By the Time We Got to Woodstock

Well, the 50th anniversary of the original Woodstock has come and gone, but the August jobs report contained a trend not seen since 1969. Here are some quick takeaways:

- On the surface, the jobs report was a modest disappointment because total nonfarm payrolls rose by 130,000, which was about 30,000 below consensus. However, this aspect of the report 'masked' some other positive developments such as wages, the unemployment rate and hours worked. Overall, it was a mixed report.

- The other measure of jobs, civilian employment, actually surged by 590,000, but this part of the report doesn’t garner the same type of media coverage.

- The civilian labor force surged for the second consecutive month, which is typically a sign of labor force optimism. The good news was that the jobless rate stayed at 3.7%, meaning those looking for jobs found them.

- The jobless rate has now been below the 4% threshold for seven consecutive months for the first time since the days of the original Woodstock.

- Perhaps the most constructive economic news within the jobs report was that average hourly earnings posted a year-over-year gain of 3.2%, or 0.2 percentage points better than consensus, and followed an upwardly revised July number as well.

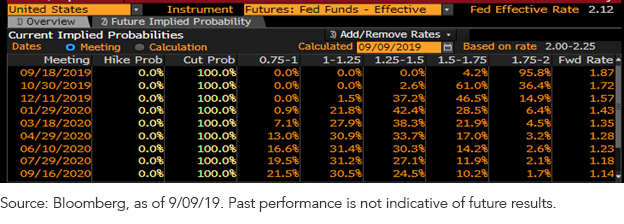

- In my opinion, the jobs report puts the Federal Reserve (Fed) in the 25 basis points (bps) rate cut camp for September 18. There appears to be a battle between some members that want a 50 bps cut and others that want no cuts at all. In order to build a consensus, 25 bps seems to match up with the phrase, “[the Fed] will continue to act as appropriate to sustain the expansion.”

- Fed Chair Powell spoke in Zurich following the jobs report, and reiterated his Jackson Hole message, which included the aforementioned phrase, while also acknowledging that risks (trade uncertainty, global growth concerns, muted inflation) have risen.

- As of this writing, fed funds futures are at 96% for a 25 bps cut in September and 4% for a 50 bps cut.

Conclusion

The August jobs report is now out of the way for the bond market as well as the Fed. Basically, the numbers did not provide any impetus for us bond guys to alter our outlook for either Fed policy or the Treasury (UST) market. That being said, Treasuries still leave little, if any, margin for error at this point.

Unless otherwise stated, data source is Bloomberg, as of 9/9/19.