Rising rates also matter for equities. An increase in rates impacts the cost of borrowing to finance new and existing projects as well as earnings growth. Even more important is the impact on the discount rate that applies for discounting future cash flows of financial assets to today. With negative real yields connoting very low discount rates, companies with low (or negative) profitability saw their valuations expand. However, once the opportunity cost of capital went higher, the competition for capital weighed on valuations and negatively impacted returns.

Conclusion

At the core, real rates represent the most fundamental measure of the cost of capital globally. In our view, the evolution of rates will continue to be a primary determinant of asset flows and returns going forward. As the dollar remains one of the most important reserve currencies in the world, investors should continue to focus on the evolution of real rates and what it means for the relative attractiveness of assets in the future.