Inflation and the WisdomTree Model Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Inflation seems to be on everyone’s mind right now. It is difficult to watch the news, open your laptop or pick up a newspaper or magazine without seeing stories and concerns about inflation.

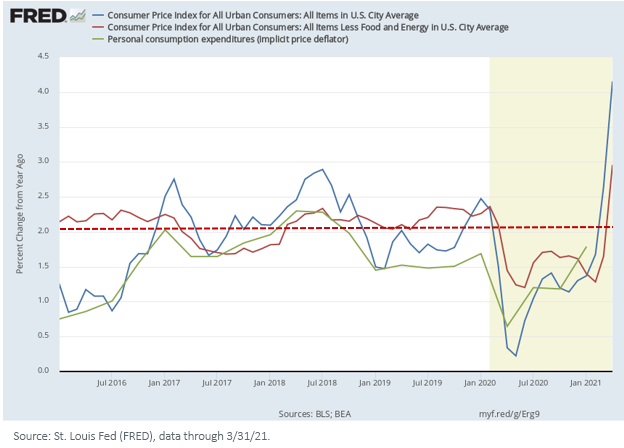

We recently published a blog post discussing the drivers of inflation. In that post, we focused not just on the headline numbers (CPI, CPI ex-food and energy and PCE) but also on the numbers behind the numbers (wages and input costs). Let’s begin by looking at the current level of these various numbers.

First, the headline numbers:

The Federal Reserve’s (Fed) historical target rate was 2% (though it has adjusted to a more fluid “average inflation targeting” approach). Certainly, part of the dramatic increase this year is because of base effects—that is, inflation was zero at this point last year during the COVID-19 lockdowns, so the year-over-year increase is amplified. But we see a distinct upward trend.

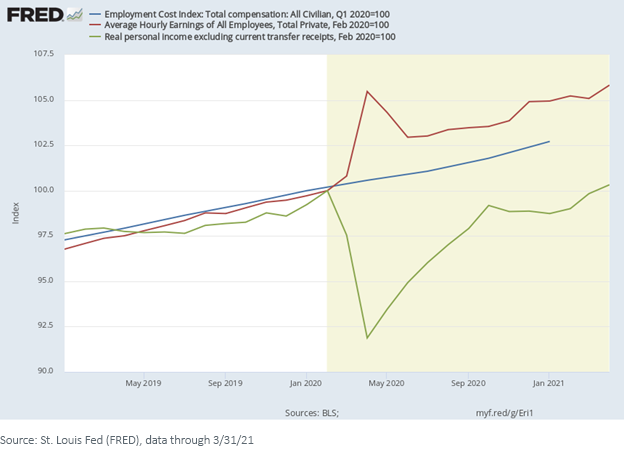

How about the numbers behind the numbers? First, we will look at wages and personal income:

We are beginning to see an upward trend in wages as the economy reopens and employers, finding it difficult to find enough qualified workers, are raising wages to attract suitable employees.

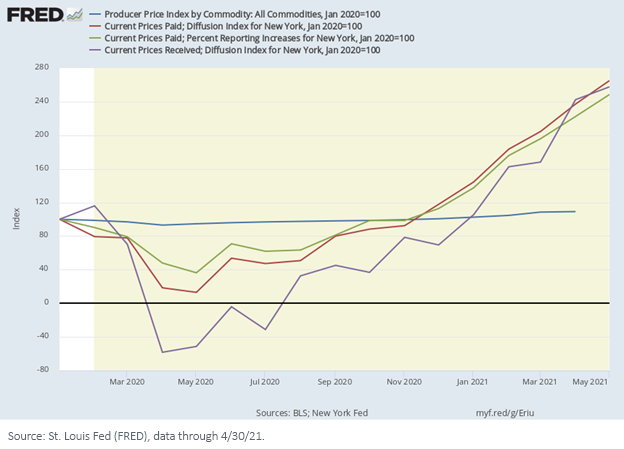

Finally, how about input prices? (We will use the New York Fed’s numbers as a proxy for the nation.)

We see a dramatic increase in prices paid, the number of firms reporting higher input prices and — important for our inflation story — prices received (the purple line). Companies are paying higher input prices but increasingly passing those increases to their clients and consumers.

For now, the Fed suggests that these upward inflationary pressures are transitory, brought on by supply chain disruptions, the global pandemic, massive fiscal stimulus in the U.S. and huge pent-up demand by consumers as the economy finally reopens.

Perhaps, but we are not so sure. And, it seems, neither are some current Fed members, who have suggested that perhaps the Fed will have to revisit its hugely accommodative monetary policies sooner than was previously signaled.

WisdomTree Model Portfolio Positioning

As we’ve posted previously, two of our primary investment themes for 2021 and beyond are reflation and cyclical rotation. By cyclical rotation, we mean a factor and asset class rotation back to things that work best during a cyclical economic recovery—value and small cap in particular.

Our Model Portfolios have a variety of investment objectives. But they do have certain common characteristics, given the nature of most of the WisdomTree strategies we include in them. Unless asked to build custom models to meet firm-specific objectives, our models are:

- Global in nature

- ETF-focused to optimize fees and taxes

- “Open architecture” (will include both WisdomTree and third-party strategies)

- "Core-satellite” in their portfolio construction—that is, they will allocate to both cap-weighted and active factor-tilted strategies (size, dividends, quality, earnings, value, etc.)

- Diversified at both the asset class and risk factor levels to seek more consistent performance over full market cycles

In addition, we charge no strategist fee.

Cyclical Rotation

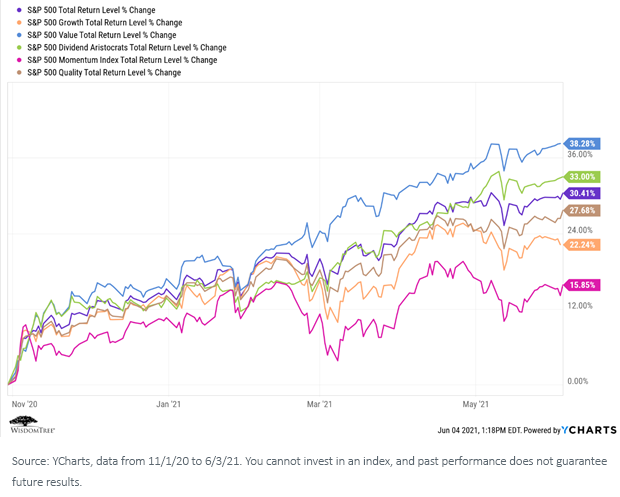

Since the announcement of the Pfizer COVID-19 vaccine last November, we’ve seen a strong cyclical rotation out of the large-cap, growth and momentum factors that led the market for years and back into the factors that historically performed best during periods of economic recovery: value and small cap (with the bonus of a nice rally in dividend-paying stocks).

Value and dividends:

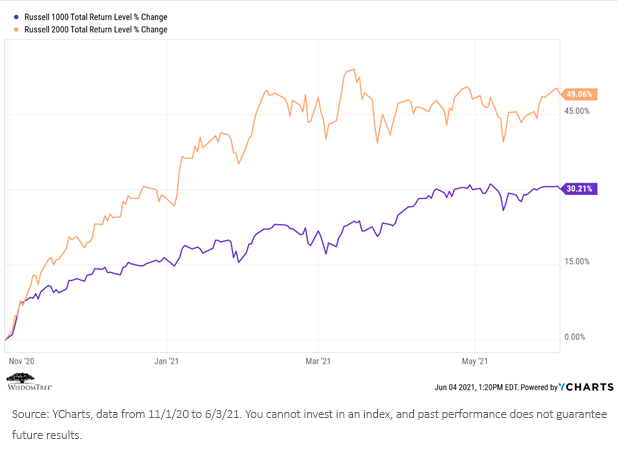

Small cap:

The small-cap rally is equally visible in non-U.S. markets.

Developed international:

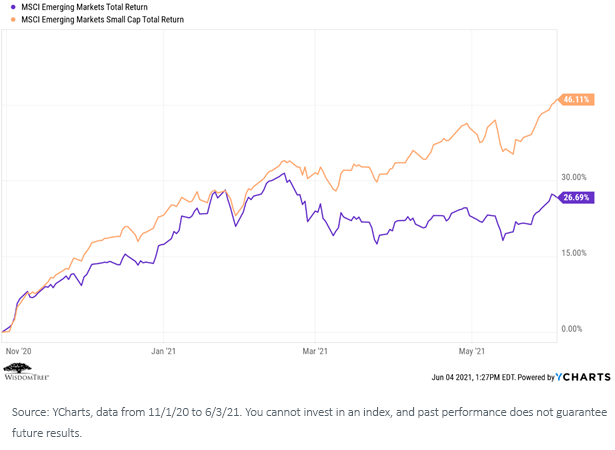

Emerging markets:

Because of the nature of many of the WisdomTree strategies we deploy in our models, most of them have distinct and explicit tilts toward smaller-cap stocks, dividend-paying stocks and value-oriented stocks. Perhaps somewhat uniquely, we also have explicit allocations to international and emerging market small caps.

As such, our performance has benefited nicely from this cyclical rotation trend, which we believe will continue throughout 2021.

Reflation/Inflation

Here is an interesting chart illustrating the historical performance of different equity sectors under various inflation regimes:

We suggest we are in a “low and rising” inflation regime. Look at some of the asset classes and strategies that historically performed best in this regime—gold, commodities, EM equity, small cap and value. Those are exactly the factor tilts built into most of our models.

In addition, our Endowment model has explicit allocations to real assets, including gold, commodities, master limited partnerships (MLPs) and infrastructure, while our Siegel-WisdomTree Longevity model has explicit allocations to gold and commodities. Because the Longevity model is allocated 75% to equities, it may provide additional inflation protection, as stocks historically have been an effective hedge against moderate and increasing inflation.

Conclusions

Two of WisdomTree’s primary investment themes for 2021 and beyond are cyclical rotation and reflation. We are witnessing both themes play out in full force so far this year.

It is always nice to have market winds at your back rather than in your face, but we believe our portfolios are (1) well-positioned to take advantage of these current winds while (2) remaining diversified at both the asset-class and risk-factor levels so that they may stay upright and afloat, regardless of which way the winds blow.

Financial advisors registered on the WisdomTree website can learn more about our Model Portfolios on the Model Adoption Center.

For definitions of indexes in the chart, please visit our glossary.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

International investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.