The Inevitable Future for Most Financial Advisors: “Rep as Financial MD”

There is a very real possibility that in the coming decades, most advisors will be exclusively utilizing home-office or third-party model portfolios.

What does that mean?

Most advisors will not promote themselves as the in-house investment professional as their sole value position to clients and prospects.

This will be a significant shift in mindset, but it is simply Darwinism.

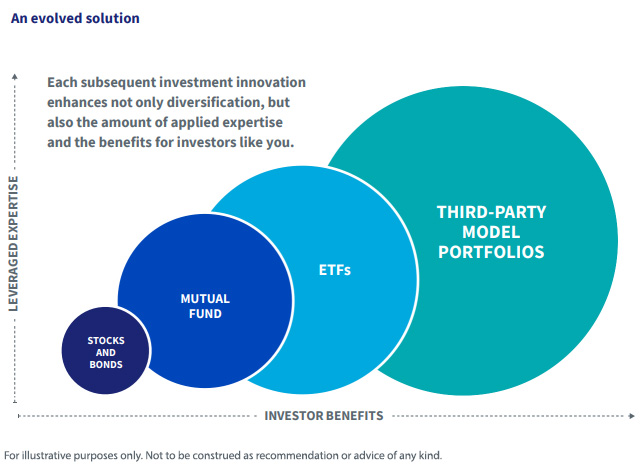

It is a natural evolution of a financial advisor’s value proposition that started with curating investments and evolved into curating potential solutions.

An oversimplified schematic illustrates this:

Michael Kitces highlighted a version of this evolution of financial advice on his Financial Advisor Success podcast:1

So as we look at this ongoing evolution of advisors from portfolio managers—I guess if I really go back to our roots as “financial advisors,” it was stock pickers and stock managers, and then we went to mutual fund pickers and ETF pickers. Our curation of investments has evolved. Now we’re maybe curating a wider range of solutions for clients in this advisor-as-curator model.

Advisors with a curator mindset are leveraging professional resources, data and technology to holistically serve their clients in pursuing their financial goals. It’s like a doctor leveraging their resources, case studies and access to AI networks that contain millions of medical records to help aid in making a diagnosis.

Hence the phrase “Financial MD.”

Financial MD refers to advisors leveraging additional expertise and resources to potentially deliver better outcomes—the example is utilizing third-party model portfolios.

Why?

Clients may find comfort in knowing that third-party models provide potential benefits of the collective expertise of an asset management firm’s analysts, strategists and PhDs. From their perspective, advisors using third-party model portfolios are combining valuable research and data with their intimate knowledge of the client’s needs— a welcomed approach.

Two studies conducted on the perception of model portfolios make this case.

State Street Global Advisors’ study found that 88% of investors agree that two benefits of advisors using model portfolios are (1) “my portfolio is being constructed by asset managers with more knowledge of the markets” and (2) “my advisor can focus on what really matters to me.”2

WisdomTree’s own proprietary study found that most individual investors believe “financial advisors using third-party models are providing a more sophisticated asset allocation approach backed by the extensive research and technology of an asset manager’s team.”3

When you add it up, clients believe third-party models provide additional expertise that may help their portfolios.

This additional expertise is a key pillar within the advisor-as-curator mindset. It enables firms to offer a wider range of services to clients, such as financial planning, estate planning and trusts, retirement planning, strategic tax planning and insurance.

There will likely be a day when individual investors do not want their financial advisor picking all their investments on their own.

Want to become your client’s “Financial MD”? Financial advisors should fill out the contact form below.

Contact Us

1 https://www.kitces.com/blog/jason-zweig-wall-street-journal-intelligent-investor-financial-advisor-curator/

2 https://www.ssga.com/library-content/pdfs/etf/us/how-do-clients-really-feel-about-model-portfolios-article.pdf

3 2020 WisdomTree Model Portfolio Research Study.

Important Risks Related to this Article

There are risks involved with investing, including possible loss of principal. Using an asset allocation strategy does not assure a profit or protect against loss.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.