Income Sans the Volatility

With one month to go in 2022, investors are no doubt eager to see what 2023 will hold. The Fed’s highwire act of fighting inflation while avoiding recession will certainly be taking center stage. For the bond market, this will more than likely lead to a theme continuing in the new year: Fed-induced volatility. This raises the question: how can investors potentially take advantage of ‘income being back in fixed income’ while potentially removing the heightened volatility quotient? The answer, in our opinion, lies in a U.S. Treasury floating rate note (UST FRN) strategy.

Certainly, one aspect of the UST market that has garnered a great deal of attention this year is the shape of the yield curve. Indeed, the Fed’s Volcker-esque rate hike action has created an environment where inverted yield curves appear to be the norm, not the exception. To be sure, as Powell & Co. have ramped up their rate hikes, 375 basis points (bps) in total to this point, shorter-dated UST yields have outpaced the increases among intermediate to longer-dated maturities. And guess what? With the Fed likely guiding the bond market toward additional rate hikes not only to end this year but into 2023, odds favor this phenomenon continuing for the foreseeable future.

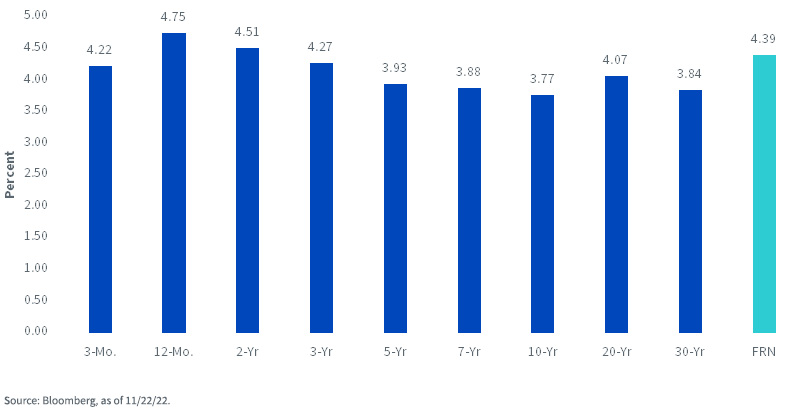

U.S. Treasury Yields

So, let’s take a look at where key Treasury yields stand to enter the final month of the year. The accompanying graph highlights the widely watched Treasury maturity spectrum, ranging from the 3-month t-bill on out to the 30-Year bond, and of course, the FRN. This way investors can get an up-close look for themselves at the various yield disparities. As you can see, the UST FRN yield stands at 4.39%, as of this writing, essentially the third-highest yielding Treasury security behind the 12-month t-bill and the 2-Year note. For the record, the 6-month t-bill has a higher yield, but I wanted to keep the focus on what are considered the more closely watched maturities.

The most interesting part of this analysis is that the UST FRN yield is visibly above the entire fixed coupon curve from 3 years on out to 30 years in maturity. In fact, some of the widest yield advantages are occurring versus the 5- to 10-year part of the curve, where the differential ranges anywhere from roughly +45 to +65 bps. The spread is even positive over both the 20- and 30-Year bonds at +32 bps and +55 bps, respectively.

Conclusion

From an investment backdrop, I keep going back to the shape of the Treasury yield curve, and what investors are being compensated for, especially given the potential for continued volatility. In addition, with the Fed continuing to signal it is not done raising rates, in our opinion, UST FRNs play an integral role in a bond portfolio given it is reset with the weekly 3-month t-bill auction. In other words, it ‘floats’ with the Fed’s rate hikes. This strategy may provide investors with both income potential and a hedge against the possibility of higher yields in ‘fixed’ coupon securities. The WisdomTree Floating Rate Treasury Fund (USFR) offers investors a means of investing in the UST FRN space.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.