Markets to the Fed: Go Fund Me

In an interesting turn of events, we had an FOMC meeting last week, but the results of this convocation were not what captured the lion’s share of Federal Reserve (Fed) headlines. Indeed, the dislocations that were witnessed in the funding markets, and attendant Fed responses, seemed to take center stage. Essentially, the stresses which emerged in this arena created a situation where participants were clamoring for the Fed to step in and provide the necessary funds to potentially alleviate the pressurized conditions.

Let’s do a quick Fed 101. There’s a certain level of reserves in the banking system that can fluctuate on a daily basis. The N.Y. Fed, acting on behalf of the FOMC’s monetary policy directive, is charged with keeping the Federal Funds target within its prescribed trading range, by either adding or deleting reserves via repurchase (repo) agreements with the primary dealer community, depending upon what is needed to achieve the aforementioned goal. Typically, these daily operations from the Fed go essentially unnoticed and don’t garner any headlines. That’s exactly the way it’s supposed to work.

So what happened this time around? Quite simply, there was a shortage of reserves, or think of it as a “cash crunch.” The “repo” market is a part of the financial system where participants borrow and lend money, using Treasury securities (as one example) as collateral within the transaction. It is in this repo market where the stresses became all too evident, for three reasons.

- The Fed’s prior quantitative tightening (reducing their balance sheet) had been draining reserves up until this program ended only a month or so ago.

- September 15 is a corporate tax date (the stresses first became evident on September 16, since the 15th was on a Sunday).

- There was also a large Treasury securities settlement for prior auctions.

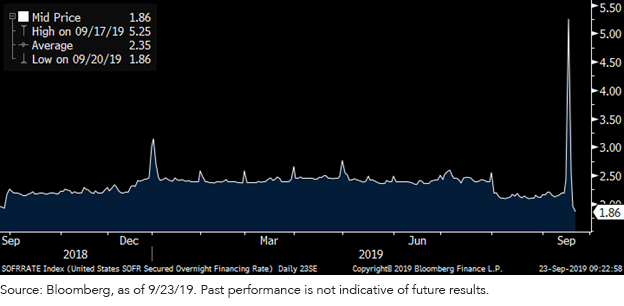

U.S. Secured Overnight Financing Rate (SOFR)

This confluence of events acted as too big a drain of reserves from the banking system and resulted in various funding market rates spiking well above the Federal Funds target range. As the graph above reveals, one of these key repo-related rates, the SOFR, surged up to 5 ¼% or 300 basis points (bps) above the top end of the Fed Funds target prior to last week’s rate cut.

In order to alleviate these upward pressures, the N.Y. Fed intervened with multiple large-scale repo operations of their own, providing much needed funding for a “starved” market. Repo operations are temporary in nature, and needed to be “re-upped” in order to achieve the desired result. Did it work? As of this writing, yes. As you can see, SOFR has since fallen back to 1.86%, within the “new” Fed Funds target range of 1 ¾–2%.

Conclusion

Looking out at the horizon, the temporary repo route might not prove to be the solution for the longer run. Given the future reserve outlook, the N.Y. Fed looks like it will have to take a more permanent approach…adding to their balance sheet. In theory, any buying of Treasuries can be defined as quantitative easing (QE), but in actuality, for this purpose, the Fed will need to clarify and/or signal to the markets the exact reason. In other words, this form of QE is not to boost the economy/inflation, but rather, designed to provide sufficient reserves for the proper functioning of the funding markets. One way the Fed could achieve this messaging is in which Treasuries they buy, namely shorter-term issues like t-bills versus longer-dated coupons, as the latter is usually associated more with the “other” form of QE.

Unless otherwise stated, all data sourced is Bloomberg, as of September 23, 2019.