Money in Motion: What’s in the Price?

The ”Money in Motion” series of blogs continues this week with our focus turning to the U.S. corporate bond market. As I mentioned last week, the turmoil in the financial markets has afforded investors the opportunity for a portfolio review. A recurring theme from my investor calls over the last week or so has been valuations in both the investment-grade (IG) and high-yield (HY) corporate arenas. The overarching question is whether current valuations represent a renewed buying opportunity. This brings me to the more pertinent query: what’s in the price?

Just some quick context. U.S. corporates experienced some of their worst weeks in March, pushing spread levels out to their widest readings since the financial crisis. By March 23, the day of the Federal Reserve’s (Fed) latest policy measures announcement, IG spreads had widened by roughly 275 basis points (bps) from late February, to hit +373 bps. During the same time frame, HY differentials ballooned an incredible 750 bps to +1,100 bps.

Back to those Fed announcements. Perhaps the most important of these policy measures are the primary market corporate credit (PMCCF) and secondary market corporate credit (SMCCF) facilities. These are brand new to the Fed’s playbook and allow the policymakers to buy U.S. IG corporates as well as IG corporate bond ETFs. Combined with the Fed’s commercial paper funding facility (CPFF), they provide a clear avenue for IG corporations to access funding, especially for vitally important short-term funding needs.

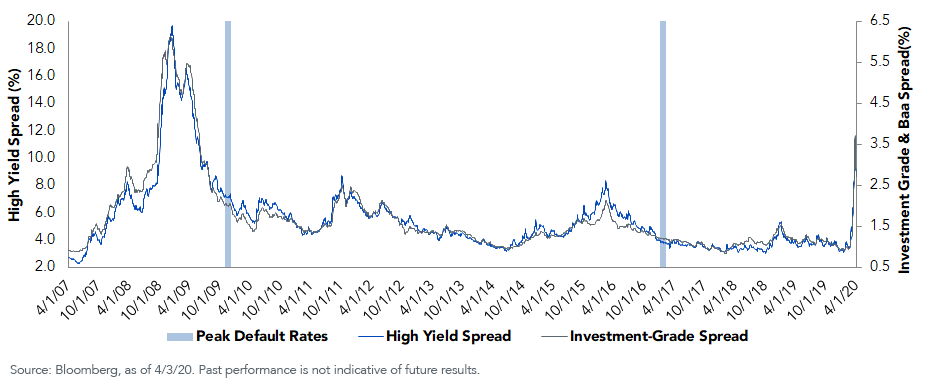

Investment-Grade Spread (RS) vs. High-Yield Spread (LS)

As a result, both IG and HY spreads have come off their widest points, narrowing by roughly 90 bps and 160 bps respectively, as of writing. Nevertheless, the absolute levels remain historically high. One could argue that these visibly elevated levels have priced in what appears to be the inevitable increase in both downgrades and defaults. In the case of IG, a number of well-known brand names, such as Ford and Delta, have recently been downgraded to junk status, but spread levels still narrowed.

What about HY? This is where things get really interesting. Prior to this most recent bout, there were three other periods of spread widening going back to the financial crisis. As the graph clearly illustrates, in two out of these three periods (2008–2009 and 2016–2017), HY spreads hit their widest points 11 months before the default rate hit its high point. The other period when HY differentials rose in a sizable fashion was 2011, but that instance did not result in a spike in the default rate. For the record, according to Moody’s, the U.S. speculative-grade peak default rate for the two periods was 14.7% and 5.9% respectively. It ended 2019 at 4.2%.

What does this tell me? If history is any guide, the March surge in HY spreads, to their second-highest reading on record, has already priced in the increase in default rates that should be forthcoming.

So, what are fixed income investors to do? I’m under no illusion that volatility has gone away, and fully acknowledge economic challenges remain. Our base case for U.S. corporates envisions a sawtooth narrowing2 spread pattern going forward.

While the expression is usually “don’t fight the Fed,” perhaps a better mantra for U.S. IG corps should be “follow the Fed’s lead.” Although the SMCCF is slated to be buying in the zero to five-year maturity range of the IG market, I suspect the IG corporate market in general should be a beneficiary of this policy.

For investors looking to enter the HY market, we offer two solutions for consideration. The WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD) provides an avenue into HY as well as a rate-protection angle. Screening for quality3 is as important as ever. The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) could provide a “core plus” solution with this attribute.

1Wide readings Typically that means price went down and yields went up

2Meaning up and down or back and forth like the teeth in a saw, but the broader trend is a decreasing one

3Using our methodology to ‘screen’ companies that may not have healthy balance sheets

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of certain Funds they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.