Lowering Your China Risk

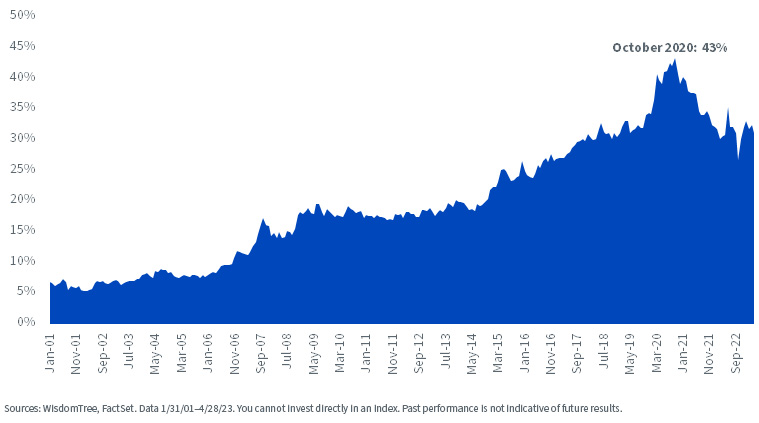

When the MSCI Emerging Markets Index launched in January 2001, the market-cap weight of the Chinese equity market was around 7%.

Fast-forward two decades and its weight has ballooned to roughly one-third of all emerging markets equities in most benchmarks. At its peak in October 2020, China made up 43% of the MSCI EM index.

Percent China Weight in the MSCI Emerging Markets Index

Chinese equities have recently been driven by idiosyncratic risks: China’s self-inflicted tech regulations, U.S.-China trade tensions, overbuilding and problems with real estate developers, and COVID-19 lockdowns and questions over the pandemic’s origins to name a few.

There is now increasing geopolitical tension with the U.S. over both China’s long-run intentions for Taiwan and its support of Russia. Seemingly, the only issue to unite Washington politicians is posturing over who could be ‘tougher on China.’

Given the significant weight of China in broad emerging markets allocations, increased but difficult-to-forecast risks have repeatedly frustrated some asset allocators.

The chorus is asking, “Is China investable?” Often an ‘un-investable’ narrative is what creates some of the best opportunities—think back to when oil prices went negative during the pandemic as a recent asset class that was also considered un-investable.

But actions of the U.S. regulators to penalize U.S. investors when Russia invaded Ukraine calls into question whether the same could happen to U.S. investments in China. This risk is certainly not zero and we believe increasingly investors will want to isolate and mitigate China-specific risks and opportunities that emanate from them.

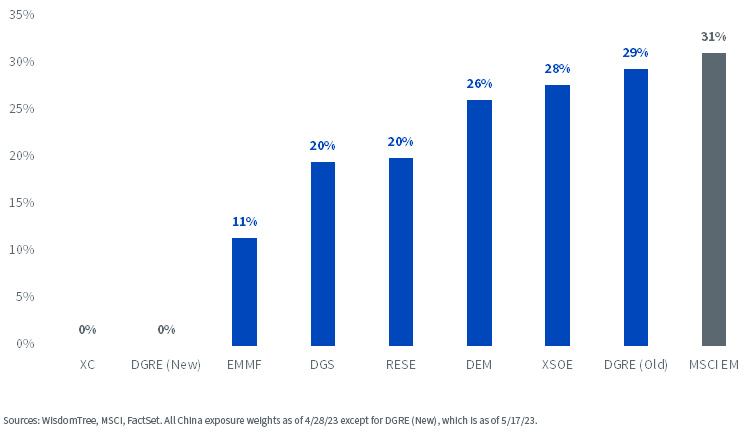

WisdomTree offers investors emerging markets exposure across seven different ETFs. In an attempt to give investors the optionality to unpack the percentage of China exposure in their EM portfolios and control how much China they really want, we launched the broad-based WisdomTree Emerging Markets ex-China Fund (XC) last fall.

In two actively run portfolios, WisdomTree took further steps to lower our China risks and give more tools to investors who want diversified emerging markets exposure.

The WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE) rebalanced and re-allocated completely away from China, while our Emerging Market Multifactor ETF (EMMF) lowered the weight in China to less than half that of the broad MSCI EM Index. We will follow up with more information on EMMF in another blog post, while focusing discussion in this post on the refreshed portfolio characteristics for DGRE.

Percent China Exposure

Methodology

DGRE is a rules-based active ETF. The model selects roughly 250–300 dividend-paying constituents, selected based on characteristics of higher operating profitability (quality) and trailing dividend growth.

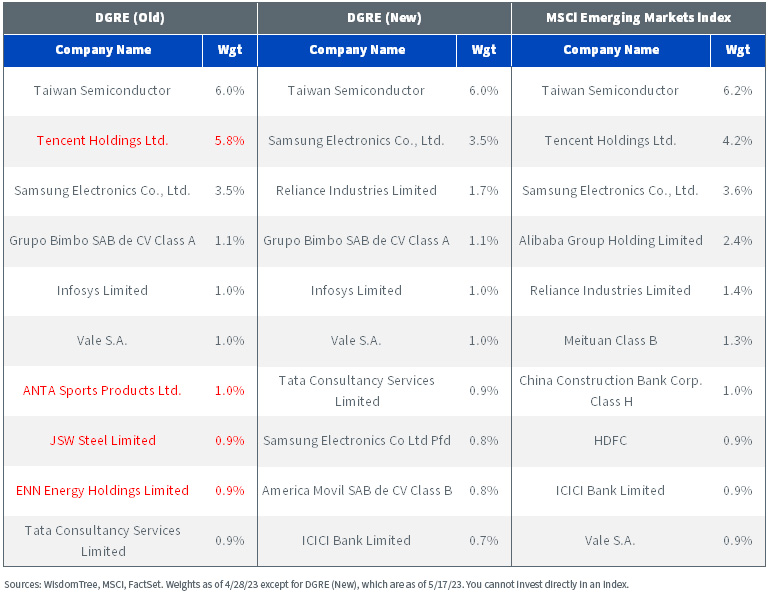

Several Chinese companies among the top 10 Fund holdings were removed for risk considerations, including Tencent Holdings, ENN Energy and ANTA Sports. JSW Steel Limited—an Indian Materials company—was the only non-China holding removed from the top 10 holdings based on the quantitative dividend-growth model.

Top 10 Holdings

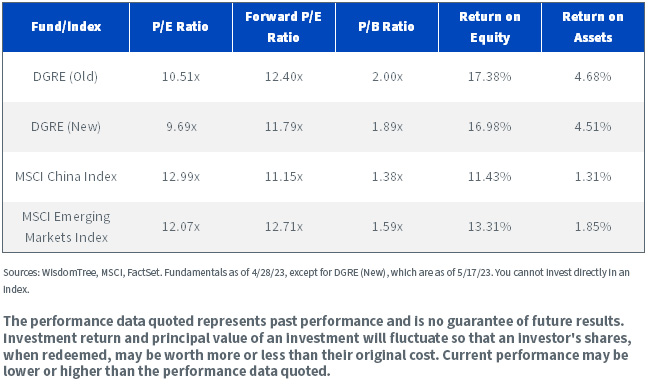

The weighting process is modified market-cap to give greater weight to companies with higher scores on quality and dividend growth. After this week’s reconstitution, DGRE maintained a trailing P/E ratio discount and 2X P/E points below the MSCI EM Index. Further, as the process favors high-quality companies earning a high return on equity and assets, those advantages over the broad MSCI EM Index were also well maintained.

In short, WisdomTree believes all the attractive portfolio characteristics of DGRE were maintained, but with the benefit of a significant decrease in China-specific risks.

Fundamentals Comparison

For the most recent month-end and standardized performance as well as fund holdings, click here.

For definitions of terms in the chart above, please visit the glossary.

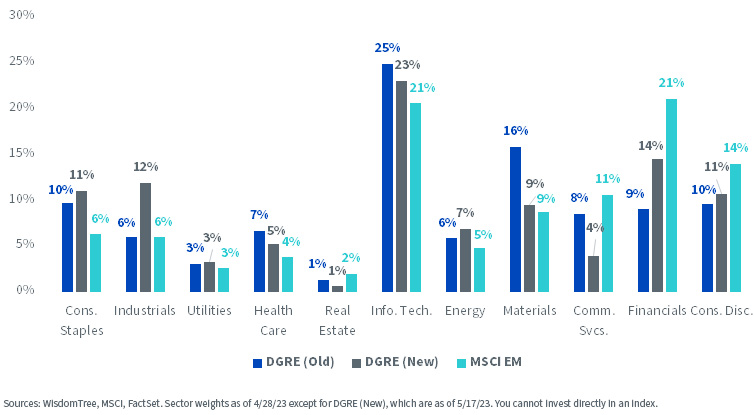

From a sector perspective, the rebalance increased weight to Financials and Industrials and reduced weight to Communication Services and Materials.

Sector Exposures

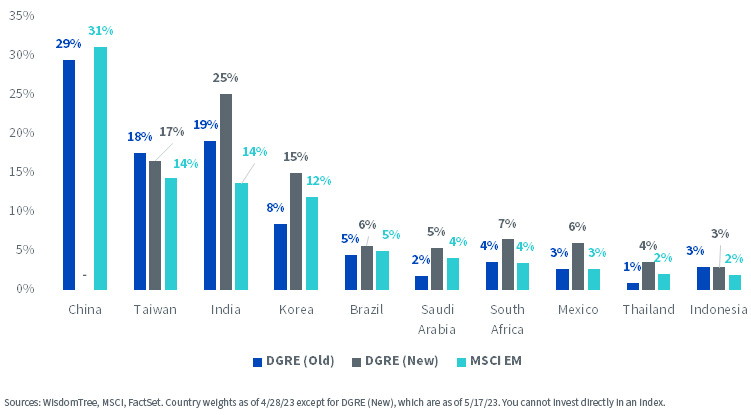

In terms of country exposures, removing the 31% weight to China results in notable increases to India (+6%) and Korea (+7%).

Country Exposures

Conclusion

After the rebalance, the ex-ante beta of DGRE to the MSCI EM Index was materially lowered from 0.97 to 0.87.

We believe the recent rebalance of DGRE allows investors to access quality dividend growth emerging markets companies while mitigating exposure to some of the idiosyncratic risks associated with Chinese equities in recent years.

Important Risks Related to this Article

DGRE: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

XC: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks. The Fund's investment strategy limits the types and number of investment opportunities available and, as a result, the Fund may underperform other funds. The Fund's exposure to certain sectors, countries, or regions may increase its vulnerability to any single economic or regulatory development related to such sector, country, or region. The Fund is non-diversified, as a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

EMMF: Investing involves risk including possible loss of principal. Investments in non-U.S. securities involve political, regulatory, and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Derivatives used by the Fund to offset exposure to foreign currencies may not perform as intended. There can be no assurance that the Fund's hedging transactions will be effective. The value of an investment in the Fund could be significantly and negatively impacted if foreign currencies appreciate at the same time that the value of the Fund's equity holdings falls. While the Fund is actively managed, the Fund's investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended.

Additional risks specific to EMMF include but are not limited to Emerging Markets Risk. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.