Income, Income, Income!

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“Well, all I hear all day long at school is how great Marcia is at this or how wonderful Marcia did that…Marcia, Marcia, Marcia!”

(Eve Plumb as Jan Brady on “The Brady Bunch,” 1971)

We last looked at our income Model Portfolios in March. At that point in time, the 10-Year U.S. Treasury yield had finally reached the S&P 500 dividend yield for the first time in more than a year. Here we are, two to three months later, and every client or prospect we have is asking about generating risk-controlled yield in the current market environment. In response, we recently launched HYIN, our alternative credit ETF.

But we also offer several yield-oriented Model Portfolios, specifically our Global Dividend, Global Multi-Asset Income and Siegel-WisdomTree Longevity models. Given our current yield-starved market regime, let’s check in with them. Financial professionals can find details on all these models via our Model Adoption Center (“MAC”).

Rates and Credit Spreads

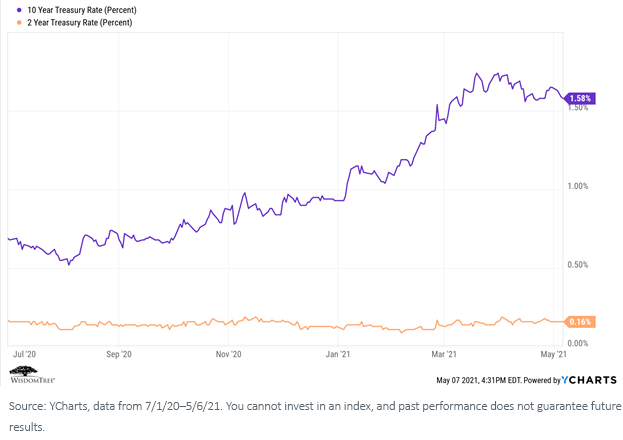

Let’s start with rates and credit spreads. After rising sharply over the first two to three months of the year, U.S. interest rates have stabilized over the past several weeks.

We continue to believe that rates will “grind higher” as the economy improves, but the rapid increases we saw earlier in the year appear to have abated, for now.

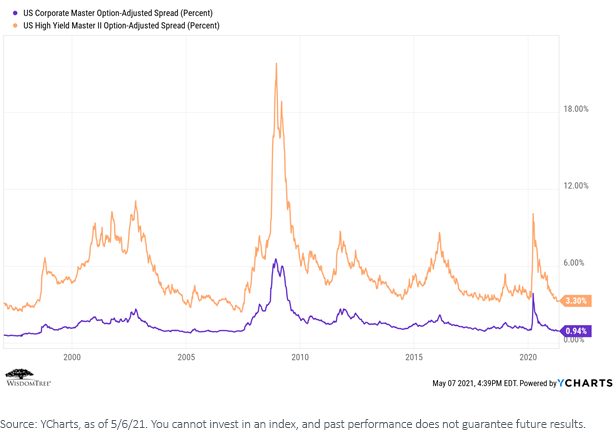

At the same time, credit spreads continue to “grind tighter” and trade at the “tights” of their pre-pandemic ranges.

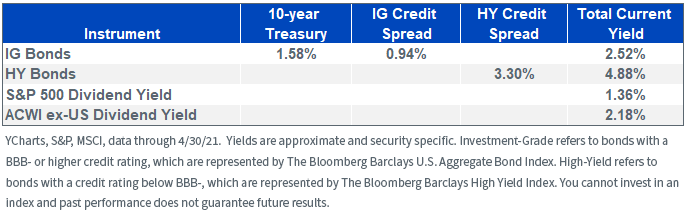

So where does that leave us? Because of aggressive price appreciation in the stock market, dividend yields have also fallen. Using the above indicated Treasury rates and “OAS” credit spreads as a “sample” outcome, here are indicative yields available in the equity and credit markets:

Not much to go on for income-focused investors. Many corporations are reinitiating or increasing their dividends and stock buybacks following the pandemic-induced cutbacks, so the yield from equities may improve over the course of the year.

We also think corporate balance sheets are in good shape, so default rates should be reasonably low, and investors can probably feel safe about their coupons.

But the total return picture for fixed income is not great, and we certainly would not recommend “stretching for yield” by taking on excessive duration or credit exposure. That defeats one of the primary purposes for owning bonds to begin with—to hedge equity risk.

WisdomTree Income-Focused Model Portfolios

Many of the WisdomTree products have a yield or income “factor tilt” associated with them. Income generation is one of “our lanes” from an investment perspective.

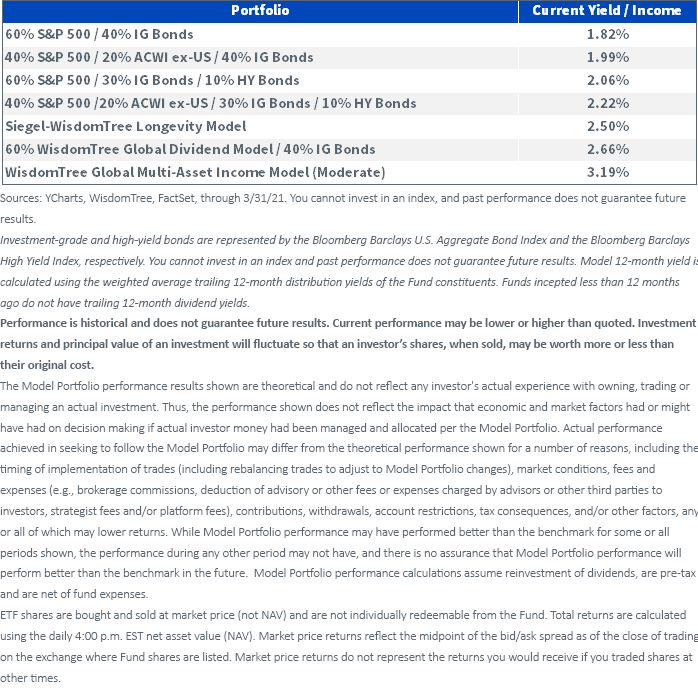

We have three publicly available Model Portfolios designed specifically to optimize current income in a risk-controlled manner: Global Dividends, Global Multi-Asset Income and Siegel-WisdomTree Longevity. In each of these, we focus on yield-producing equity investments versus taking excessive risk in our fixed income allocations. Here are how the yields on those portfolios stack up versus more “traditional” models, as of March 31, 2021.

For standardized performance of model portfolios in the table, please click the respective model: Siegel WisdomTree Model Portfolio, WisdomTree Global Dividend Model Portfolio, WisdomTree Global Multi-Asset Income Model Portfolio.

Current Yield/Income refers to the most recently posted 12-month dividend yield, as indicated here.

Conclusions

In an income-starved world, there is no free lunch. If you want to generate current income, you must take risk. But we continue to believe the better way to do so is by seeking to generate income via the equity market, and not by taking excessive duration or credit risk.

Our income-focused Model Portfolios are designed for exactly this purpose—“Income, Income, Income!”—but without the teenage angst Jan Brady experienced all those years ago.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

For retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment adviser may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment adviser and may differ from information provided by your investment adviser. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.