Political Risk in China’s State-Owned Enterprises Is Rising

How emerging markets indexes are constructed matters, especially when the news cycle is dominated by Washington-Beijing relations.

On Twitter, my colleagues Brad Krom and Jeremy Schwartz have focused for weeks on the performance of emerging markets’ state-owned enterprises (SOEs). The MSCI China Index was up 7.6% in the first nine months of 2019, yet the companies in it that are more than 20% government-owned were up just 0.2%. The low state-ownership firms returned 13.1% in the same time period.

Now broaden it out to the whole developing world. In the five years through September, the MSCI Emerging Markets Index was up 2.33%, though the 26% of the index that is state-owned could only muster a 0.38% annual performance. The other three-quarters of the index was up 2.94%.

Western politicians are out in force with harsh China rhetoric. Among those making hardline comments on Twitter are Massachusetts senator Elizabeth Warren—a top candidate for the Democratic nomination—and Republican senator Marco Rubio from Florida.

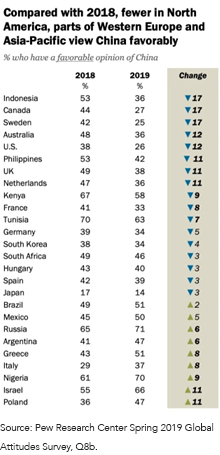

One of the reasons U.S. politicians feel as if they have carte blanche to attack China is public sentiment. I can’t be the only one who has been surprised by how much Western attitudes toward the country have deteriorated in the last year (figure 1).

Figure 1: Pew Research Center—“Favorable View on China”

Scrutiny in D.C.

In addition to an ever-burgeoning “entity list” of companies that the U.S. views as national security threats, there is a move to take a closer look at all Chinese companies listed on U.S. exchanges. This partly explains the struggle in SOE stock prices this year.

The EQUITABLE Act was sponsored by four senators. Here’s the June release from Rubio’s office:

Washington, D.C. — Today, U.S. Senators Marco Rubio (R-FL), Bob Menendez (D-NJ), Tom Cotton (R-AR) and Kirsten Gillibrand (D-NY) introduced the Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges (EQUITABLE) Act, which would increase oversight of Chinese and other foreign companies listed on American exchanges and delist firms that are out of compliance with U.S. regulators for a period of three years.

Index Pressure

Rubio also wrote a letter to MSCI’s CEO in June, asking to cut down Chinese weights in the company’s indexes. Michelle Price of Reuters quotes from this letter: “What MSCI is doing is allowing the Chinese Communist Party controlled market ... to access a critical source of capital and clothe itself in a facade of legitimacy.”

Let’s go back a few years. What was the initiative at the big index houses? To increase the weights of underrepresented Chinese companies, namely the mainland-listed “A-shares.” Unlike Hong Kong-listed “H-shares,” the mainland companies are disproportionately state-owned, loaded with Communist Party insiders, and critically, have a reputation for endemic corruption.

Washington’s pressures could force a rethink of the big initiative to “up” SOE weights in the big index houses. Suddenly, the investment inflow-based thesis for being bullish SOEs withers.

What if MSCI proves recalcitrant and just ignores the senators? The politicians already thought about that, so the next step was to contact MSCI’s clients themselves.

In August, Rubio and Jeanne Shaheen, the Democratic senator from New Hampshire, wrote a letter to Michael Kennedy, chairman of the Federal Retirement Thrift Investment Board (FRTIB), urging him to stop tracking the MSCI All Country World ex-US Index, on the grounds that providing capital to Chinese companies fuels the regime. The firms closest to the Party? The SOEs.

Finally, there’s President Trump. On September 27, Bloomberg reported that the administration is considering options such as “delisting Chinese companies from U.S. stock exchanges and limiting Americans’ exposure to the Chinese market through government pension funds."1

From here on, it appears the SOEs will no longer be able to fly under the radar. If Washington continues playing hardball, investors may want to approach them with caution.

Unless otherwise stated, data source is Bloomberg, as of September 30, 2019.

1Jenny Leonard and Shawn Donnan, “White House Weighs Limits on U.S. Portfolio Flows into China,” Bloomberg, 9/28/19.