How Early Are We in the Shift to the Cloud?

On last week’s episode of Behind the Markets, we had a special discussion about cloud computing with two great guests.

For the last four years, Bessemer Venture Partners (BVP) has worked with Forbes to create an annual “state of the cloud” report. The Cloud 100 list is a ranking of the 100 best cloud companies, as rated by a panel of cloud business CEOs, BVP and Salesforce Ventures.

We spoke with Mary D’Onofrio, Vice President at BVP, about her insights from the first four Cloud 100 lists. She also discussed the latest benchmarking report she just released.

We also had Frederic Kerrest, Executive Vice Chairman, Chief Operating Officer and Co-Founder of Okta, discuss trends in his business and the cloud generally.

Developments in the Private Cloud Market

In 2016, the average Cloud 100 company valuation was $1.1 billion, but four years later, the average is about $1.7 billion. In September, BVP will release its 2020 Cloud 100 list and host a virtual conference where we will hear from CEOs and industry participants. D’Onofrio expects the average valuation of the 2020 list may be over $2 billion.

The Cloud 100 list foreshadows the future pipeline of companies expected to go public in the near future, and speaks to the future potential of investing in the space

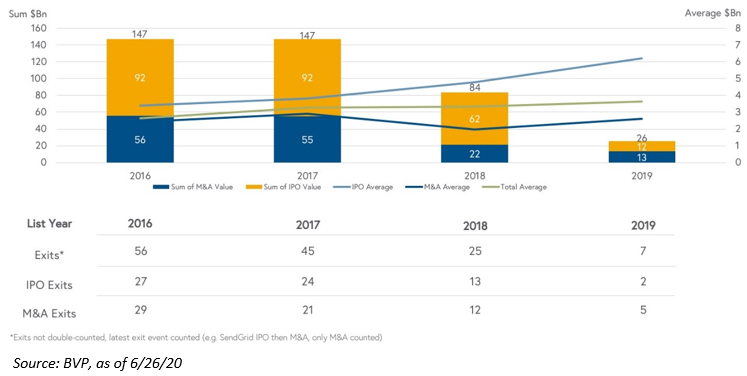

Of all the private equity investment exits in cloud companies over the last four years, about half went public via an initial public offering (IPO). The other half were acquired in mergers and acquisitions (M&A) transactions.

From the 2019 list, only seven companies have exited, which means there is a backlog of 93 private businesses that should see accelerated exits soon. Founders and employees often prefer going public to capture more upside from public financial markets. M&A transactions often involve less direct upside.

The business fundamentals of cloud businesses are supporting growth in public market valuations. D’Onofrio’s analysis of the latest quarter of earnings for companies in the BVP EM Cloud Index showed the average cloud company growing sales by over 35%, while 95% of companies beat their first-quarter earnings expectations.

Total Valuation of Cloud 100 Exits by List Year

In four years, 56% of Cloud 100 2016 exited for $147 billion.

A Closer Look at Okta and Kerrest’s Background

Okta has been one of these top-performing cloud companies in public markets over the last three years. Okta today is a $25 billion market cap enterprise security business with about $750 million in revenue. It has 8,400 customers and has been growing over 40% annually for a number of years. The Okta identity cloud allows a single sign-on (SSO) to over 7,000 separate applications that Okta has integrated.

Kerrest’s background is in computer science and writing code. He went to Salesforce in 2002 when it had a few hundred employees. There he met his Okta co-founder, Todd McKinnon, who was then head of Salesforce engineering.

How Early Are We in the Cloud Shift?

Kerrest believes we are still “very early” in industry’s shift to the cloud. Okta just had its 10 year anniversary, and Kerrest discussed the following to frame what is ahead for the company:

- From 2009–2019, enterprise information technology (IT) grew to become a $3.2–$3.8 trillion business worldwide, exhibiting 20% growth.

- The enterprise software business grew from $220 billion to $430 billion, nearly doubling.

- Enterprise Software-as-a-Service (SaaS), or enterprise cloud, grew from a $7.5 billion business to $95 billion. But if it already grew 12 times over, can it continue to grow? The enterprise cloud business is still just 3% of total IT spend.

Digital transformation is another key buzzword in the cloud business. Consider how that has accelerated with the pandemic. E-commerce as percentage of total commerce grew from 6% to 16% from 2010 to 2020. But from January 2020 to July 2020, we’ve gone from 16% to 27% in North America alone. A decade of growth occurred in five months, and Kerrest believes we are not going back.

These were two great conversations on what is happening in the cloud industry, one of the hottest spaces in markets today. You can listen to the entire discussion below.

Important Risks Related to this Article

Short-term performance in the cloud computing industry may reflect conditions that are not sustainable and may not be repeated in the future.

The growth of the cloud computing industry can be negatively impacted by various factors including limited product lines, world economic growth, government regulation, intense competition and potentially rapid product obsolescence. Many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results.

Rule of 40: a principle that combines a software company’s growth rate and profit margins. If the sum of a company’s growth rate and profit margins meets or exceeds 40%, then the company is believed to be growing efficiently and mindful of balancing growth and profitability.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.