Rebalancing Our Core Equity Strategies for 2022

WisdomTree is a pioneer in fundamentally weighting strategies. We seek to manage risks like valuation and profitability that are inherent with market cap-weighted strategies.

In 2007, WisdomTree launched its domestic core equity family of Funds, seeking to give investors broad exposure to the different size cuts of the U.S. market by selecting profitable companies and weighting them by their earnings.

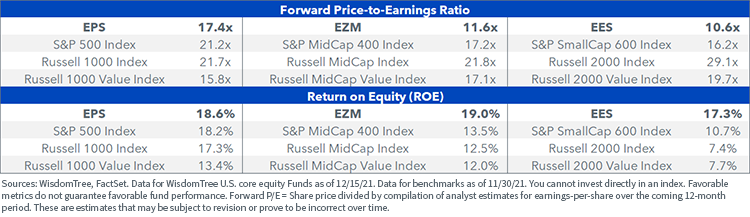

With annual rebalancing, the WisdomTree U.S. LargeCap Fund (EPS), the WisdomTree U.S. MidCap Fund (EZM) and the WisdomTree U.S. SmallCap Fund (EES) seek to maintain lower valuations than the broad market and help ensure investors are not overpaying as markets rise.

Last year, we added a layer seeking to reduce the risk of these strategies by limiting exposure to companies our CRS model flags as having higher-than-average earnings risk, along with actively constraining sector and individual security biases, reducing active risk versus the market. The constraints included:

- Sector constraints: In addition to our existing 25% sector cap, we introduced +/- 5% active sector constraints. This means sector weights are limited to within 5% of the sector exposure of a market cap-weighted version of our core equity Indexes.

- Individual security constraints: Relative to the market cap-weighted version of our core equity Indexes, the weight of an eligible company will be equal to or between 0.33 times and 3 times its market cap weight.

This year we announced the creation of the WisdomTree Core Equity Index Committee, which will oversee the rebalance of the underlying WisdomTree Indexes these Funds seeks to track the price and yield performance of, before fees and expenses. The Index Committee will ensure the earnings measure used as input in the annual reconstitution properly reflects a company’s recurring profitability, an area our team has done extensive research on throughout the year.

Improving Measure of Earnings

One of the focus areas of the Index Committee is a topic that has received increased academic coverage over the past few years: how traditional accounting measures often fail to reflect the structure of modern businesses.

Technology and health care companies, among others, invest significantly in intangible assets such as products, patents and other competitive advantages created through research and development (R&D) activities.

Since 1974, the Financial Accounting Standards Board (FASB) has required that companies must expense R&D, deducting it in their income statements in the fiscal year the expense is incurred. Businesses that spend on tangible assets, such as vehicles and factories, are allowed to capitalize these expenses and depreciate/amortize them throughout the life of the asset—basically, spreading out the expense across many reporting periods.

The argument behind this is that tangible assets have a value that can be easily assessed, whereas intangible assets are more difficult (or impossible) to value. In a conservative approach by the FASB, intangible assets are not assigned a value on the balance sheet, unlike tangible assets.

All else equal, this distinction results in higher earnings for asset-heavy businesses operating in the Industrials, Materials and Energy sectors and lower measures for asset-light businesses in the Information Technology and Health Care sectors. This can have important implications in terms of eligibility and weighting for the WisdomTree domestic core equity Funds.

Although less than 3.5% of the companies eligible for each basket were affected by this adjustment, we believe the Index Committee adjustments provide a better, more diversified family of Indexes and enhanced exposures.

Rebalance Results

WisdomTree rebalanced its domestic core equity Funds after the close on December 14. As a result of their annual reconstitution, these Funds are trading at significant discounts to their broad-based benchmarks.

As intended, the combination of earnings weighting along with the previously mentioned risk-reduction layer results in higher-quality characteristics, with aggregate return on equity (ROE) above the broad-based cap-weighted benchmarks.

Outlook for 2022

Following 2020, a year in which overvalued, unprofitable stocks experienced strong returns, 2021 has seen the market focus on profitability and valuations. Through December 9, 2021, EZM and EES are outperforming their broad cap-weighted benchmarks, the Russell MidCap and Russell 2000 indexes, by more than 7% and 17% year-to-date, respectively. During this same period, EPS has managed to track closely to the S&P 500, lagging by less than 150 basis points1.

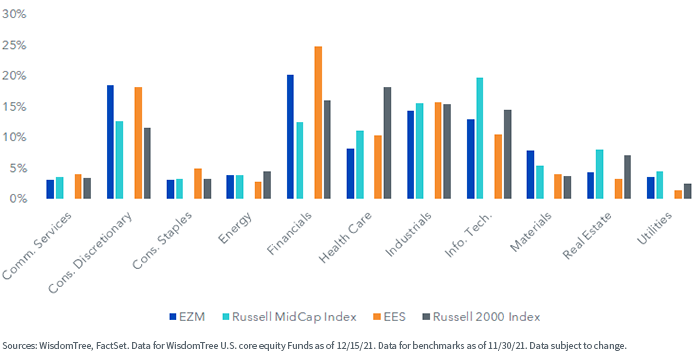

Going into 2022, and due to their earnings focus, EZM and EES remain overweight in cyclical sectors compared to their broad benchmarks. We like this positioning heading into the middle stages of the economic recovery

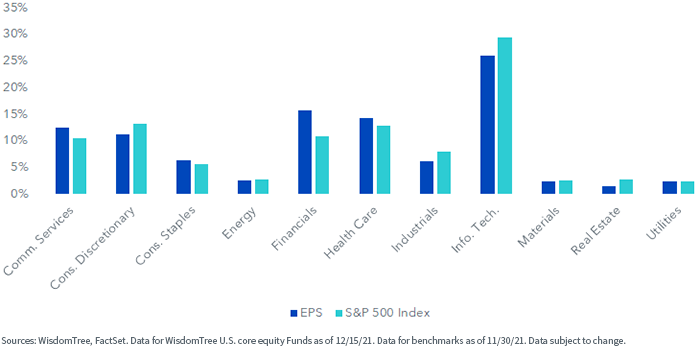

Meanwhile, EPS's sector biases are contained except for its slight overweight allocation to the Financials sector and underweight allocation to the Information Technology sector, seeking to provide investors with a core exposure at constrained valuations and increased quality.

Exclusions on High Earnings Risk

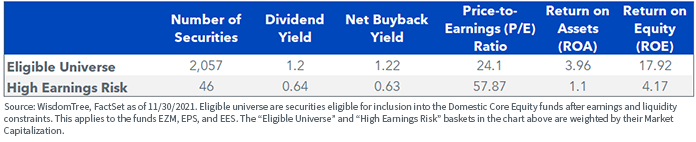

The rebalance process for the domestic core equity Funds includes a risk screen to remove companies with high earnings risk from the eligible universe. There were 46 companies excluded because of this additional composite risk score.

Looking at the chart below, we see that the excluded companies had significantly higher trailing P/E ratios at 59 times earnings and substantially lower standard quality metrics like ROE and ROA.

1 Sources: WisdomTree, FactSet. Data 12/31/20–12/09/21. All performance information referenced in terms of Fund NAV. Past performance is not indicative of future results.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.