The WisdomTree Q1 2023 Asset Allocation and Portfolio Positioning Summary

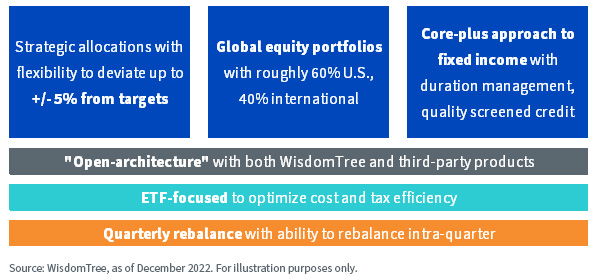

In the recent past, we’ve produced blog posts as well as more comprehensive content summarizing our general Economic and Market Outlook for 2023.

In this blog post, we take those outlooks and translate them to our current Model Portfolio allocations and positions. Before we get to that, a quick reminder of our general framework with respect to asset allocation and portfolio construction.

Now let’s summarize our current Economic and Market Outlook:

Economy

- There is a rising consensus view that the U.S. will enter a recession in the next 12 months

- While getting inflation down toward the Fed’s 2% target remains elusive, we believe inflation in the U.S. has peaked and should continue to decelerate in 2023

Equities

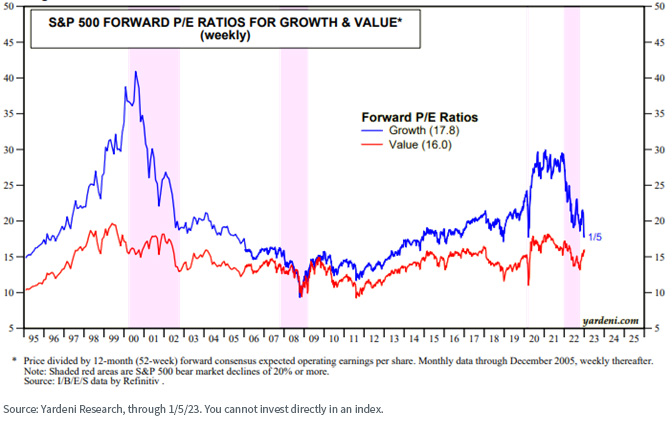

- If S&P 500 earnings disappoint in 2023, as we anticipate, we are hard-pressed to see expensive stocks and those with negative earnings present themselves as a haven

- In this choppier market environment, we favor value over growth and quality companies with stronger earnings, cash flows and balance sheets

- Attractive valuations and dividends outside the U.S. support our conviction in global equity allocations

- As the era of negative rates comes to an end, there’s “income back in fixed income”

- We expect the Fed to proceed with rising rates in the first half of this year before pausing around the end of the second quarter, which could lead to a modest rally in rates and a steeper yield curve

- We favor corporate issuers with strong fundamentals and resilient balance sheets

Real Assets and Alternatives

- We maintain our conviction in the role of real assets, commodities and alternative strategies as risk diversifiers

For a summary of the general asset class outlook click here.

Equities

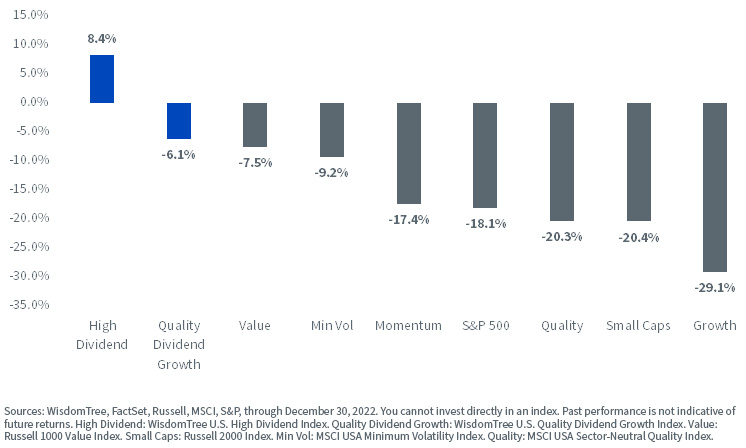

Many of WisdomTree’s ETF strategies (and, therefore, our Model Portfolios) have explicit factor tilts toward dividends, value, size and quality. While we did not avoid the “tsunami” market conditions of 2022, these tilts in two of our Indexes helped us to deliver positive relative value performance versus cap-weight-focused models.

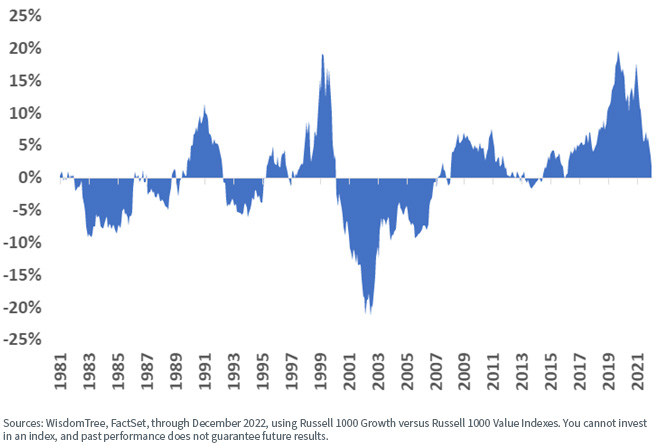

Historically, when we have seen a factor rotation from growth to value, such as we saw in 2022, it has not been a single-year phenomenon—it has tended to be a multi-year cycle.

Rolling 3-Year Annual Return Difference of Growth vs. Value: 1979–2022

And despite the outperformance of value stocks in 2022, they remain attractively valued versus growth stocks.

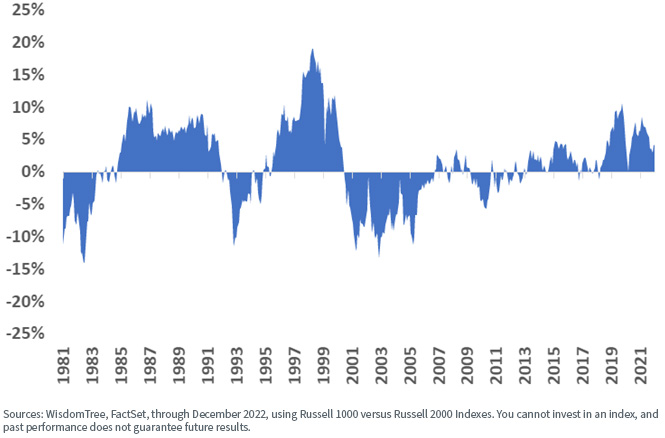

We see a similar performance story in historical large-cap/small-cap rotations…

Rolling 3-Year Annual Return Difference of Large vs. Small: 1979–2022

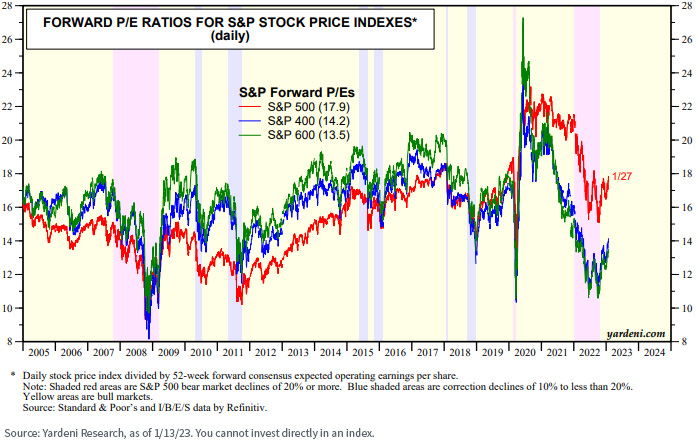

…and a similar current valuation attractiveness in mid- and small-cap stocks versus large-cap stocks.

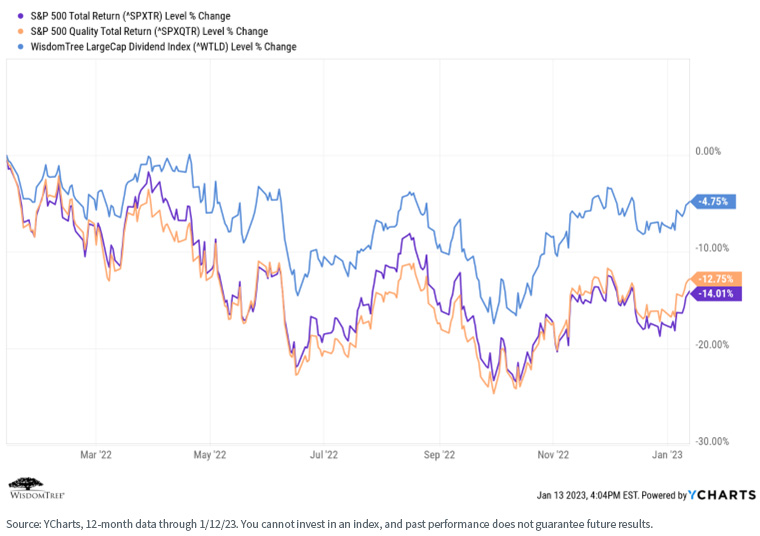

Now let’s look at how dividends and quality performed over the past 12 months.

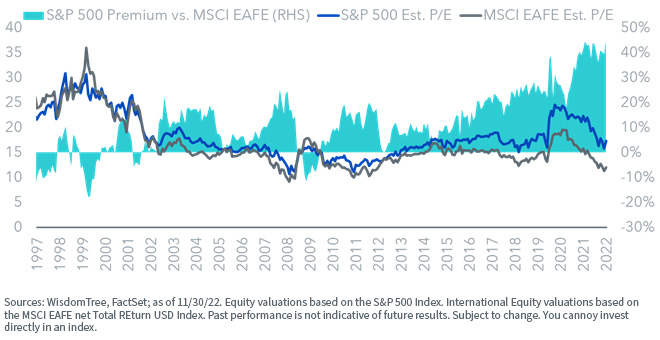

Finally, let’s examine current valuations between U.S. and non-U.S. stocks. Combined with the higher dividend yield typically available outside the U.S. and what we believe may be a downward-trending dollar, perhaps it is time for U.S. investors to rethink their allocations to non-U.S. stocks.

Estimated Price-to-Earnings (P/E) Ratios and S&P 500 Valuation Premium

Bottom Line: Our Model Portfolios have distinct factor tilts toward value, dividends, size and quality, and we maintain a roughly neutral allocation to non-U.S. versus the MSCI ACWI Index. We think we are in the “early innings” of these rotational trades, and we remain comfortable with our current positioning.

Fixed Income

One of our narratives for 2023 is, “There is income back in fixed income.”

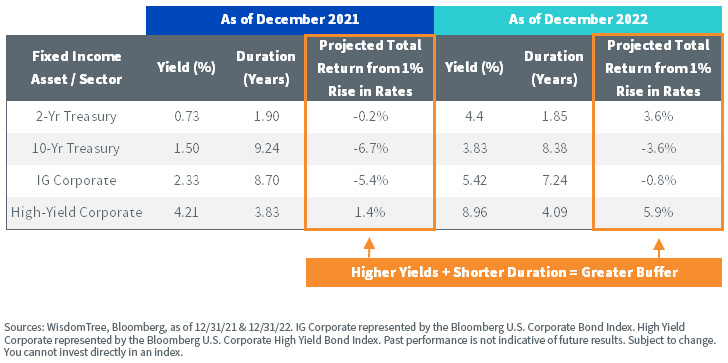

Perhaps current market conditions are best illustrated in the following table, which compares, across various fixed income sectors, the current (December 2022) and one year prior (December 2021) yields, durations and projected total returns, assuming a 1% rise in interest rates.

The higher total returns in the far right (December 2022) column demonstrate how current yield levels may provide fixed income investors with a greater buffer against interest rates increasing faster or to a greater extent than current market expectations.

Projected Total Return from a 1% Rise in Interest Rates: December 2021 vs. December 2022

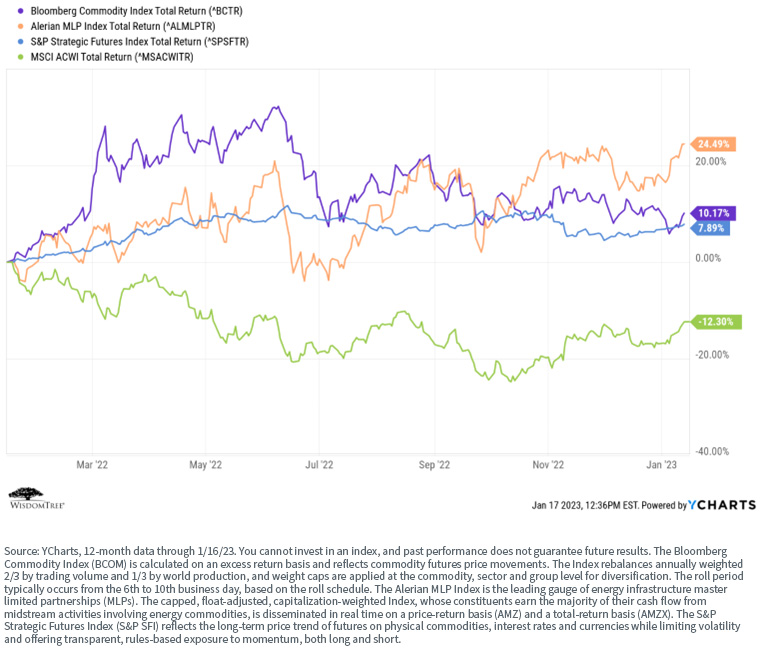

Finally, for those advisors and investors for whom it made sense, we have advocated considering allocations to real assets and alternatives for most of the past two years.

Certainly, the inclusion of these types of strategies, depending on the strategies and exposures, benefited many investors as they provided lower-correlation diversification to the abysmal stock and bond performances of the past year.

While we are neutral on the outlook for these allocations going forward, we still believe they can play an important role in constructing diversified portfolios.

Conclusion

Trying to predict future market performance is a fool’s errand and a loser’s game. Given historical performances and trends, we like how our portfolios are positioned. But it is also why we continue to recommend longer-term time horizons and appropriate diversification.

Financial advisors can learn more about our Model Portfolios, allocations and exposures at the WisdomTree Model Adoption Center (MAC).

Important Risks and Disclosure Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Neither diversification nor asset allocation strategies assure a profit or protect against loss. Investors should consider their investment time frame, risk tolerance level and investment goals.

For definitions of terms/indexes in the charts above, please visit the glossary.