Whole Lotta Shakin’ Goin’ On

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional.

Come on over baby

Whole lotta shakin' goin' on

Yes, I said come on over baby

Baby you can't go wrong

We ain't fakin'

Whole lotta shakin' goin' on

We got chicken in the barn

Oooh... huh

Come on over baby

Babe we got the bull by the horns

We ain't fakin'

Whole lotta shakin' goin' on…

Come on over baby

We got chicken in the barn

Whose barn

What barn

My barn…

Come on over baby well, we got the bull by the horns

Whole lotta shakin' goin' on

(From “Whole Lotta Shakin’ Goin’ On” by Jerry Lee Lewis, 1957)

Prior to the election, we posted an actionable items position paper about how the markets might react depending on the outcome. As we write this blog, it appears that it will be “Outcome Two” (Biden win, GOP Senate, Dem House), although we will not know the final make-up of the Senate until after the dual run-off elections in Georgia in early January. With the Republicans (probably) holding a small majority in the Senate and actually picking up seats in the House (while still remaining in the minority), we probably will not see the sweeping legislative changes we might have seen had there been either a red or blue wave.

In the event of this outcome we had suggested the following market, legislative and monetary environment: (a) a continuation of accommodative monetary policy, (b) a continued steepening of the yield curve, (c) the passage of some kind of significant fiscal stimulus package and (d) a continued improvement in the economy. The caveat to this forecast is that we still cannot anticipate the medium-term impact of the COVID-19 pandemic, or the consequences of any national, state or local level responses to it.

But in the days immediately following the election, despite there being no decided presidential winner and an uncertain Senate, the market reacted vigorously. It seemed to price in (a) no massive new tax hikes, (b) moderate to minimal new regulatory restrictions and continued political gridlock. What is interesting is that, historically, the market likes political gridlock, because it tends to minimize the thing it hates the most—uncertainty. Progress on the development of a COVID-19 vaccine also resulted in fairly vigorous market movements, but we think these may be more transitory in nature.

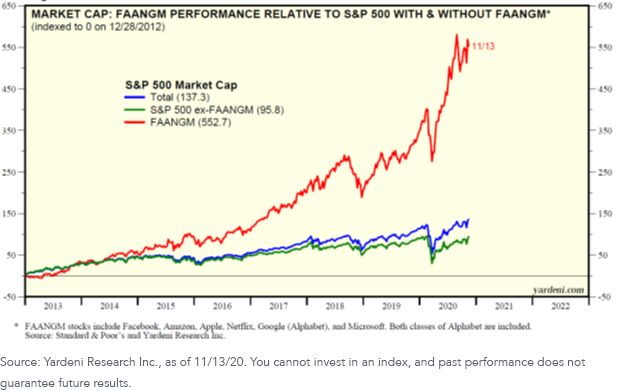

Heading into the election, the market, fearing a projected blue wave election, had been migrating toward more conservative and “risk-off” positioning. We saw this especially in the short-term decline in growth stocks over the course of October, especially the hyper-valued FAANG stocks (Facebook, Apple, Amazon, Netflix and Google/Alphabet).1

Here we compare the S&P 500 Index to the S&P 500 Growth Index and the NASDAQ 100 Index (as a proxy for the FAANG stocks) over the course of October:

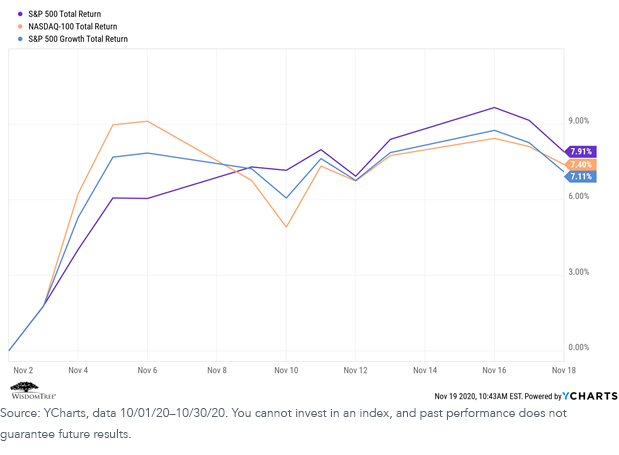

But once the market began to price in a divided government environment, regardless of president, growth stocks roared back (with a slight pause as positive vaccine news hit the wires):

Note that, following the announcement of positive COVID-19 vaccine news shortly after election day, we witnessed a factor rotation back toward value stocks (as suggested by the broad market S&P 500 Index outperforming the two growth indexes). But the growth indexes were still strongly positive.

Now, of course, 15 days do not make a trend. It is not unreasonable, however, to think that the market—which for several years rewarded large-cap growth stocks despite escalating valuations—may return to that trend in the wake of the election results and corresponding assumed tax, fiscal and monetary policy going forward.

The impact on market performance over the past several years of the FAANG stocks (and some include Microsoft to form “FAANGM”) cannot be overstated:

For definitions of terms in the chart, please visit our glossary.

Recognizing that many advisors and their end clients believe in this “all growth, all the time” narrative, we recently launched the WisdomTree Disruptive Growth Model. This model seeks to capture the attraction of many advisors to rapidly evolving new technologies (e.g., cloud computing), new ways of living, working and playing (e.g., biotech, cybersecurity and online gaming) and disruptive solutions in existing industries (e.g., platform-based solutions and financial technology).

The Disruptive Growth model was designed explicitly to allocate to ultra-high-growth industries and sectors in a diversified manner, where each of the allocations has minimal security overlap with the others or with broad market indexes.

We’ve previously discussed our Disruptive Growth Model, and financial advisors can learn more about it by registering on the WisdomTree website and reviewing the model information available there.

This model allocates to a variety of disruptive-themed ETFs: our Cloud Computing Fund (WCLD) and Growth Leaders Fund (PLAT) (with a focus on high-growth platform-based companies), as well as other ETFs that invest in areas such as genomics/biotech, fintech, cybersecurity, and online gaming and e-sports.

The securities that make up these various allocations are high growth, with the corresponding high valuations to show for it—this is a “go-go” portfolio.

But if you believe that the election results and corresponding economic, political and market conditions suggest we may return to a similar environment to that of the past few years (even including the pandemic-induced recession of the first half of 2020), then adding some disruptive “whole lotta shakin’” into your portfolios may be just what’s “goin’ on”.

1As of November 19, 2020, the WisdomTree ETF PLAT held positions in Facebook (6.85 % of the portfolio), Amazon (7.78 %), Alphabet/Google (8.95 %) and Microsoft (7.92 %), but not in Netflix or Apple. The WisdomTree ETF WCLD did not hold positions in any of the FAANGM stocks.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

PLAT: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses, and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition, and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCLD: There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.