Managing Chinese Equity Risk in Emerging Markets

With relations between the U.S. and China remaining fluid, some investors are questioning if Chinese equities should be a part of their asset allocation.

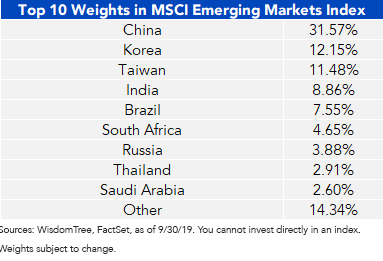

In our view, an equally important question is whether investors should have exposure to companies where a government can be a highly influential shareholder. With Chinese companies accounting for nearly 32% of the MSCI Emerging Markets (EM) Index,1 these nontrivial decisions can have a significant impact on total returns.

China currently accounts for the largest percentage of the MSCI EM Index, at almost one-third of the total Index weight.

Furthermore, as the Chinese government takes additional steps to integrate its capital markets with the rest of the world, we anticipate that this position may become even larger as A-shares inclusion grows in the Index. The challenge for many will be how to access emerging markets broadly while managing exposure to China.

While geography is one risk that investors can manage (via the MSCI Emerging Markets ex China Index), we believe an underappreciated risk is the impact that state-owned enterprises (SOEs) can have on investor returns.

WisdomTree defines SOEs as those companies in which the government owns at least 20% of shares outstanding, and this ownership risks levels of influence on business decisions that would otherwise be left strictly to shareholders and company management. These companies may not operate as efficiently when government intentions and sound business decisions have a conflict of interest.

Adding Value by Avoiding Exposure

We believe avoiding SOEs can add value, particularly in the Chinese market, where SOEs are concentrated in the banks and energy sector. Removing SOEs tends to tilt weight to more technology- and consumer-focused names, which we think have stronger growth trajectories.

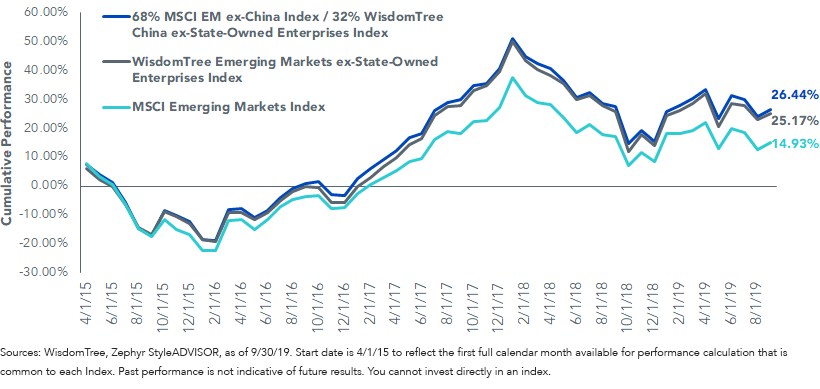

The chart below showcases the cumulative performance of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index, the MSCI EM Index, and a blend of both the MSCI Emerging Markets ex China Index and WisdomTree China ex-State-Owned Enterprises Index.

Within the blend, we’re substituting broad China exposure in emerging markets, which includes a healthy portion of SOEs, for WisdomTree’s unique approach that aims to avoid them. As a result, we maintain the same China exposure within emerging markets, while adding almost 12% more cumulative return compared to the broad index.

Emerging Markets Index Performance 4/1/15–9/30/19

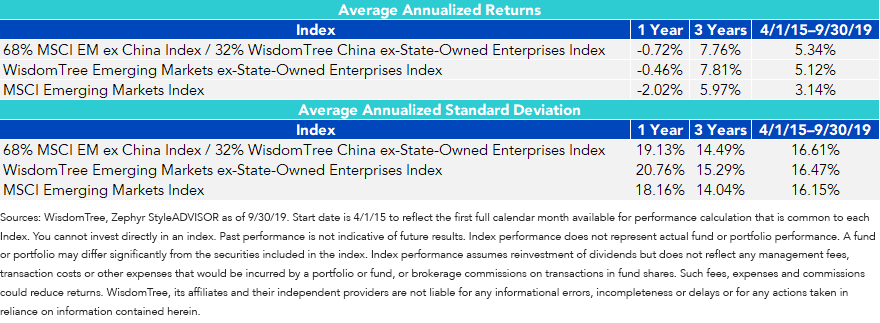

The return advantage is also evident on an annualized basis. By substituting China’s market exposure with a similar makeup that excludes SOEs, we were able to improve the return profile over the past one- and three-year periods, as well as since April 2015.2

Over the same periods, the ex-SOE-based approaches were also able to maintain comparable levels of volatility versus a market cap-weighted approach.

Rethinking China Exposure with an SOE Filter

With fears of a slowing global economic growth and the risk of recession top of mind, it is important to consider ways to manage volatility and growth profiles without having to drastically alter portfolio exposures or sacrifice return potential.

Investing in emerging markets can already entail considerable risk, and in our view, there’s little reason to add extra government influence. Rethinking exposure to SOEs within China can be one method that may actually enhance returns while keeping volatility under control, all while tilting exposure to companies that best reflect the long-term growth profile of China, which is more technology-oriented than state-run banks.

1Sources: WisdomTree, FactSet, as of 9/30/19.

2Common inception period from 3/31/15.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.