It’s You, Sweet Income

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Honey it's you, sweet babyEver lost and captured by your smile, sweet baby

I will always be right there by your side

Right by your side

Lying here alone I'm dreaming

My mind keeps wandering, my thoughts are only you

Looking through the memories in my mind

How could love so real have turned so empty

I just keep wondering why

Will I ever find the love we shared together, you and I?

(From “Sweet Baby” by Stanley Clarke and George Duke, 1981)

Investment Themes for 2021

As described in a previous blog post, WisdomTree has identified five primary investment themes that we believe have a high probability of playing out over the course of 2021 and beyond:

- Cyclical rotation back toward small-cap, value and emerging market stocks

- Emerging markets, both in equity and debt

- Reflation (higher than expected inflation in the second half of the year)

- Disruptive growth

- Focus on quality and income, both in equity and debt

In this blog post we take a deeper look into quality and income and how our Model Portfolios are aligned with this investment theme.

What Worked in 2020

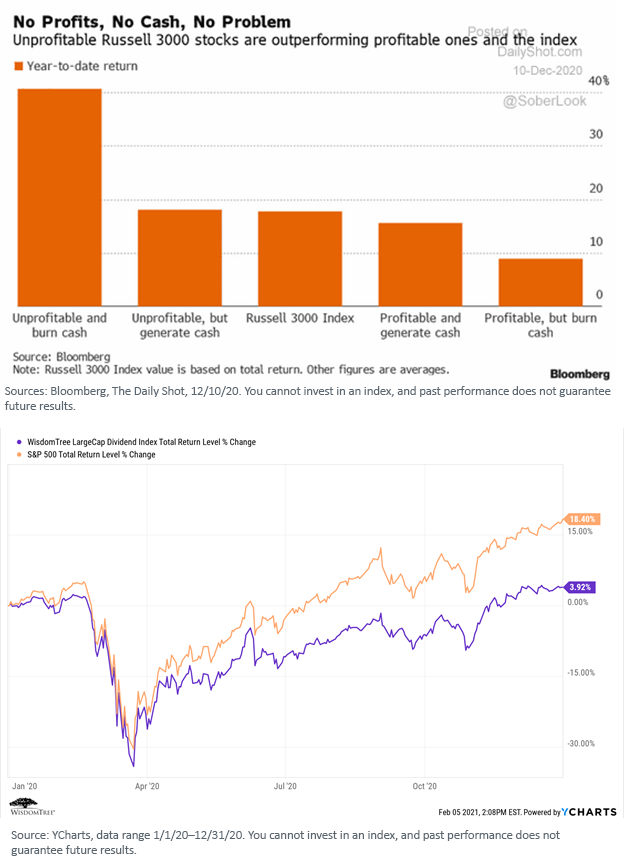

In the equity markets in 2020, neither quality nor income was rewarded by the market as it priced in assumed dividend cuts during the pandemic and rewarded “junk” companies:

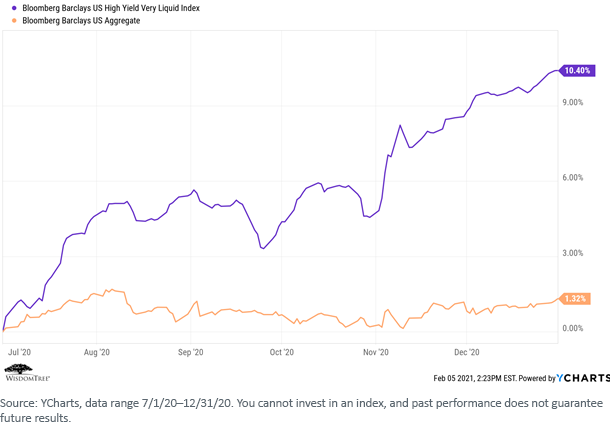

In the bond market, high-yield (“junk”) bonds, though much more volatile, outperformed investment-grade bonds, especially in the second half of the year:

On the equity side, when we say “quality” we mean screening for companies that have strong balance sheets, earnings and cash flows. This is a common screen for most WisdomTree equity indexes, and so our Model Portfolios tend to have a distinct quality tilt to them. We never think it is a bad idea to invest in quality companies, even if the market disagrees with us from time to time.

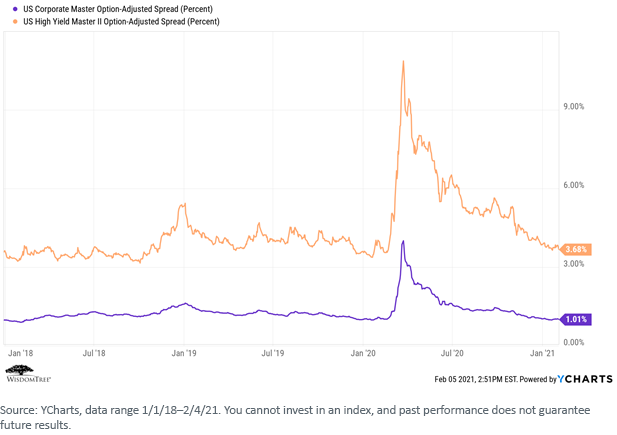

On the fixed income side, we mean companies with solid debt coverage ratios and lower risk of default. Within our core fixed income models, we have for quite some time maintained a strategic positioning of underweight duration and overweight credit. We remain comfortable with that positioning, given our view of future yield curve and spread movements. But, within that overweight credit exposure, we are also highly focused on quality security selection, given current spread levels:

While quality and income companies seemingly were out of favor in 2020, we think they are poised for a comeback in 2021. We can see this playing out, at least in small- and mid-cap stocks, if we compare the performance of the S&P 600 Index to that of the Russell 2500 Index since the beginning of the third quarter of 2020 (the S&P indexes typically contain higher quality stocks than the comparable Russell indexes):

How does all of this pertain to WisdomTree Model Portfolios? In two primary ways:

- As mentioned earlier, all of our Models have a distinct quality tilt to them, as that is a common screen we apply in creating the indexes that underly many of our core equity products. On the fixed income side, an excellent example is our WisdomTree High Yield Corporate Bond Fund (WFHY), which screens out companies with negative cash flows.

- Our Global Dividend, Global Multi-Asset Income and Siegel-WisdomTree Models all have quality and income tilts. A differentiating factor from other income-focused models is that we allocate more heavily to yield and income-oriented equities, versus taking excessive duration or credit risk in the fixed income market. In addition, the Global Multi-Asset Income Model allocates to less traditional sources of income, such as covered call options, master limited partnerships (MLPs) and preferred securities, to enhance current income while increasing portfolio diversification.

Conclusion

With rates and credit spreads where they are, we believe it will be difficult to generate much income from a traditional fixed income allocation without taking excessive risk. Given the quality tilt and diversified nature of the income sources in many of our Model Portfolios, especially the Global Dividend, Global Multi-Asset Income and Siegel-WisdomTree Longevity Models, we believe we are well positioned to capture a quality and income theme in 2021, and thereby help advisors deliver a differentiated end client investment experience.

For definitions of indexes in the charts, please visit our glossary.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Asset Allocation Committee of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as a consultant to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.