A Potential High-Income Solution for a Yield-Challenged Environment

In today’s financial markets, investors are faced with some potential challenges when trying to determine where best to place their funds. Certainly, one of the most noteworthy challenges is the level of global interest rates. Whether the investment focus is here in the U.S. or on a global scale, investors are still dealing with historically low rates, and in some cases, the readings are either at zero or in negative territory. In addition, corporate bond spreads have returned to pre-pandemic readings, and do not offer as much in terms of relative value. Equity markets are near all-time highs as well.

So, where does an investor turn to find income in this yield-challenged environment? One answer is alternative credit. This is why we just launched the WisdomTree Alternative Income Fund (HYIN).

What Is Alternative Credit?

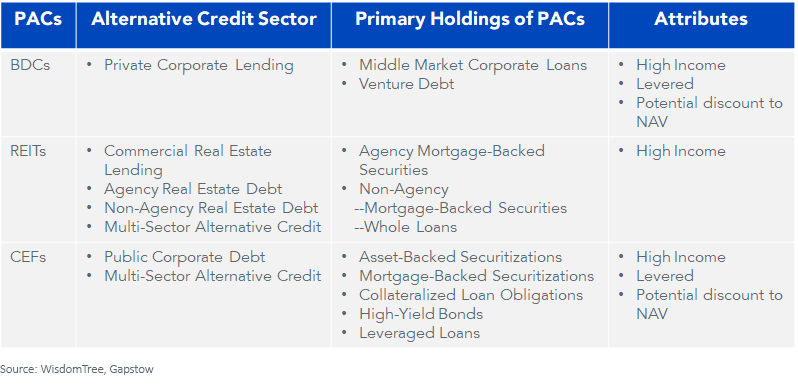

Alternative credit consists of debt and debt-based securities that have a higher risk-return profile than traditional high-yield bonds. Historically, this investment space has been primarily limited to institutional or ultra high net worth investors through private fund instruments. However, publicly traded alternative credit vehicles (PACs) offer another way of access for a wide range of alternative credit sectors on an intra-day basis.

PACs are a subset of business development companies (BDCs), real estate investment trusts (REITs) and closed-end funds (CEFs). Here are some examples of what each sub-sector consists of:

Where Does Alternative Credit Fit in a Portfolio?

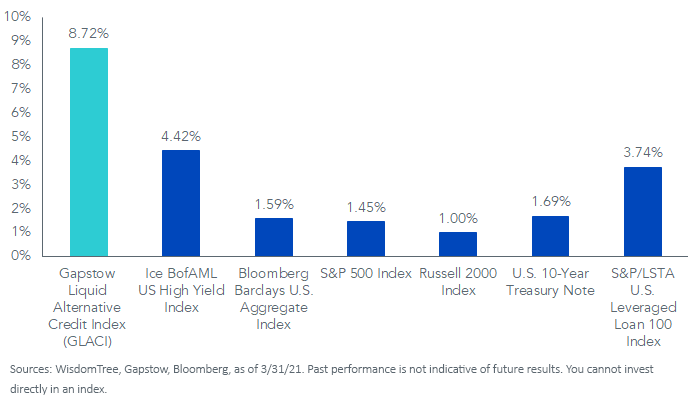

Against the backdrop of low yields in areas such as Treasuries, corporate bonds and equities, investors could consider using the newly launched HYIN, which seeks to track the price and yield performance, before fees and expenses, of the Gapstow Liquid Alternative Credit Index (GLACI), as a complement to their fixed income holdings. This strategy currently offers considerable yield advantages compared to a variety of both equity and fixed income classes and provides a moderate to low correlation to equity and fixed income markets.

Current Yields

WisdomTree views alternative income as a longer-term, strategic investment for model portfolios. With the goal of providing higher yields without taking on disproportionately higher risk, this approach offers a potential solution for income-focused investors.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in alternative credit sectors through investments in underlying closed-end investment companies (“CEFs”), including those that have elected to be regulated as business development companies (“BDCs”) and real estate investment trusts (“REITs”). The value of a CEF can decrease due to movements in the overall financial markets. BDCs generally invest in less mature private companies, which involve greater risk than well-established, publicly traded companies and are subject to high failure rates among the companies in which they invest. By investing in REITs, the Fund is exposed to the risks of owning real estate, such as decreases in real estate values, overbuilding, increased competition and other risks related to local or general economic conditions. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

High yield securities may be regarded as predominantly speculative with respect to the issuer’s continuing ability to meet principal and interest payments.