The Bond Market’s Sell-Off Is Taking Out the Stock Market’s Leaders

This is part 1 of a two-part blog series. In part 2, “Plenty of Price, Not Much Sales,” we will take a look at the growing list of companies that are trading at extraordinary valuations.

Long duration bonds are witnessing some ugly price action.

It came so quickly that you could be forgiven for not fully appreciating the extent of the pain—the 30-Year U.S. Treasury is officially in a bear market, defined as a loss of more than 20% (figure 1).

Figure 1: Ryan Labs U.S. 30-Year Treasury Total Return Index

My suspicion is that rising yields—bond market pain—amount to a greater headwind for growth stocks than value stocks, owing to the effect that higher discount rates have on distant cash flows.

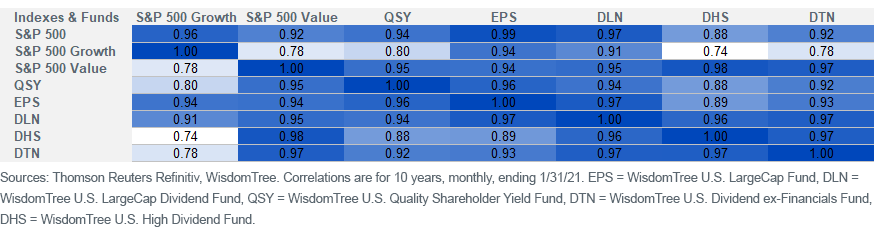

Focus on the bold fonts in figure 2, which show the correlation to the S&P 500 Growth of some of our major U.S. large-cap value-tilted Funds.

Figure 2: WisdomTree Large Cap Core & Value Correlations

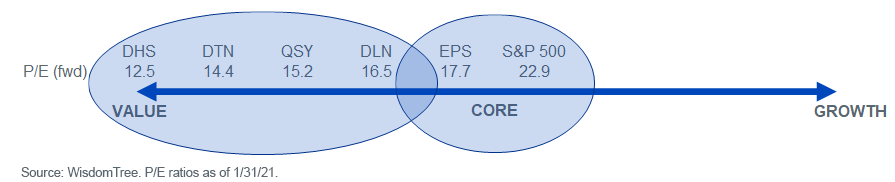

On a value-core-growth spectrum, the five Funds look something like figure 3. DHS, DTN and QSY give a deeper value bias than DLN, which is a more traditional value. EPS is more of a core Fund that has a value flavor.

Figure 3: WisdomTree Funds’ Value-Core-Growth Positioning

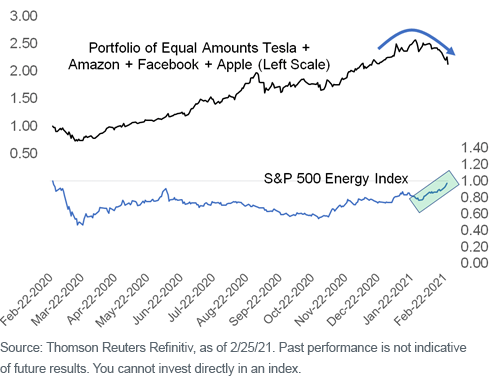

It’s still early days, but the stock market’s response to the bond sell-off has been to take out growth stocks. For sure, not all of the market’s leaders are in trouble: Google-parent Alphabet is still near its highs, while Microsoft’s decline since mid-February is just a blip on the long-term chart. Then again, I am not sure many people consider that one to be a growth stock anymore.

But things are looking ugly with some of the market’s “generals,” with Tesla, Amazon, Facebook and Apple acting sickly of late. That is a sharp contrast to the surge in the reflation-themed Energy sector.

Figure 4 is the 2021’s reflation thesis in one exhibit: disinflation beneficiaries are “off,” and inflation beneficiaries are “on.”

Figure 4: Old Leaders vs. New Leaders

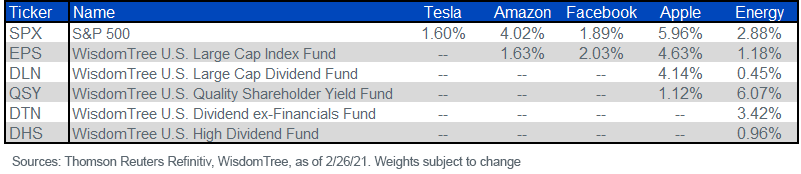

The “value-lite” EPS tends to under-weight in high flyers because its 500-stock methodology weights components by their earnings as a proportion of all stocks’ earnings. It only has 1% in Energy, owing to that group’s low profits. If the goal is to have more in that sector, maybe something like QSY is the angle.

DLN requires a dividend for inclusion, so it is a course that can be taken to completely exclude a handful of the market’s darlings. Similar concepts are found in DTN and DHS, which have their own twists on dividend screens.

Figure 5: Fund & Index Weights

In part 2 of this two-part blog series, we look at the abundance of companies in the S&P 500 that are trading at a price-to-sales ratio above 10—and what may happen to them if rising interest rates hinder growth stocks.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.