Let the Good Times Roll

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Let the good times roll

Let them knock you around

Let the good times roll

Let them make you a clown

Let them brush your rock and roll hair

Let the good times roll

Let the good times roll, oh

Let the good times roll

(From “[Let the] Good Times Roll” by The Cars, 1978)

Investment Themes for 2021

As described in a previous blog post, WisdomTree has identified five primary investment themes that we believe have a high probability of playing out over the course of 2021 and beyond—emerging markets, reflation, quality and income, disruptive growth and cyclical rotation.

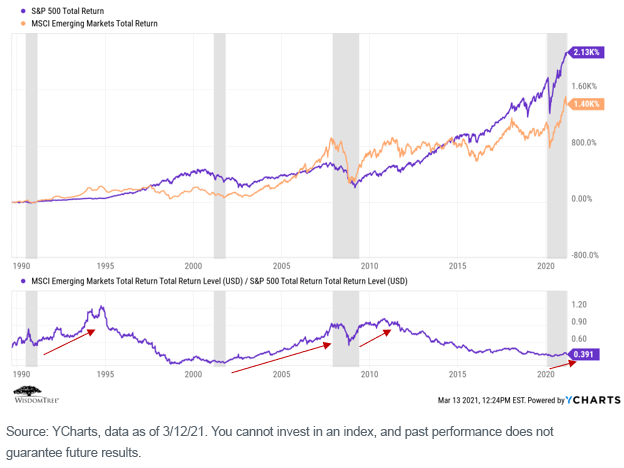

In this blog piece, we will take a deeper look into this last theme—cyclical rotation. We’ve blogged before that coming out of a recession, value, small-cap and emerging market stocks historically have outperformed. Let’s a quick look at how that “cyclical rotation” trade has played out over time. We’ll begin with emerging markets:

While the S&P 500 Index has outperformed EM on a cumulative basis since 1990, we see specific periods of time when EM outperformed—typically aligned with the U.S. coming out of recession (the gray bars in the chart).

The current outperformance is more clearly visible if we look at relative performances since the beginning of Q3 2020.

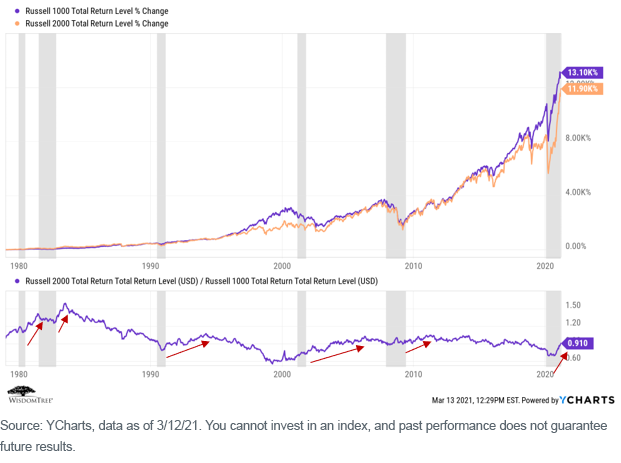

How about small-cap stocks? Let’s start with historical performance. We again see that small-cap stocks tend to lead as the U.S. comes out of recession:

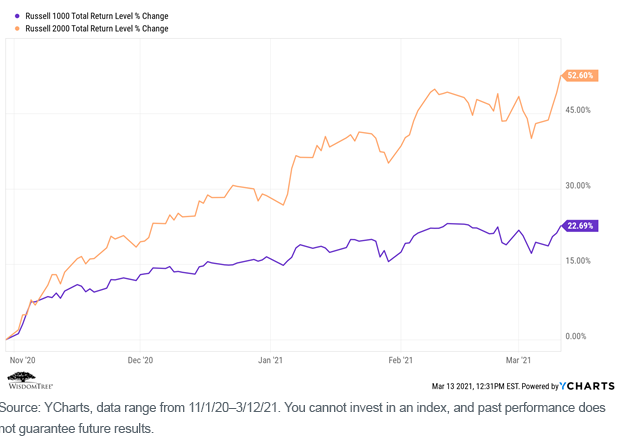

The bounce back for small-cap stocks in the U.S. has been especially pronounced since the announcement of the Pfizer COVID-19 vaccine back in early November:

Nor is this strictly a U.S. phenomenon. Here is a comparison of developed international (“EAFE”) small-cap versus large-cap stocks since the beginning of Q3 2020:

When investing in small-cap stocks, we believe that quality should be an essential screen, given the growing number of “zombie” companies that occupy the small-cap space—companies that are barely generating enough cash flow to cover interest expenses and rely instead on borrowing and other sources of financing to stay afloat.

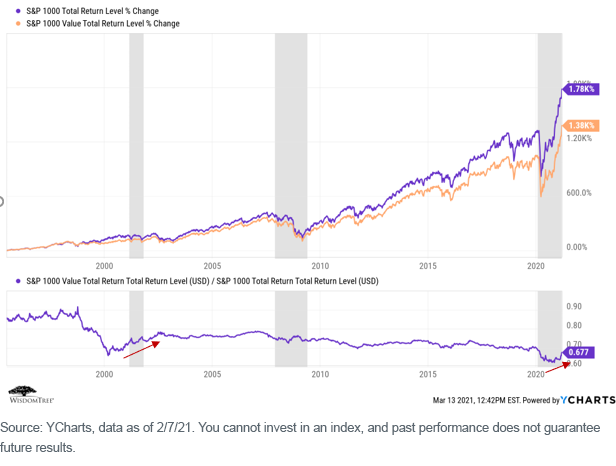

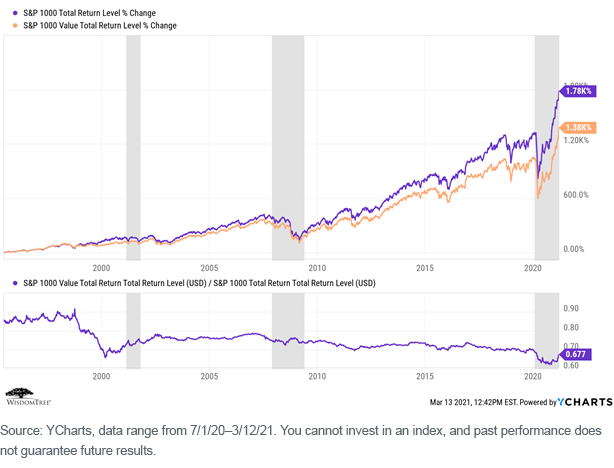

Finally, let’s look at the performance of value stocks versus the broader market, first historically and then since the beginning of Q3 2020. The picture is somewhat distorted by the incredible outperformance of growth stocks since roughly 2010.

But we see that value stocks have outperformed since the beginning of Q3 2020:

Model Portfolio Implications

At a strategic level, all of the WisdomTree Model Portfolios have certain common characteristics:

1. Relative to the MSCI ACWI Equity Index (our global equity benchmark), our core equity model is over-weight in the U.S. and EM, and under-weight in developed international (“EAFE”). This model can be (and is) used as a stand-alone model, and it is also a fundamental “building block” to our various strategic multi-asset models;

2. Also relative to the MSCI ACWI Index, we are over-weight in small cap and value stocks. The WisdomTree product set tends to “tilt” this way, based on the various screens we apply to our underlying Indexes. So, even though all our models are “open architecture” in that they include both WisdomTree and third-party strategies, we will normally have inherent small-cap and value tilts to our portfolios.

Furthermore, all the WisdomTree small-cap strategies, across all geographies, have a quality screen—they seek to identify companies with strong balance sheets, profitability and cash flow. This is tangible in our core equity model, where we deploy DGRS, our small-cap quality dividend growth strategy, as our U.S. small-cap allocation, DLS, our International (“EAFE”) SmallCap Dividend Fund, as our international small-cap allocation, and DGS, our Emerging Markets SmallCap Dividend Fund, as our EM small-cap allocation. All three carry explicit quality (“anti-zombie”) screens.

3. Within our core fixed income model, which is both a stand-alone model and a fundamental building block of our various multi-asset models, we recently added an allocation to ELD, our emerging markets local currency debt strategy. This position aligns well with our both our “cyclical rotation” and our “emerging markets” investment themes1.

Conclusion

We believe the cyclical rotation back toward small cap, value and emerging markets has “legs” —that is, we believe it will remain in place throughout 2021, and perhaps beyond. We believe this for several reasons:

1. We think the continued rollout of COVID-19 vaccinations, combined with massive fiscal stimulus, will drive a significant economic recovery in the U.S. in the second half of the year. Historically, this “phase” of the economic cycle is when the small-cap, value and emerging markets “risk factors” have performed well.

2. We are not “anti-growth,” by any means. Growth continues to perform quite well, and one of our primary investment themes for 2021 is the continuation of a “disruptive growth” trend. But the performance and valuation differential between growth and value stocks and between small-cap and large-cap stocks had grown to historically wide levels. Since the markets historically have exhibited “reversion to the mean” tendencies, we believe this current cyclical rotation back toward small cap, value and emerging markets still has significant room to run.

If we are correct in our outlook, we believe our Model Portfolios are well-positioned to take advantage of and capitalize on what we believe will be significant “tailwinds.” It’s a nice feeling to have the wind at your back and to “let the good times roll.”

1Model portfolio allocations are subject to change and should not be considered investment advice.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.