Studying Abroad: China State-Owned Enterprises

Investing is rooted in quantitative analysis, but the ultimate decision to buy or sell is often overruled by intuition.

The latter situation may cause investors’ portfolios to reflect a home bias—their portfolios lack global diversity and are concentrated in securities listed in their own country.

Perhaps there is some validity to this common behavioral tendency. Investing internationally can add a layer of complexity, especially when corporate governance and political influence are concerns.

Naturally, many investors default to “beta” products that offer total market exposure for their foreign equity allocations.

But intuition tells us extra discretion may be needed when investing abroad.

Illustration by Example: China State-Owned Enterprises

China’s equity market has become more accessible to nondomestic investors over the last decade. The nation’s Stock Connect program, which opened stocks listed in mainland China (A-shares) to offshore investors, and MSCI’s decision to include a greater proportion of A-shares in its Emerging Markets benchmark are key developments that have helped buoy China’s equity market to rank second largest globally, behind the United States’.1

Despite these advancements, 2019 returns for the broad Chinese equity market did little to incentivize investors to diversify outside of the U.S. Chinese equities, as measured by the MSCI China Index (MXCN), returned 23.46% while the MSCI USA Index returned 30.88%—a 7.42% performance differential.2

For investors still searching for a compelling reason to diversify, there is a Chinese equity market exposure that significantly outperformed both the broad Chinese and U.S. benchmarks in 2019—the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) returned 36.44% in 2019.3 For standardized performance of CXSE, please click here.

Our intuition about political influence in foreign markets can help explain CXSE’s outperformance.

CXSE invests in non-state-owned companies (non-SOEs), defined as companies with less than 20% government ownership.

State-owned enterprises (SOEs) have been a meaningful headwind on MXCN’s returns in, and before, 2019:

- 2019: MXCN held approximately 40% of its weights in SOEs, which returned 9.27%. The non-SOE group returned 34.94%. As a reminder, CXSE returned 36.44% compared with MXCN’s aggregate return of 23.46%.4

- Since Third-Quarter 2015: MXCN’s weight was about evenly split between SOEs and non-SOEs. The SOE group generated a negative annualized return of -3.86%, and the non-SOE group returned 13.28%, annually. Over this same time period, CXSE’s annual return was 10.30% versus 3.90% for MXCN.5

- Last 10 Years: MXCN held approximately 65% of its weight in SOEs, which returned 2.23%, annually; non-SOEs returned 8.05% annually. In aggregate, MXCN’s annualized return over the last decade was 5.78%.6

Measurable results help validate the instinct that government ownership could negatively impact returns, but we are still left questioning “How?”

SOEs are more heavily concentrated in “old economy” sectors like Financials and Energy, while non-SOE companies tend to be driven by “new economy” consumer trends in the Information Technology and Consumer Discretionary sectors.

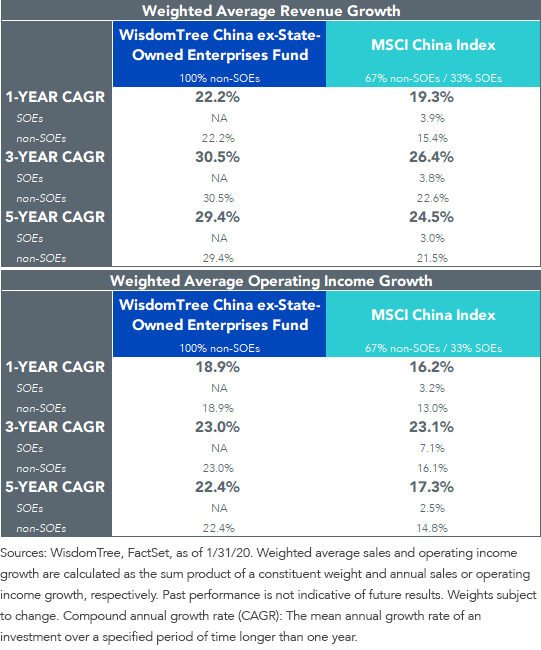

Our sense is China’s evolution into a more consumer-centric economy would result in faster revenue and pretax operating earnings growth for SOEs versus non-SOEs. Taking a step further, given that CXSE filters out exposure to SOEs, we would expect the weighted average revenue growth of the companies currently held in CXSE to be greater than that of MXCN.

The results in the figure below confirm our assumptions—the current constituents of CXSE have consistently generated stronger weighted average revenue and operating income growth than those currently held in MXCN.

CXSE’s over-weight allocations in the Consumer Discretionary (+7.4%) and Information Technology (+3.8%) sectors are certainly major drivers of the growth differential versus MXCN.7 However, it’s worth noting that growth measures for CXSE still outpaced MXCN over the trailing 1-,3-, and 5-year periods based on median and simple average calculations, which remove the impact that constituent weights can have on aggregate measures of central tendency.

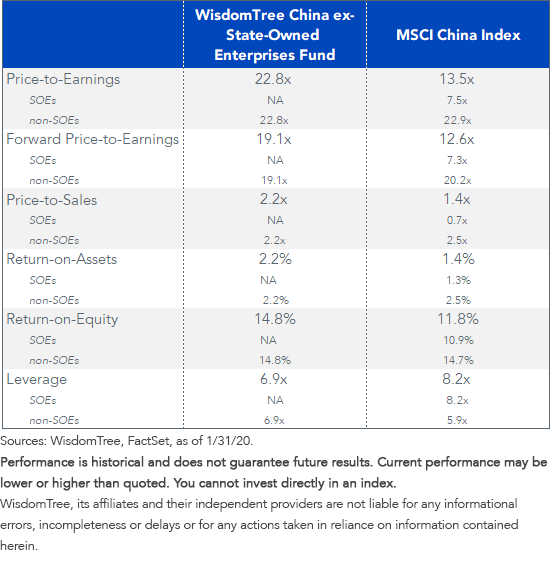

As expected, a basket of faster-growing companies has a higher valuation—CXSE is currently valued at 19.1x estimated earnings versus 12.6x for MXCN.8 Importantly, CXSE appears fairly valued relative to the non-SOE subset of the MSCI China Index:

- CXSE is valued at 22.8x trailing-12-month price-to-earnings, in line with the non-SOEs in MXCN (22.9x).

- CXSE is valued at 19.1x forward-12-month price-to-earnings, slightly below the non-SOEs in MXCN (20.2x).

- CXSE is valued at 2.2x trailing-12-month price-to-sales, slightly below the non-SOEs in MXCN (2.5x).

In addition to a growth premium, CXSE’s valuation also likely incorporates a premium for higher quality. In aggregate, CXSE benefits from a higher return on equity and assets, with a lower level of leverage than MXCN.

For definitions of terms in the chart please visit our glossary.

Naturally, this analysis of growth trends in China raises questions about the potential impact from the coronavirus outbreak. The virus will likely be a headwind on sales and earnings in the near term, but there is too much uncertainty to determine the ultimate extent of the impact. For reference, year-to-date returns for CXSE and the MSCI China Index are 5.37% and 2.01%, respectively, as of this writing.9

Despite potential near-term headwinds, we urge investors to trust their intuition when investing in Chinese equities over the long term. The WisdomTree China ex-State-Owned Enterprises Fund is a potential solution for investors seeking to avoid portions of the Chinese market where a high-level government influence may dilute future potential returns.

1Source: Bloomberg, as of 2/7/20.

2Sources: Bloomberg, WisdomTree, for the period 12/31/18–12/31/19, in U.S. dollars. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in fund shares. Such fees, expenses and commissions could reduce returns.

3Source: WisdomTree, for the period 12/31/18–12/31/19 at net asset value (NAV), in U.S. dollars.

4Sources: WisdomTree, FactSet, for the period 12/31/18–12/31/19, in U.S. dollars. CXSE returns are at NAV.

5Sources: WisdomTree, FactSet, for the period 7/01/15–01/31/2020, in U.S. dollars. CXSE returns are at NAV. Time period chosen because on 7/01/15, the WisdomTree China Dividend ex-Financials Fund (CHXF) was restructured and renamed the WisdomTree China ex-State-Owned Enterprises Fund (CXSE).

6Source: WisdomTree, FactSet, for the period 1/31/10–1/31/20, in U.S. dollars

7Sources: WisdomTree, FactSet, as of 1/31/20.

8Sources: WisdomTree, FactSet, as of 1/31/20. Lower numbers indicate an ability to access greater amounts of earnings per dollar invested.

9Sources: WisdomTree, Bloomberg, for the period 12/31/19–-2/12/20, in U.S. dollars. CXSE returns are at net asset value.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increase its vulnerability to any single economic or regulatory development related to such sector. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.