Managing Portfolio Volatility as Correlations Rise

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

This year has offered no shortage of headaches, but the most acute source of pain for most traditional portfolios has been the positive correlation between falling stock and bond prices.

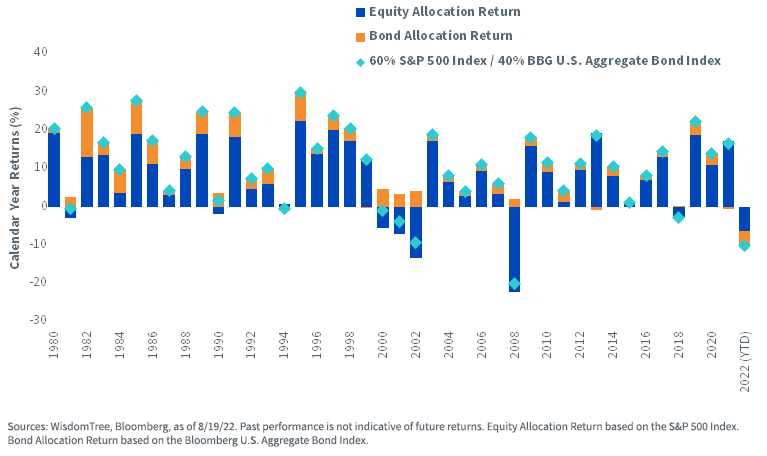

There is historical precedent for balanced 60/40 portfolios experiencing negative calendar year returns. What makes 2022 so uniquely challenging? So far, it is the first time in recent history when both stocks and bonds have had steep, simultaneous declines.

Calendar Year Returns of a Traditional 60/40 Portfolio

For index definitions in the chart above, please visit the glossary. You cannot invest directly in an index.

At WisdomTree, we remain strong believers in equities as a long-term driver of real portfolio growth and bonds as an important source of diversification and income.

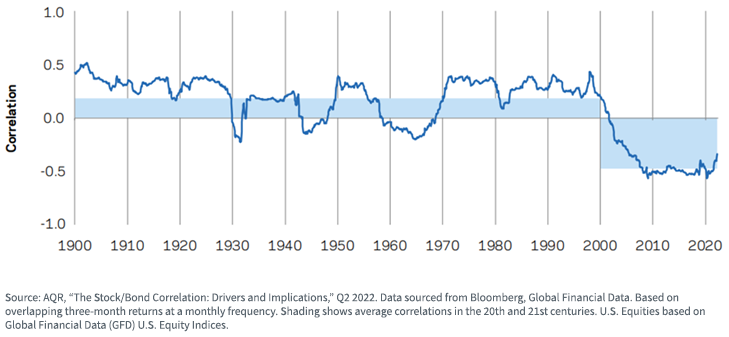

But many investors view this year’s relationship between stock and bond returns as potentially the start of a new correlation regime.

And history may support this view—in the 20th century, the average long-term correlation of stocks and bonds was positive, particularly in times of heightened inflation uncertainty.

Rolling 10-Year Correlation Between U.S. Equities and U.S. Treasuries 1/1/1900–3/31/2022

For index definitions in the chart above, please visit the glossary. You cannot invest directly in an index.

What does this mean for investors with traditional asset allocations?

In our view, the risk of ongoing inflation uncertainty and unstable asset class correlations supports the case for additional sources of portfolio diversification.

WisdomTree’s Volatility Management Model Portfolio—one of our “outcome-focused” Model Portfolios—is designed to act as a complement to a traditional portfolio by incorporating these alternative sources of potential return and potential risk mitigation.

One of the Funds included in the model is our own managed futures strategy, WTMF, which seeks to achieve uncorrelated returns by capturing rising and falling price trends across commodity, currency, equity and interest rate markets.

Importantly, trend-following strategies like managed futures have a long track record of delivering strong performance in periods of elevated inflation risk, when traditional 60/40 portfolios have typically struggled (Hurst, Ooi and Pedersen, 2017).1

In addition to managed futures, the portfolio includes hedged equity2 and diversified arbitrage3 strategies.

While each allocation within the portfolio follows a unique and differentiated investment approach, the overarching goal of the Model Portfolio is to generate attractive, uncorrelated risk-adjusted returns.

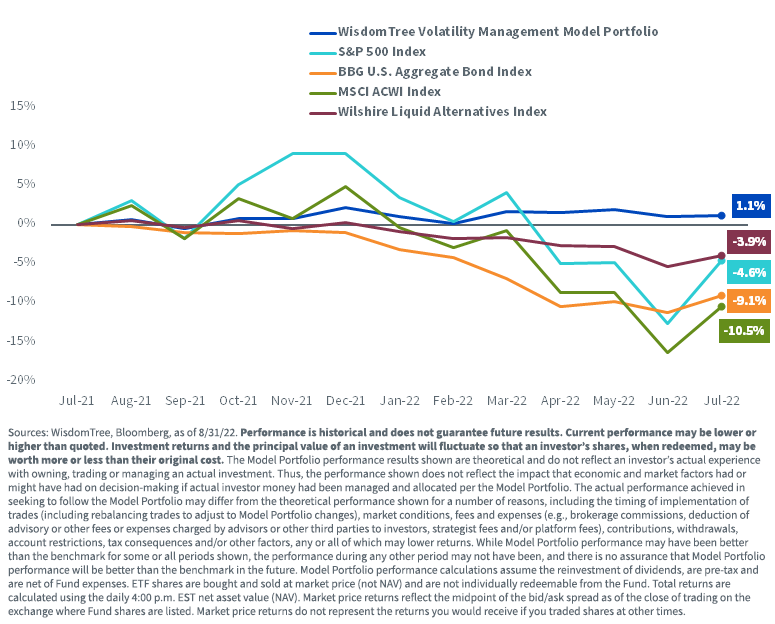

In the 12 months ending July 31, 2022, the Volatility Management Model Portfolio has performed as intended—the portfolio has generated positive absolute returns while outperforming the broader liquid alternatives universe. For investors utilizing the Model Portfolio as a complement to a 60/40 allocation, it has dampened volatility at a time when equity and fixed income markets each experienced steep declines.

Cumulative 1-Year Performance as of July 2022

For index definitions in the chart above, please visit the glossary. You cannot invest directly in an index.

For most recent month-end and standardized performance of the Model and underlying Funds, please click here.

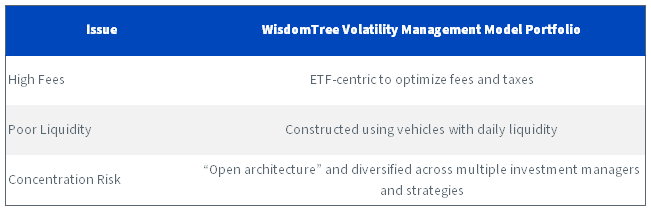

Issues Often Cited with “Alternatives”

The category of “alternatives” is overly broad and often carries with it a negative connotation. Below we explore some of the issues most often cited with these strategies, and how the Volatility Management Model Portfolio addresses each:

Another important drawback to alternatives as an asset class has been its historical underperformance relative to equities. It is fair to say that, since the great financial crisis, diversification away from U.S. equities and bonds has generally not rewarded investors.

But with today’s market conditions, are we now in a world where diversification matters again? In this environment, investors may well benefit from access to alternative sources of return.

Funding an Allocation to Volatility Management

While we can all agree that diversification sounds great, most investors still need a healthy allocation to equities and bonds to accomplish long-term return objectives and generate necessary income. Where can a new allocation to Volatility Management be sourced from?

For years, some of the world’s largest institutional investors have prudently utilized leverage in portfolio construction with the aim of reducing equity market volatility without sacrificing long-term expected returns.

With our “Efficient Core” strategy, NTSX, individual investors now have access to a modestly leveraged 60/40 “core” allocation, freeing up capital to invest in diversifying strategies such as those found in our Volatility Management Model Portfolio.

Conclusion

While we believe that traditional 60/40 portfolios remain a viable and effective long-term strategy for many investors, those most focused on volatility and downside protection were likely met with an unwelcome surprise this year.

If 2022 is a sign of what’s to come, bonds may not provide the level of equity market diversification that investors have come to rely on over the past several decades.

An allocation to diversifying strategies like those in our Volatility Management Model Portfolio can potentially provide differentiated sources of returns while also mitigating exposure to increasingly high levels of equity and interest rate risk in traditional portfolios.

Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses.

You cannot invest directly in an index.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

WTMF: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include the use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and, historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise (or short-only indexes decline). The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed; thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

NTSX: There are risks associated with investing, including the possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as the perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.