Earnings Pullback? Not This Quarter

Did this year’s falling market get too far ahead of underlying earnings?

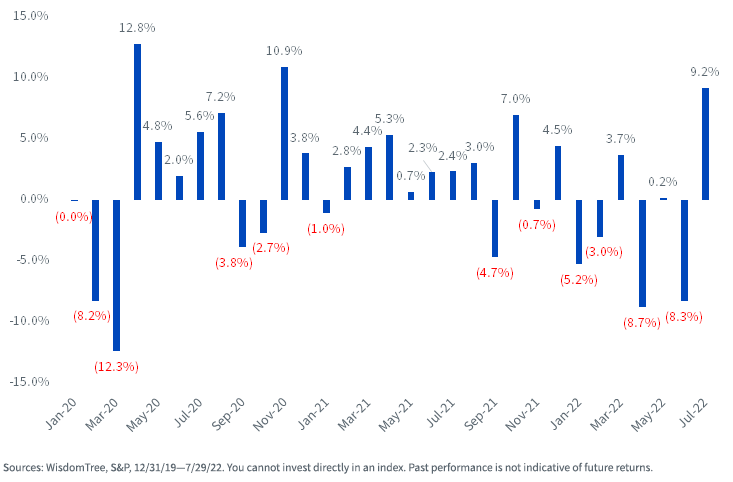

After plunging more than 22% from the start of the year through mid-June, U.S. equities in July had their biggest rally since November 2020 amid earnings reports that were generally stronger than forecasted.

S&P 500 2Q earnings per share (EPS) are on track to beat analyst estimates by 3%.1

Monthly S&P 500 Total Returns

Several major factors drove the sell-off in equities to start the year.

As we recently learned, gross domestic product (GDP) growth was negative for the second straight quarter, confirming for many what had been suspected about the economy—growth was moderating, if not in outright recession.

A slowdown in economic activity coupled with a hawkish Federal Reserve and inflation at multi-decade highs created the perfect conditions for a bear market.

What has become more apparent in recent weeks is that two main catalysts may be helping markets find a floor:

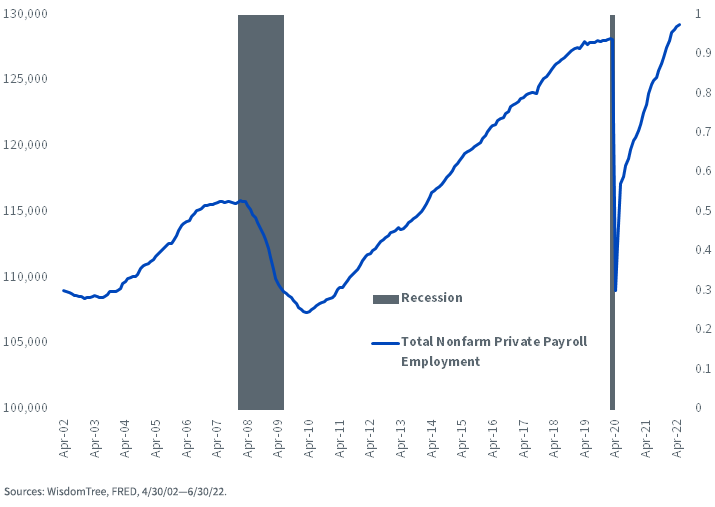

- Rapid jobs growth that is at odds with a recession

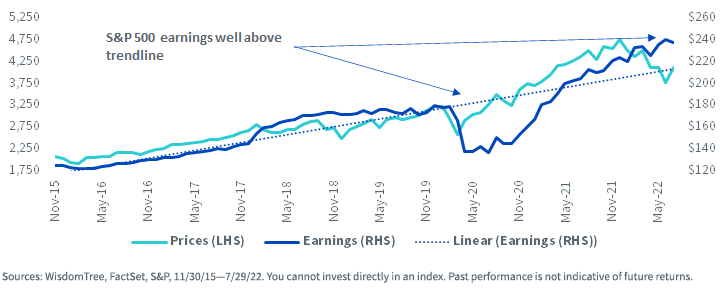

- Decidedly positive expectations for earnings growth

Employment and Recessions

Consensus analyst estimates are for earnings to grow 9% in 2022. The forward 12-month EPS has increased more than 6% since the start of the year, continuing to climb in the face of an S&P 500 sell-off.2

S&P 500 Index Price Level and Fwd. 12m Earnings per Share, as of 7/29/22

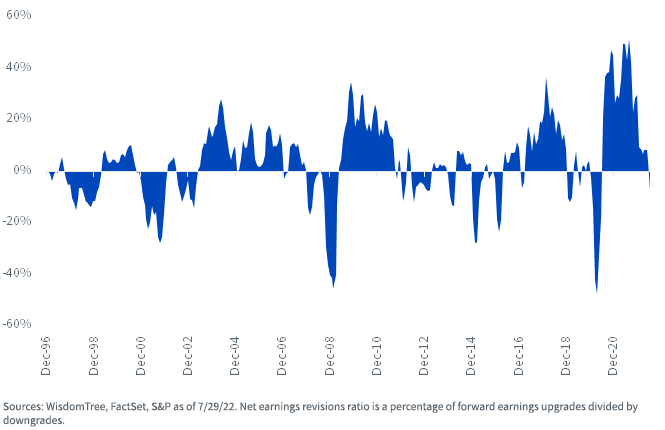

Net negative earnings revisions have started to indicate some moderation in growth estimates—a cautionary but not yet alarming trend.

S&P 500 Net Earnings Revisions Ratio

Growth Sell-Off

At the beginning of the year, the front-and-center market narrative was rising interest rates sending high-growth stocks into a tailspin.

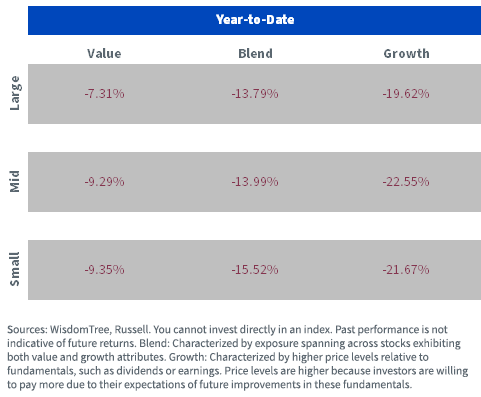

As a result, growth has handily lagged value across large, mid- and small caps.

Russell Style Indexes, as of 8/1/22

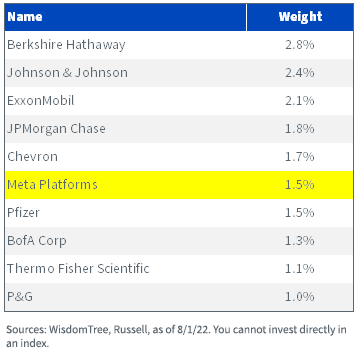

During the past few weeks, some of the most recognizable growth names have had some or all of their market caps moved from the Russell 1000 Growth Index toward the Russell 1000 Value Index.

In a major turnaround from its outsized stature in the Russell 1000 Growth Index, Meta is now a top-10 holding in the Russell 1000 Value Index.

Russell 1000 Value Index Top 10 Holdings

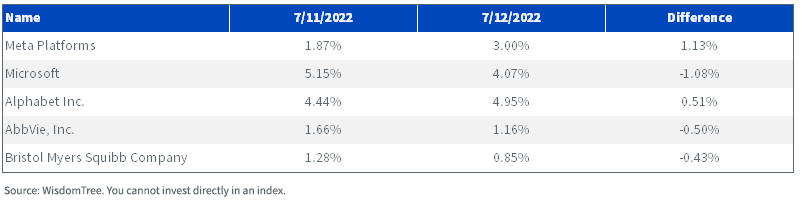

Given the acute drawdowns in select large-cap names—moves that have, to this point, materially outpaced the deterioration (or lack thereof) in underlying earnings—the Index Committee for WisdomTree’s core equity indexes decided to rebalance weights of a handful of stocks in the WisdomTree U.S. LargeCap Index to be more in line with earnings weights.

The Index, which uses a modified earnings weighting approach, had an aggregate total of less than 5% weight change to the portfolio.

The weight of Meta was increased from less than 2% to 3%, and the weight of Alphabet increased by about 50 basis points.

Weight was trimmed from Microsoft, AbbVie and Bristol-Myers Squibb to offset these increases.

WisdomTree U.S. LargeCap Index: Top 5 Portfolio Changes

Bottom Line: Rebalance to Earnings Amid Sell-Off

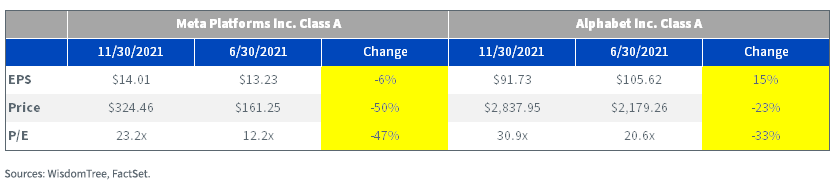

Through June 30, 2022, Meta and Alphabet had declined by 50% and 23%, respectively, since the last screening date for the WisdomTree U.S. LargeCap Index on November 30, 2021.

These market movements had greatly diminished the weight of these securities in the Index. The construction of the Index is meant to tether constituent weights to underlying earnings rather than be heavily dictated by price movements. Therefore, we adjusted our Index intra-year to more appropriately reflect the earnings weights of some of the largest companies.

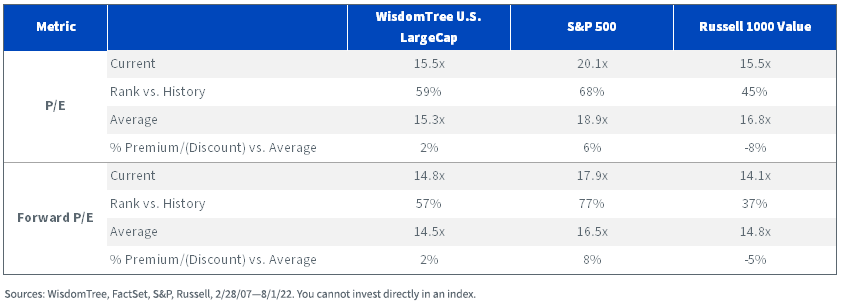

As a byproduct of the disciplined fundamental rebalance process, the current trailing and forward price-to-earnings ratios on the WisdomTree U.S. LargeCap Index are heavily discounted compared with the S&P 500 Index, and they have valuations in line with the Russell 1000 Value Index.

Index Fundamentals

1 Source: FactSet, 7/29/22.

2 Source: FactSet, 7/29/22.