What’s Love Got to Do with This Stock Market? Ask TINA

During the first half of the year, it seemed everyone was grabbing so-called “low-volatility” stocks.

Why?

The popular “TINA” trade—“There Is No Alternative”—is based on the belief that stocks should be bought because bond yields are so paltry.

If you are of a certain age, you got the blog post title’s Tina Turner reference. The Grammy winner’s biggest song, according to me, was “What’s Love Got to Do with It?” If Turner had been asking about this 10-year bull run in stocks—which would have been really cool—the answer would have been “not much.”

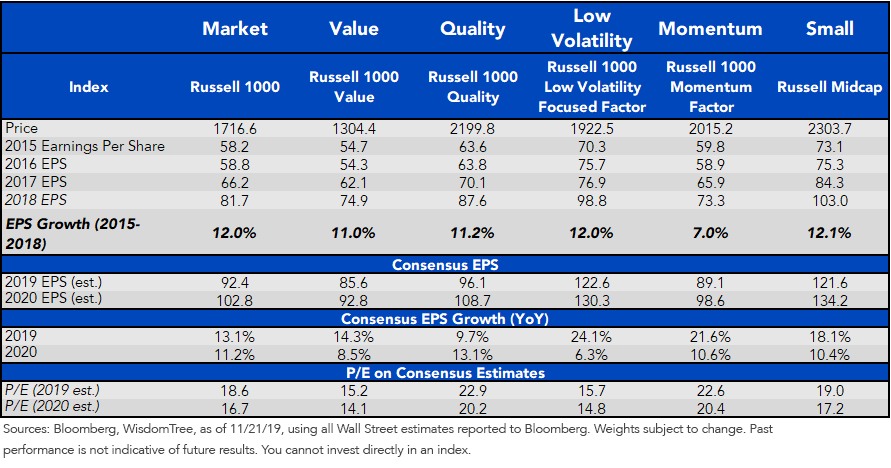

Despite 17.4% annualized S&P 500 Index returns from the March 2009 lows through October 2019, the sentiment survey by the American Association of Individual Investors (AAII) shows a largely unloved market, as the percentage of respondents labeling themselves “bullish,” “bearish” or “neutral” is a mixed bag.

In figure 1, I divided the proportion of bullish respondents by the total of bulls and bears.

Figure 1: American Association of Individual Investors Bulls Divided by Sum of Bulls + Bears

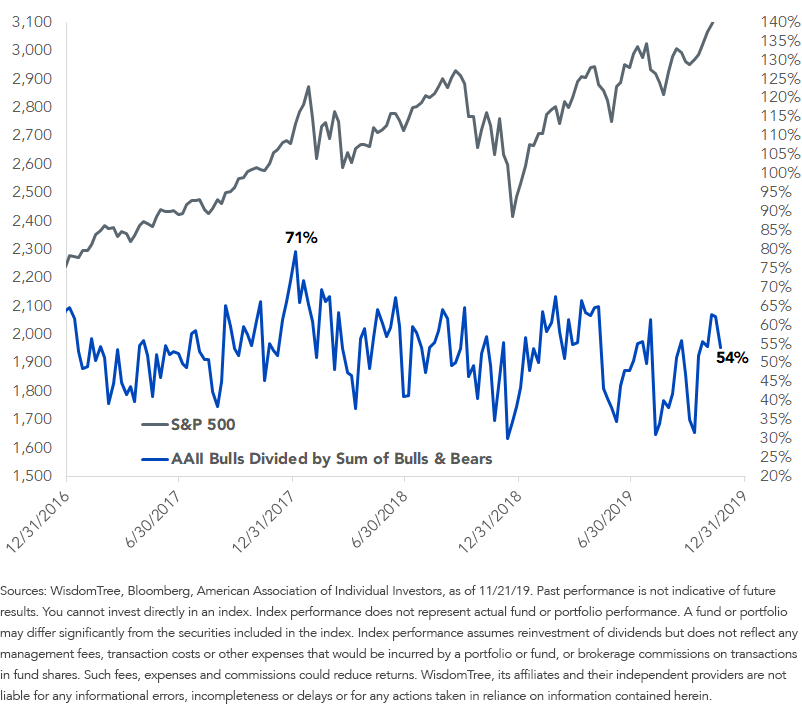

In the first eight months of this year, investors bought stocks with abandon. But market leadership was nevertheless dominated for the most part by the staid “minimum volatility” stocks. No-frills sectors such as Utilities, Real Estate Investment Trusts (REITs) and Consumer Staples joined this cycle’s momentum sector—Technology—atop the performance board.

Until they didn’t.

Though momentum-oriented Tech has held strong this autumn, many of the minimum volatility sectors have been troubled since the market’s sector leadership switched on August 27 (figure 2).

Figure 2: S&P 500 Index Sector Performance, 2019

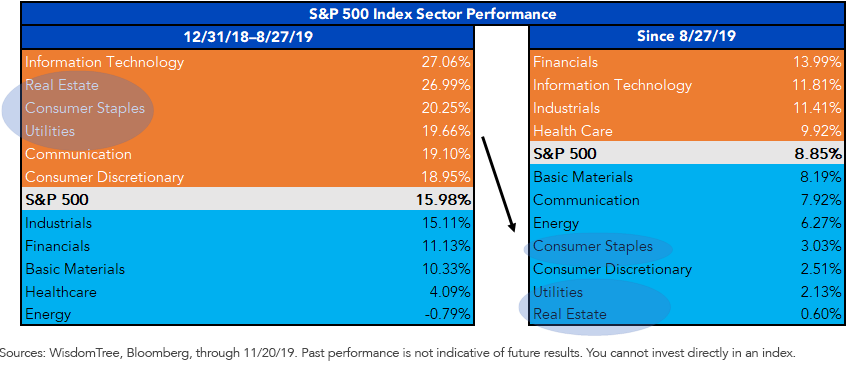

Because “minimum volatility” and “momentum” became synonymous with each other as the former morphed into the latter, the relative breakdown of defensive sectors hit both factor types in recent months. The MSCI USA Momentum Index has been reeling relative to the broad market for a couple of months (figure 3).

Figure 3: MSCI USA Momentum Index Minus WisdomTree U.S. LargeCap Index

The new market darling, at least for the last few months, is the Financials sector, much to the relief of investors in value factor funds. The sector has defied threats of Washington “cracking down on Wall Street,” beating the S&P 500 Index by more than 5 percentage points since the August 27 leadership switch from momentum to value stocks.

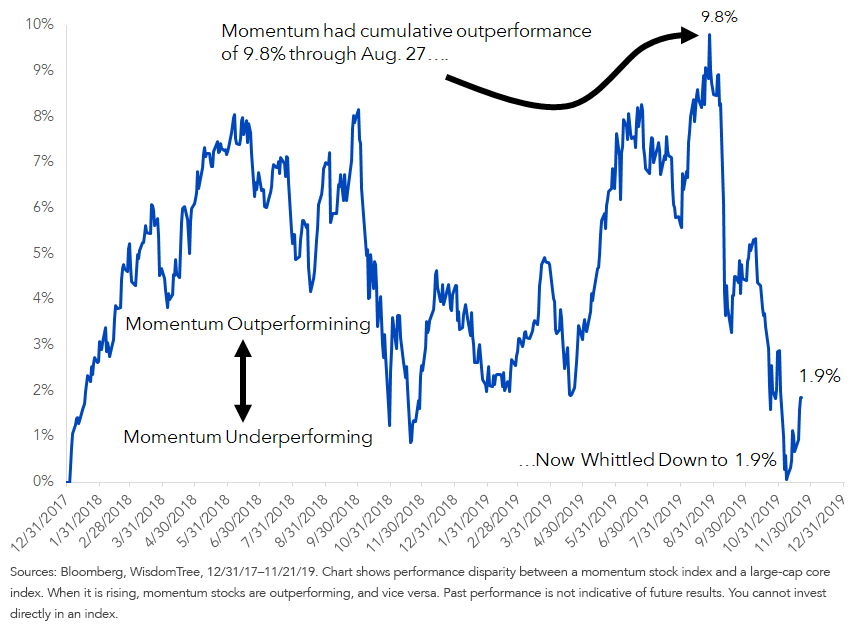

Russell’s factor indexes are in figure 4. To the momentum factor’s credit, it has a robust 2019 Wall Street earnings growth estimate. But soon, I believe, savvy investors will try to steal a march on 2020 expectations. The consensus has the Russell 1000 Momentum Factor Index’s earnings growing 10.6% next year—only a tad bit higher than the 8.5% expected for the Russell 1000 Value Index. But the former is trading for 20.4x next year’s earnings estimate, a 6-point premium over its value counterpart. Is it worth it?

Figure 4: Street Consensus, Russell Indexes

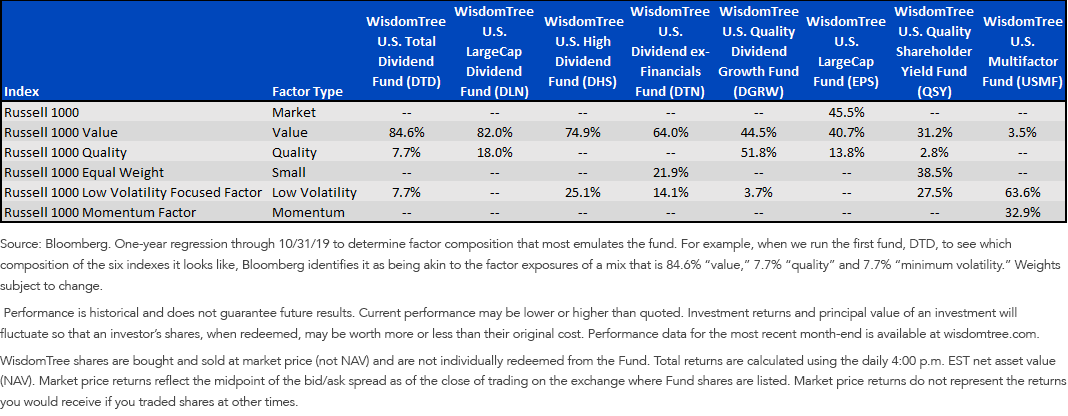

Figure 5 shows the returns-based analysis of our U.S. equity exchange-traded funds (ETFs) using the Russell 1000 Index and the five major ““smart beta” factors” factors. Our broad market WisdomTree U.S. LargeCap Fund (EPS) is a 500-stock blend fund that tilts toward value. The ETFs that are even more value-focused are “the Ds,” our dividend-weighted ETFs with tickers that start with that letter in the table below.

Figure 5: Fund Regressions to Smart Beta Factors (%)

Please click here for standardized performance of the ETFs mentioned in the table.

Until now, “TINA” has been a mantra to buy stocks because bond yields are so low. But now that rates are rising a bit, is the recent embrace of value stocks here to stay?

Love doesn’t have anything to do with it. Valuations do.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While some of the Funds are actively managed, the Funds’ investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.