Tailwinds for Gold Are Beneficial for Gold Miners

Gold miners have begun the year on a positive trajectory, up 13.2%1, following in lockstep with gold, up 5.2%2. This makes logical sense—gold miners’ stocks are leveraged bets on the metal they mine, as their earnings amplify gold’s price trends. Now that gold’s 2022 macro headwinds (tight monetary policy, strong U.S. dollar, rising U.S. Treasury yields) have turned to tailwinds (weaker U.S. dollar, peak U.S. inflation paving the way for dovish U.S. monetary policy and lower U.S. Treasury yields), we expect this current rally for gold miners has further to run.

Figure 1: Gold Miners Taking the Lead from Gold’s Price Performance

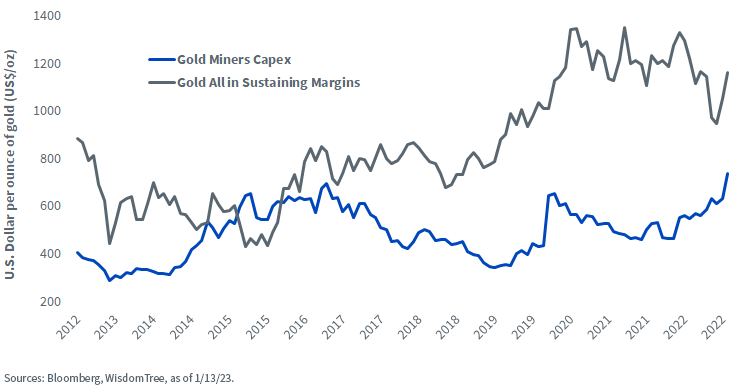

Capex on the Rise Owing to High-Cost Inflation

The business fundamentals for gold miners have improved substantially and their outlook remains positive. As the amount of gold in a mine nears exhaustion, mining becomes harder and costlier. Higher inflation over the past year has resulted in higher prices for mining inputs such as energy, labor and equipment. This has contributed to the general increase in average cash costs3 over the past decade. The all-in-sustaining costs (AISC), which include the full cost of producing gold including exploration and bringing new mines online, have been rising. However, AISC margins4 have increased 40% from US$677 in 2018 to US$948 in 2022 as the gold price has risen substantially faster than miners’ estimated AISC.

Figure 2: Gold’s Price Has Risen Faster than Miners’ Estimated Costs

Environmental, Social and Governance (ESG) Issues Have Gained Dominance for Gold Miners

ESG issues have become an important consideration for gold miners. While safety has historically been a top priority, ESG metrics are now needed to retain shareholders. One well known ESG metric for gold miners is greenhouse gas (GHG) emissions. Most gold miners have set out clearly defined targets to reduce emissions over time, backed with capital expenditure plans to achieve them.

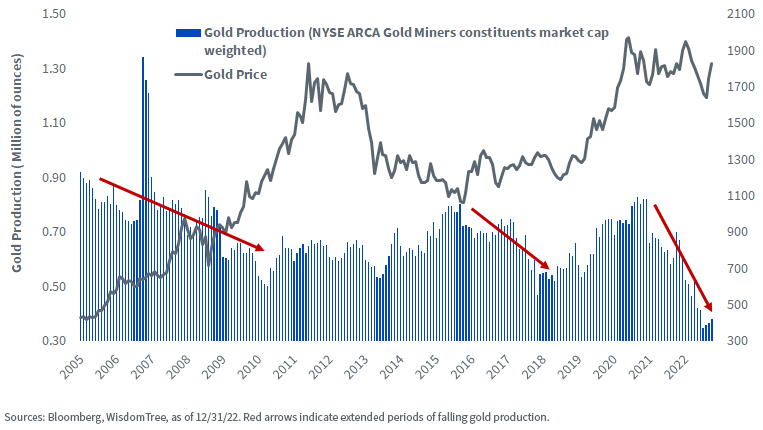

However, miners’ ability to achieve these goals are dependent on investing in renewable energy sources such as solar and wind, while seeking to curb energy consumption through increased efficiency in their mines and processing plants. Gold production has been declining since 2020. As miners allocate more resources to projects that comply with the green agenda, we expect gold production to suffer. Historically, gold prices tend to rebound after extended periods of falling gold production.

Figure 3: Global Gold Production Has Been Declining

Improving Fundamentals

Gold miners’ shares are trading at 1.67 times price-to-book value (P/B), marking a 2.59% discount to the long-term average. The book value, also often referred to as the net asset value (NAV), is the theoretical value of a company’s assets net of liabilities. We believe Gold miners offer attractive dividend yields amid the backdrop of a rising rate environment. Currently, gold miners offer a dividend yield 2.4% higher than the S&P 500 Index at 1.72%.

Despite the recent rally staged by gold miners, we continue to see long-term valuation support, based on higher AISC margins and lower debt, alongside higher free cash flow levels. Historically, gold miners have tended to outperform gold prices when global business activity, as measured by the OECD leading indicators, is high and rising. If the recession is mild, we believe gold miners could outperform gold. Conversely, if the recession is deeper than expected, we believe gold may benefit from its safe haven status, which should provide an important tailwind for gold miners’ performance.

WisdomTree’s Approach—Efficient Access to Comprehensive Gold Exposure

WisdomTree offers a unique approach to investing in gold and its miners by amalgamating what we believe are the best of both worlds. WisdomTree designed the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN), which seeks to deliver a capital efficient investment strategy that provides exposure to a modified market capitalization-weighted basket of gold miner equities with gold futures exposure layered over it.

Investors bullish on gold often allocate to both the physical precious metal and equities representing gold miners as separate allocations. This requires twice the investment capital, but by using leverage and a ‘return stacking’ framework that layers gold futures on top of the exposure to miners, we believe GDMN can provide both trades with better capital efficiency.

Conclusion

Gold miners have been a relatively disappointing investment over the last two decades, with high volatility and sub-par returns, but the rise in gold prices is improving the outlook for gold miners’ profitability. Gold miners’ net profit margins have consistently been rising since 2016, in lockstep with increases in their level of capital expenditures.

1 Source: Bloomberg price performance of the NYSE ARCA Gold Miners Index (Ticker: GDM Index), from 12/30/22–1/13/23.

2 Source: Bloomberg price performance of Gold (Ticker: GC1 Comdty) Index, from 12/30/22–1/13/23.

3 Average cash cost is measured based on the market-weighted average of the constituents on the NYSE ARCA gold miners index, as of January 2023.

4 AISC margins is the difference between the gold price and AISC.

Important Risks and Disclosure Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“Gold Miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically, and have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of Gold Miners, the Fund may be susceptible to financial, economic, political or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic or regulatory conditions affecting that country or region, or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

For definitions of terms/indexes in the charts above, please visit the glossary.

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.