WisdomTree's Original Idea

WisdomTree launched 20 Funds in a day on June 16, 2006, with a simple idea: dividend weighting.

We believe that cap-weighted indexes contain an inherent bias to market mispricing that over-weights the most over-valued stocks with no mechanism to adjust weights toward valuations.

Our first family of stock Indexes anchored and rebalanced weights to the ultimate cash flows that companies return to shareholders: cash dividends.

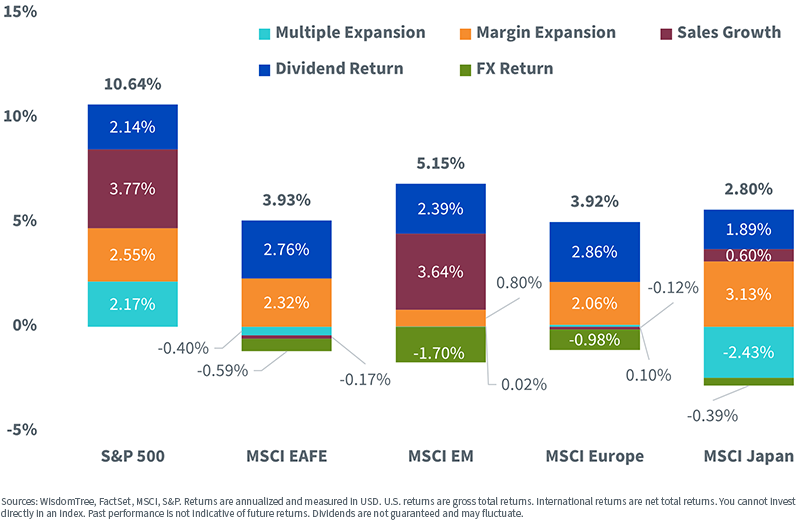

Over the last 15-plus years, the S&P 500 has delivered significant returns and the best of the major regions—more than 10.5% per year. But this will be hard to repeat.

- Sales growth increased at 3.8% per year—a rate similar to economic growth.

- Profit margins expanded from 8.9% to 13.1%, contributing 2.5% per year to the gains.

- Price-to-earnings ratios expanded from 16.2x to 22.4x, contributing a further 2% per year to the gains.

- Dividend yields averaged 2.2% over the period but are currently down to only 1.3% per year today because of price gains.

Return Attribution: 6/30/06–3/31/22

Chris Bloomstran, CIO of Semper Augustus Investments Group and a well-known value investor and Warren Buffett analyst, used a similar framework for deconstructing returns and believes the S&P 500 is priced to deliver only a 5% return looking ahead.1

Bloomstran cited a few headwinds for the S&P 500 that include:

- Less opportunity for rising market valuations.

- Profit margins expanded to all-time record levels. Higher labor costs, rising inflation and other input costs and new forces from the de-globalization of supply chains could cause profit margins to revert to lower levels.

- The S&P 500 dividend yield today is nearly 1% lower than it was looking back 15 years due to higher market multiples.

We are not quite as pessimistic in our outlook over the coming five to seven years, but counseling for more sober expectations is practical.

Dividends Representative of Value Rotation

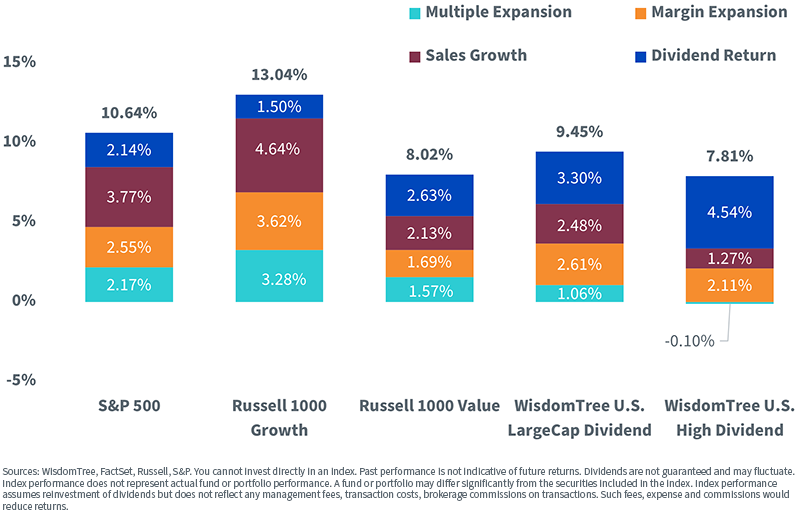

Dividend-weighted stock indexes help improve valuations and dividend yields in particular.

While growth dominated value over the last 16 years because of strong and above-average sales growth due to more profit margin expansion and even more multiple expansion, many of these features are unlikely to be repeated.

Past performance is no guarantee of future returns, as all the disclosures read, but this is very much relevant to growth index dominance, in our view.

WisdomTree’s dividend-weighted Indexes—the WisdomTree U.S. LargeCap Dividend Index and the WisdomTree U.S. High Dividend Index—had 3.3% and 4.5% annualized returns from dividends alone.

Neither Index relied heavily on multiple expansion for returns, with the large-cap dividend Index having a modest 1% return from multiple expansion and the more value-tilted high dividend Index having a slight multiple contraction over this period.

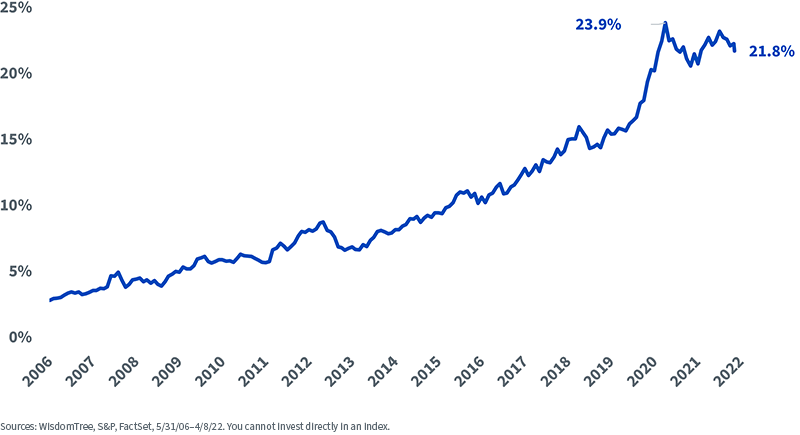

As large businesses, the “Fab Five” tech stocks are less likely to contribute as much to the market—and growth indexes specifically—looking ahead as they did over the last 16 years when their combined weight increased from less than 5% to as high as 24%.

Combined S&P 500 Weight: Apple, Microsoft, Amazon, Alphabet, Meta Platforms

In a sign of the recent resurgence for value stocks, the Russell 1000 Value Index has outperformed the Russell 1000 Growth Index by more than 1,300 basis points to start 2022.

While the S&P 500 is down nearly 8%, the Russell 1000 Value Index is down just over 1.5%.

The WisdomTree U.S. LargeCap Dividend Index fared even better as it is virtually flat around a 0% return. We think this outperformance of high-quality, dividend-paying stocks represents just the early stages of a multi-year cycle.

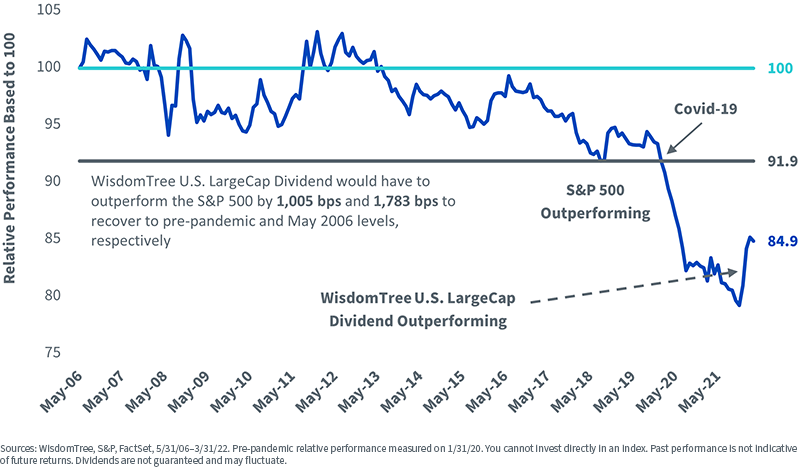

The “stay-at-home” world accelerated the performance of tech stocks during the pandemic, but now a reopening economy with higher inflation and interest rates is flipping the regime.

With the deflating of the growth trade, the WisdomTree U.S. LargeCap Dividend Index has provided a cushion in a world of negative stock and bond returns.

Relative Performance: WisdomTree U.S. LargeCap Dividend Index/S&P 500 Index

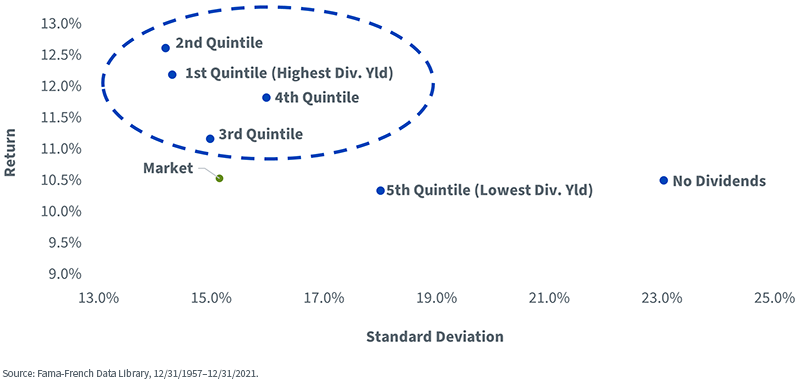

While the environment over the last 15 years has been challenging for value mandates, let’s close with this reminder of dividend yield quintile returns going back to the launch of the S&P 500 in 1957.

Over the long run, companies with higher dividend yields have handily outperformed those with the lowest yields and no dividends and have generally done so with lower risk than the market.

The last 16 years were outliers from this long-run data, and WisdomTree is excited to bring revitalized attention to our original idea that launched the firm in 2006: rebalancing indexes to a concept of relative value metrics—dividends—can be a powerful driver of returns in a world of expensive markets and higher volatility.

1 “We Study Billionaires – The Investor’s Podcast Network – Tip 438: Berkshire Hathaway Masterclass w/ Chris Bloomstran,” 4/10/22.

Important Risks Related to this Article

Past performance is not indicative of future results. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs, brokerage commissions on transactions. Such fees, expense and commissions would reduce returns.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.