Can Europe’s Dismal Decade Turn Around?

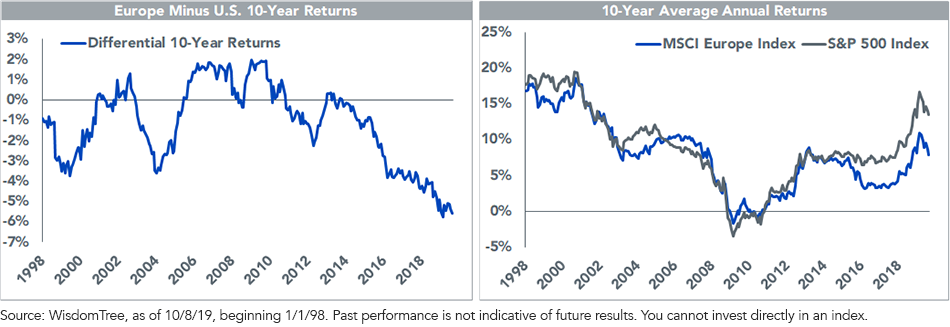

European stock markets are currently having their worst 10-year stretch for relative returns compared with the U.S. stock market in 40 to 50 years.1 Despite continued Brexit uncertainty weighing on sentiment, investors might want to start paying attention to European equities again.

Ever since the financial crisis, the U.S.’s role in global capital markets has become increasingly dominant, with European equities compounding returns over 600 basis points (bps) per year less than the S&P 500 Index’s returns over the most recent decade.

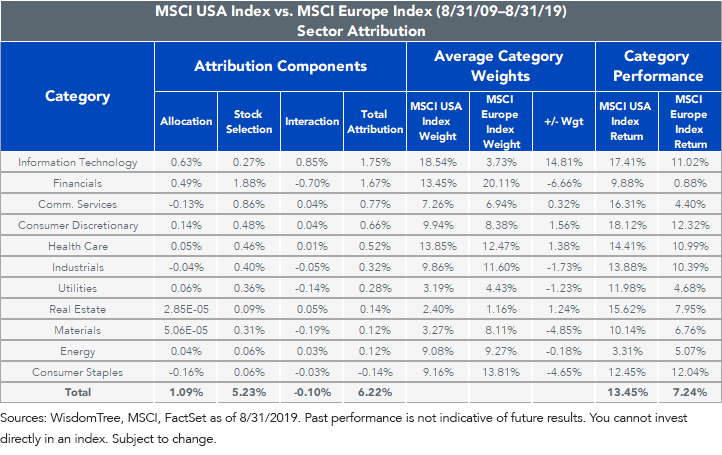

Anecdotally, we often hear that Europe’s inability to keep pace with the U.S. over the past decade is caused by over-weight positions in banks, which have struggled in the post-crisis environment, and the absence of firms comparable to the U.S. tech giants.

I examined this narrative by running an attribution report of the performance differential for the MSCI USA Index compared with the MSCI Europe Index over the last decade.

The attribution analysis was done in local currency terms for European markets because if it had been measured in U.S. dollars, Europe’s underperformance would have been even worse!

- The top contributing sector to Europe’s underperformance was Information Technology. Europe had less than 4% weight on average in the Information Technology sector over the last decade, compared with almost 20% in the MSCI USA Index. The U.S. Information Technology sector returned 17% per year this last decade, 11 percentage points ahead of the European markets as a whole. This explains over a quarter of the total gap in average annual returns and illustrates the differences in composition between each region’s equity market.

- The Financials sector was the next biggest contributor. While Europe had more weight in financials, European financials lagged U.S. financials by almost 1,000 bps per year for a decade. This toxic combination accounted for another quarter of the annual returns gap.

- Not all of the big U.S. tech firms are classified in the Information Technology sector, however. Amazon is classified as a Consumer Discretionary company, while Facebook and Google2 are in the Communication sector. When you look at these two additional sectors, they explain another quarter of the relative return gap between the U.S. and Europe.

- In short, the Information Technology and Financials sectors made up approximately 75% of the outperformance of the U.S. market, while the other 25% is attributed to the secular outperformance of U.S. stocks versus European stocks in basically every sector outside Energy.

Many value-minded investors may see this raw gap in relative returns and get attracted to the potential for mean reversion.

In the 30 years prior to 1999, European markets had outperformed U.S. markets, even when measured at the peak of the U.S. tech bubble.3 So, who is to say the U.S. will always outperform looking forward?

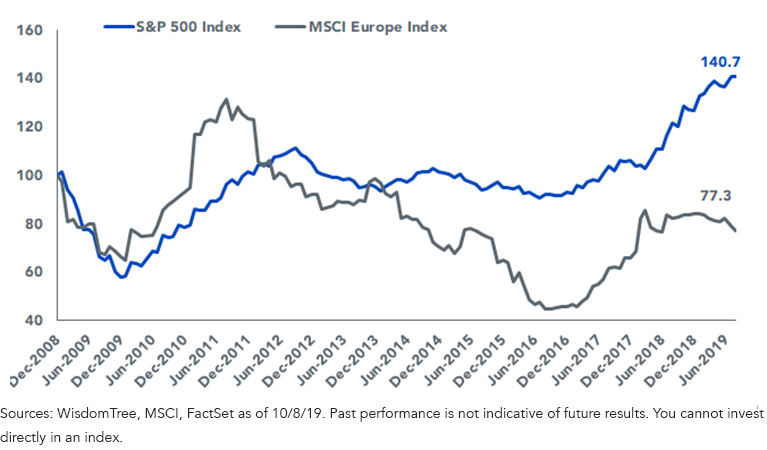

The higher returns in the U.S. were fully supported by underlying fundamental earnings trends: European earnings contracted 23% cumulatively over the last decade while U.S. earnings grew over 40%. The average annual growth rate differentials in these earnings metrics is close to 6%, which is essentially the same difference in relative outperformance between each equity market.

Earnings: S&P 500 Index vs. MSCI Europe Index (rebased to $100 as of 12/31/08)

Whether European markets are destined to mean revert and outperform the U.S. boils down to expectations for relative earnings growth.

Some considerations:

- European banks have been under enormous pressure. Structural forces are weighing on net interest margins, a key measure of bank profitability and lending activity, and there is a lot of excess capacity in European banks, but low valuations make consolidation very hard.

- Germany is being dragged down by a manufacturing slowdown that corresponds to weakness in global auto sales, global capital goods expenditures and especially weakness in China.

- There also remains uncertainty around Brexit and how the United Kingdom will leave the European Union that casts another shadow over European markets.

All this uncertainty makes allocations to European equity markets quite hard, but also potentially quite rewarding when the earnings outlook and sentiment inflects more positively.

The most immediate catalyst could be a resolution of global trade tensions, which has hurt China, emerging markets and ultimately Europe as well.

Further, a change in fiscal spending from countries with surpluses such as Germany could be a positive surprise that many may consider only a remote possibility today.

European investment strategies to consider:

- The WisdomTree Europe SmallCap Dividend Fund (DFE) has high sensitivity to the local economy in Europe, and we’d expect any impulse from more positive growth dynamics to support small caps over large caps.

- WisdomTree also believes there’s reason for taking less risk when investing abroad by using a currency-neutral approach, and the WisdomTree Europe Hedged Equity Fund (HEDJ), mitigates exposure to fluctuations in the euro. Unless one has a particularly bullish view on the euro itself, a blend of 50% HEDJ for large caps and 50% DFE for small caps may be an attractive combination that we have discussed before.

- Consider lowering exposure to financials. The WisdomTree Europe Quality Dividend Growth Fund (EUDG) includes profitability screens (return on equity and return on assets) as well as long-term earnings growth expectations, resulting in very little exposure to European banks that were battered over the last decade. Combining EUDG with small caps is another 50/50 combination that can provide diversified factor exposures to value, quality and size.

Unless otherwise stated, all data is from Bloomberg, WisdomTree and FactSet as of October 8, 2019.

1Sources: MSCI and WisdomTree research, as of 10/8/19.

2Please note that Amazon, Facebook and Google are not held in any of the exchange-traded funds mentioned in this post and are not eligible for inclusion, either.

3Based on WisdomTree and MSCI Index research, as of 10/8/19.Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses. There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. These Funds focus their investments in Europe, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. As these Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting those issuers. The Funds invest in the securities included in, or representative of, its Index regardless of their investment merit and the Funds do not attempt to outperform its Index or take defensive positions in declining markets. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.