Looking Back at Equity Factors in Q4 with WisdomTree

2021 closed with a bang. After a disappointing third quarter, developed market equities delivered their best performance of the year in Q4. However, despite this positive outcome, markets remained wary, and defensively minded factors performed the best. In this installment of the WisdomTree Quarterly Equity Factor Review, we aim to shed some light on how equity factors behaved in Q4 2021 and how this may have impacted investors’ portfolios.

- In Q4, quality was the only factor that managed to outperform across all markets

- In U.S. equities, more defensive factors, minimum volatility and quality fared better

- In Europe, good performance was more widespread, but defensive factors still ruled, and cyclical ones suffered

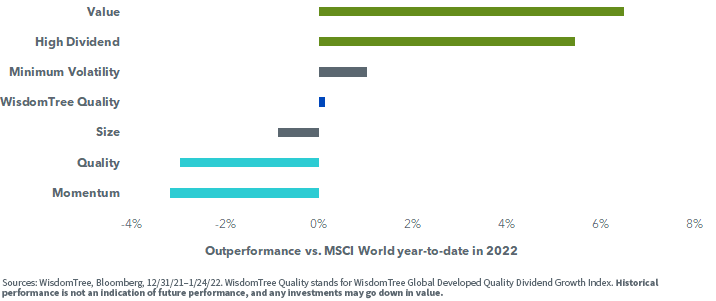

2022 has already started with a sharp reversal away from mega-cap and growth and toward value and high-dividend strategies. Looking forward to the year ahead, investors are starting to worry about:

- Heightened volatility in the markets

- Elevated inflation for the medium to long term

Research has shown that value or discounted stocks tend to do well in periods of high inflation and rate increases but tend to suffer from higher volatility. On the other hand, high-quality stocks are usually known to withstand volatility well and have high pricing power that allows them to defend their profitability in a high-inflation environment.

Performance in Focus: Defensive across the Board

In the last quarter of 2021, the equity rally started again. The MSCI World gained 7.77% over the quarter: the best quarter of 2021 and the sixth quarter of positive performance since March 2020’s nadir. In that environment, the U.S. led the way with +10% over the quarter.

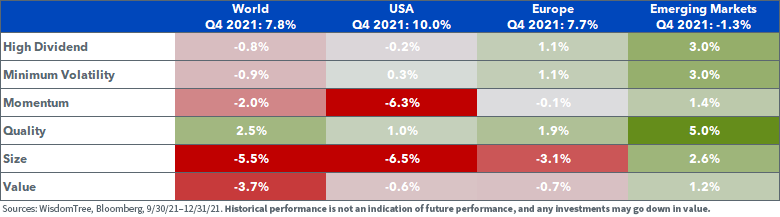

In Q4 2021, we continued to observe geographical disparities in factor performance:

• Quality was the only factor that managed to outperform across all markets

• In U.S. equities, more defensive factors, minimum volatility and quality fared better

• In Europe, positive performance was more widespread, but defensive factors still ruled, and cyclical ones suffered

• Emerging markets lost 1.3% over the quarter; quality, min volatility and high dividend posted the strongest gains.

Figure 1: Equity Factor Outperformance in Q4 2021 across Regions

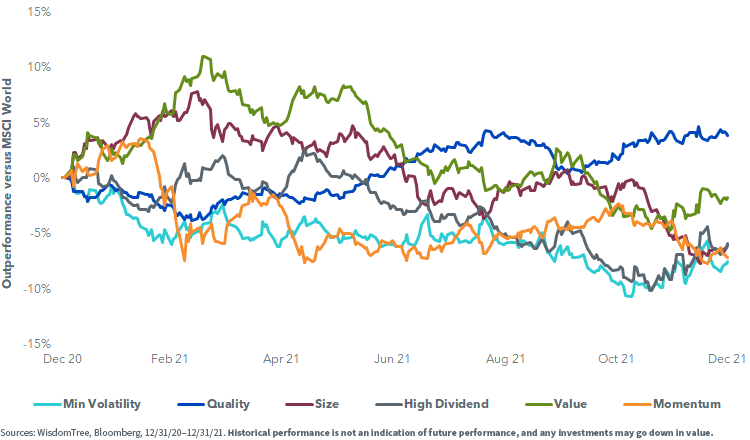

Looking back at the whole year, it is clear that developed markets suffered from the many factor rotations. Value and growth stocks fought for leadership all year long. This created a challenging environment for factor investing in general, with most of them ending in the red. Only quality managed to outperform over the full year.

Figure 2: Year-to-Date Outperformance of Equity Factors

In emerging markets, however, factors have been performing very strongly. Only growth ended up underperforming, while size outperformed by 21% and high dividend and quality by 11%.

Factors and Volatility

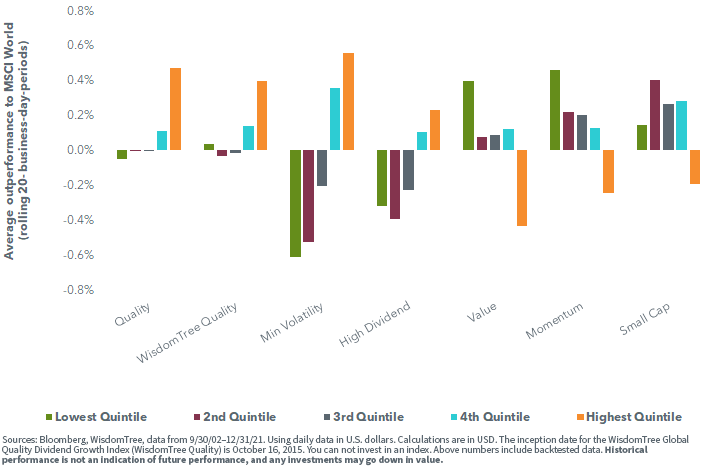

In figure 3, we analyze the performance of equity factors depending on market volatility levels. To do so, we split the last 20 years into short periods of 20 business days and classify them in five buckets from the lowest quintile with the 20% less volatile periods to the highest quintile with the 20% most volatile periods. We observe clear differences in behavior between the different factors:

- Min Volatility and High Dividend tend to behave defensively, outperforming in periods of high volatility and underperforming in low-volatility periods.

- Value, Size and Momentum tend to behave very cyclically, outperforming in periods of low volatility and underperforming in high-volatility periods.

- Quality stands out with an “all-weather” behavior, acting defensively and outperforming in periods of high volatility but performing strongly and matching the market in low-volatility periods.

Figure 3: Outperformance of Equity Factors Depending on Volatility Levels

For definitions of terms in the chart above, please visit the glossary.

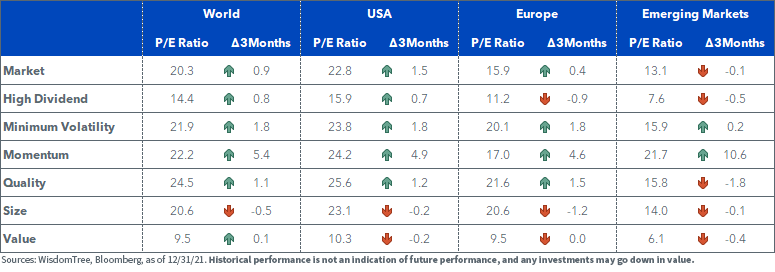

Valuations Continue to Come Down on the Back of Improved Earnings

In Q4 2021, valuations started to increase again in most factors globally. Emerging markets are the outlier with a decrease in valuations. Momentum came out of their recent rebalancing with significantly higher valuations through a rotation toward more expensive higher-growth stocks.

Figure 4: Historical Evolution of Price-to-Earnings Ratios of Equity Factors

Looking forward to the year ahead, markets have already started to retreat in light of expectations of:

- Heightened volatility in the markets

- The Federal Reserve’s hawkish turn and multiple expected hikes for 2022

- Elevated inflation for the medium to long term

This led to a sharp reversal. Mega-caps and the growth styles have been underperformers, while value-oriented and high-dividend strategies outperformed. Surprisingly enough, in a down market, minimum volatility is not doing too well. Minimum volatility’s historical dislike of inflation and rate hikes may be at play here. Also, Netflix, a pandemic darling, found its way into this Index, leading to a strong negative contribution.

It is worth noting also that not all quality strategies are the same. While the MSCI factor definition of quality tends to reward many of the technology companies that have been hit in the 2022 rotation, this is not the case for strategies focusing on high-quality companies that are growing their dividend.

Figure 5: Equity Factor Outperformance in Early 2022

Research has shown that value or discounted stocks tend to do well in periods of high inflation and rate increases but tend to suffer from higher volatility. On the other hand, as discussed above, high-quality stocks are usually known to withstand volatility well and have high pricing power that allows them to defend profitability in a high inflation environment.

Important Risks Related to this Article

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.