Portfolio Crunches: Building a Strong Core

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We last visited our core strategic Model Portfolios back in April. We will once again “get back to basics” by focusing on our core strategic Model Portfolios, specifically our Core Equity model. This equity model serves as the foundational base for almost every other model we manage, including our Strategic Multi-Asset models, our Endowment models, our Multi-Asset Income models and the Siegel-WisdomTree Longevity model.

As with all WisdomTree models, our Core Equity model has certain characteristics:

1. Unless asked to customize differently, it is global in nature.

2. It is ETF-centric, which we believe helps to optimize fees and taxes.

3. It is “open architecture” and allocates to both WisdomTree and third-party strategies. This is (a) just the right thing to do for advisors and end clients, (b) allows us the freedom to deploy other firms’ “best ideas” and (c) helps us to build both asset class and risk factor diversified portfolios.

4. The factor tilts (dividends, quality, value, size, etc.) embedded into most WisdomTree ETFs allow us to construct “core/satellite” portfolios in a more cost- and tax-effective manner than the traditional approach of building an inexpensive passive (i.e., market cap-weighted) core and surrounding that core with actively managed mutual funds or separately managed accounts. Mutual funds tend to be more expensive and less tax efficient than ETFs.

5. WisdomTree charges no strategist fee on any of its models—our revenue is generated only by the expense ratios of the WisdomTree products that are included in any given model.

We refer to the Core Equity model as our “strategic building block.” While it can be and is used as a stand-alone model, it is more often mixed and matched with other models to create different variations of multi-asset models.

Core Equity

Let’s do a refresh on our core equity model. It currently contains 11 individual line items of globally diversified equity ETFs. We maintain a geographic/regional exposure that is roughly in line with the MSCI ACWI IMI Index—as of September 30, 2022, the model had allocations of roughly 58% U.S., 30% EAFE (developed international) and 12% emerging markets.

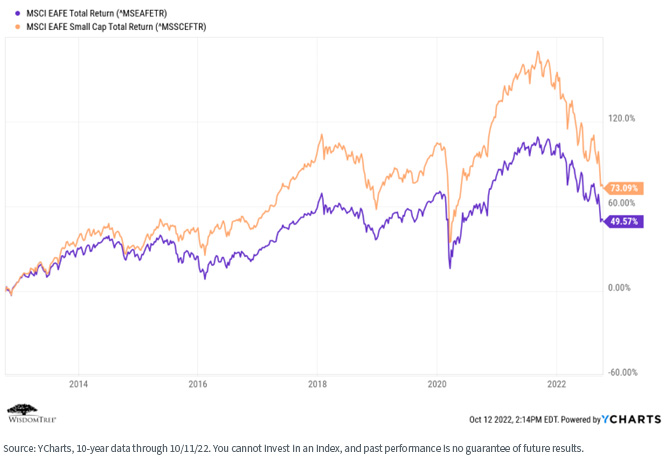

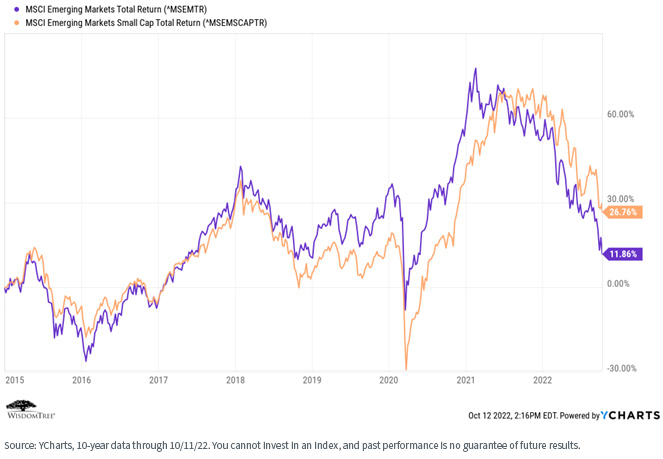

At the asset class level, we are allocated (versus the Index) at roughly 68% large cap (82%), 19% mid-cap (14%) and 13% small cap (4%). The over-weight to mid- and small caps is not surprising given WisdomTree’s heritage as a factor-based asset management firm—we believe size, value, dividends and quality can add value over time versus cap-weighted market beta. We believe we also are one of the few firms that explicitly allocates to non-U.S. small caps (both in EAFE and in EM)—allocations that have added value over time.

Within the U.S., we recently increased our allocation to small caps, given the significant valuation difference versus large caps.

Russell 2000 Fwd. P/E (ex. Negative Earners) vs. Russell 1000

Finally, at a line-item allocation level, the model holds 71% in WisdomTree products and 29% in third-party strategies.

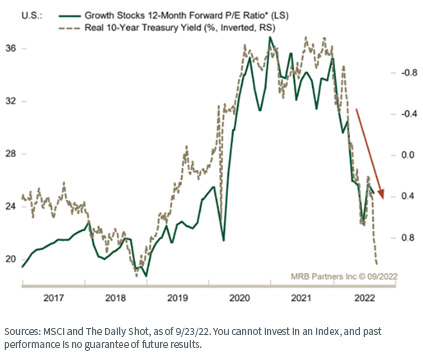

Given the underlying factor tilts of many of the WisdomTree products, the portfolio is over-weight in allocations to smaller-cap stocks, higher-quality stocks (where “quality” is defined as companies that have stronger earnings, balance sheets and cash flows), value stocks and dividend-paying stocks. These factor tilts have benefited us this year, as growth stocks have been relatively crushed by the rising interest rate environment.

Normalizing Real Bond Yields Remain a Threat to Growth-Stock Valuations

So, How Are We Doing??

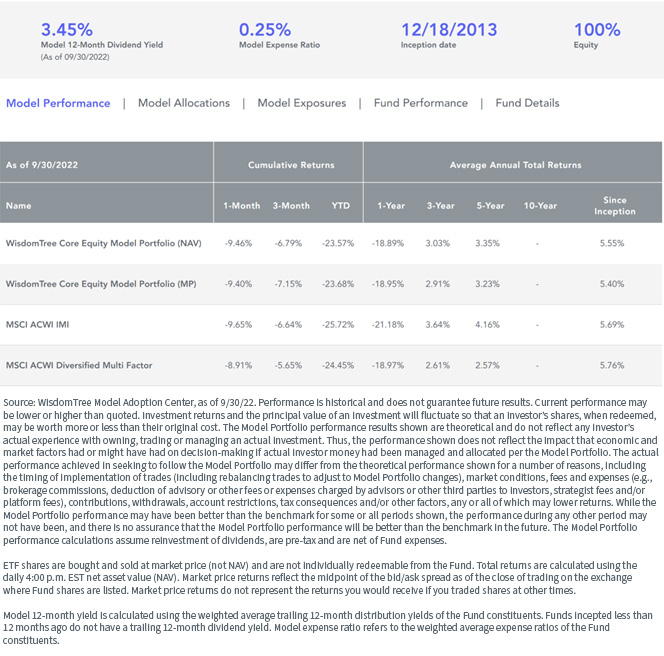

Since its inception in 2013, the performance of our Core Equity model has held up very well despite a multi-year environment where large-cap growth stocks dominated market performance. We attribute this to both smart asset allocation and smart security selection decisions.

We also note our relative outperformance over the past 12 months, due primarily to our size, value and dividend tilts—tilts we believe will continue to perform well in the current market environment of rising rates, a slowing economy and an investor preference for dividends.

WisdomTree Core Equity Model Portfolio

For the most recent month-end and standardized performance of the model and underlying Funds, please click here.

For the 30-day SEC yield for each of the underlying ETFs, please click the respective ticker: DON, DWMF, EPS, EES, XSOE, USMF, DLS, DGRW, DGS, SCHG, SPDW.

Two final observations:

1. The current expense ratio for our Core Equity model is 0.25%, which we believe is attractive for an actively managed global equity portfolio; and

2. The current 12-month dividend yield on the model (through 9/30/22) is 3.45%, which compares favorably to the 2.49% yield offered by the MSCI ACWI Index as of that same date.

Conclusion

The WisdomTree Core Equity model is the foundational base for almost every other model we manage. It is constructed to deliver risk-adjusted alpha relative to its benchmarks while delivering a superior yield and dividend profile.

Since its inception almost 10 years ago, this model has performed as expected, and we believe it is well-positioned to take advantage of the market regime we believe we will have for the foreseeable future.

That market regime (as we see it) is defined by slow economic growth, “sticky” inflation, volatile markets and a refocusing on market fundamentals (e.g., earnings, dividends, valuations and quality).

Financial advisors who register on the WisdomTree website can access fully transparent information (performance, fees, yield, allocations, etc.) via our Model Adoption Center.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.