Shareholder Yield as a Value Factor in 2021

Value investing is in the spotlight, but not all value strategies are created equal. Benefiting from the recent value rally has likely been driven by your choice of value factor.

Let’s dig into how the various value factors have performed over recent and longer-term periods.

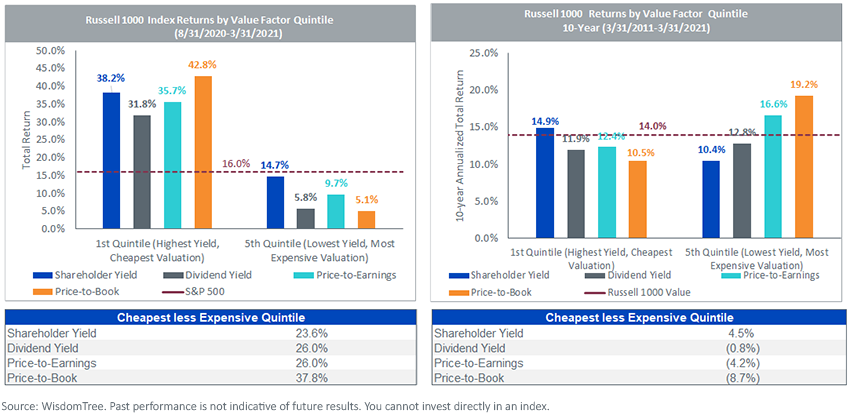

Every value factor has performed well since September 2020, but price-to-book and shareholder yield are the leaders of the value factor pack. The least expensive quintiles of the Russell 1000 Index, as measured by price-to-book and shareholder yield, have returned 42.8% and 38.2% respectively.1

More interesting is the performance differential between the least and most expensive quintiles of the market. The median outperformance of the inexpensive versus expensive quintiles across factors is 26%.2 The clear outlier of the group is price-to-book with 37.8% of value outperformance.3 This is a very notable shift in dynamic for price-to-book, which was in the hot seat for many years as critics questioned its efficacy as a value factor, with good reason.

Despite these recent value factor trends, it would be remiss to neglect the past. In the last 10 years, shareholder yield was the only value factor that “worked”—meaning it was the only effective way to screen the Russell 1000 Index for the least expensive stocks and outperform not only the expensive stocks, but also the benchmark index itself.

Over this same period, price-to-book was the least effective of the group, with the most expensive quintile outperforming the least expensive by 8.7% annualized.

Please see Glossary for definitions of terms and indexes referenced.

The consistency of shareholder yield in the recent value upturn and over the last 10 years is an important differentiator. At WisdomTree, we view shareholder yield as an effective value factor for both short-term, tactical value investors and long-term, strategic value investors.

Our Shareholder Yield Strategy—QSY

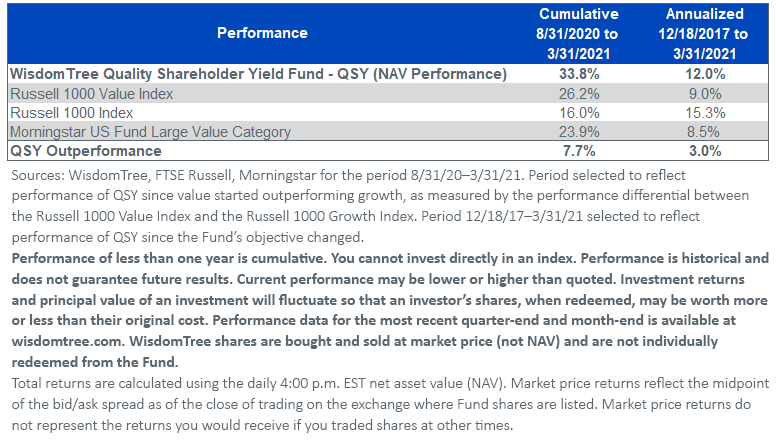

Since the value tide started turning in September 2020, our WisdomTree Quality Shareholder Yield Fund (QSY) has outperformed the Morningstar U.S. Fund Large Value category average by 990bps and the Russell 1000 Value Index by 776bps.4

For standardized performance of QSY, please click here.

QSY is a quantitative active strategy that combines a methodical approach to ranking stocks on their shareholder yield and quality scores, with the added ability to apply discretion where risks or opportunities to the quantitative model arise.

We recently rebalanced QSY to update the holdings for some notable repurchase activity taking place. Most importantly, we added Berkshire Hathaway to QSY, which repurchased 5% of its shares outstanding in calendar year 2020.5 In dollar amount and yield terms, Berkshire repurchased $24.7 billion in shares relative to its approximately $580 billion market cap, equating to a 4.2% shareholder yield.

Although repurchases are a recent development at Berkshire, Chair and CEO Warren Buffett discussed the benefits of price-sensitive repurchases: “The math of repurchases grinds away slowly, but can be powerful over time. The process offers a simple way for investors to own an ever-expanding portion of exceptional businesses.6"

In Buffett’s view, prudently managed repurchase programs allow investors to increase their ownership in a given company without spending a single dollar of their own money.

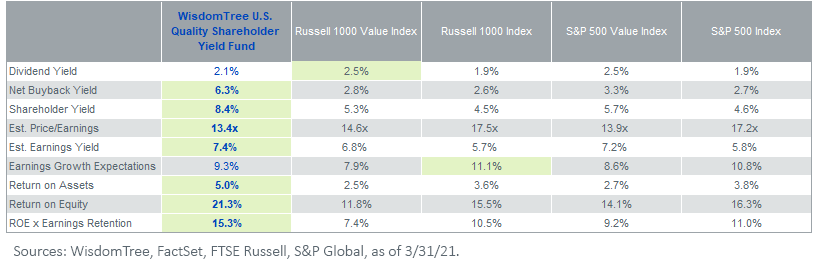

QSY incorporates Buffett’s principles of investing on buybacks, as well as his emphasis on investing in high-quality businesses at reasonable valuations. This is readily apparent in QSY’s fundamental characteristics. Relative to the Russell 1000 and S&P 500 benchmark indexes, QSY boasts lower valuations on both shareholder yield and price-to-earnings, with higher or top-tier quality metrics, including return on assets, return on equity and forward earnings growth expectations.

Please see Glossary for definitions of terms and indexes referenced.

The combination of a well-executed, high-conviction buyback program with a consistent cash dividend has the potential to drive excess returns for investors across value factor cycles.

We suggest QSY as a potential solution for investors seeking exposure to large- to mid-cap U.S. companies exhibiting high-quality characteristics while returning significant amounts of capital to their shareholders.

1Source: WisdomTree, FTSE Russell, for the period 8/31/20–03/31/21. Period selected to reflect performance of QSY since value started outperforming growth, as measured by the performance differential between the Russell 1000 Value Index and the Russell 1000 Growth Index.

2Source: WisdomTree, FTSE Russell, for the period 8/31/20–03/31/21. Period selected to reflect performance of QSY since value started outperforming growth, as measured by the performance differential between the Russell 1000 Value Index and the Russell 1000 Growth Index.

3Source: WisdomTree, FTSE Russell, for the period 8/31/20–03/31/21. Period selected to reflect performance of QSY since value started outperforming growth, as measured by the performance differential between the Russell 1000 Value Index and the Russell 1000 Growth Index.

4Sources: WisdomTree, Morningstar, for the period 8/31/20–3/31/21, performance at NAV.

5As of 3/31/21, QSY held 1% of its total weight in Berkshire Hathaway.

6Berkshire Hathaway 2020 Annual Letter to Shareholders

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.