State Owned Enterprises: The Principal-Agent Problem

Why exclude state-owned enterprises (SOEs) from equity allocations?

This a natural first question investors tend to ask when they hear of WisdomTree’s suite of ex-state-owned equity ETFs.

The rationale is simple: to mitigate exposure to the corporate governance issues that arise from state ownership, which can cause operational inefficiencies and weaker profitability.

WisdomTree was the first to package this type of solution into rules-based ETFs. But we were far from the first to identify the negative impact of the state-ownership structure on shareholders. This topic has been analyzed and written about in many forums—in intergovernmental organization (IGO) reports, the financial press and sell-side research.

Let’s review some of the recent commentary.

The Washington Consensus

The International Monetary Fund (IMF) and the World Bank have long advocated for the economic development of emerging markets through a market-based approach, with a preference for the privatization of SOEs. The philosophy of these IGOs is often referred to as the Washington Consensus.

The IMF published a paper in June assessing SOEs in Central, Eastern and Southeastern Europe.1 Their conclusion was that SOEs in the region generally “generate less revenue than their private counterparts, incur heavier costs of production not least on wages, and as a consequence are significantly less profitable.” Political influences often result in SOEs employing too many people that are paid too much.

A broader study written by the World Bank in 2014 came to a similar conclusion. It argues SOE underperformance is in part driven by exogenous factors such as lower commodity prices or other sector-specific factors, but conclude there is “increasing recognition that poor corporate governance of SOEs is at the heart of the matter.”2

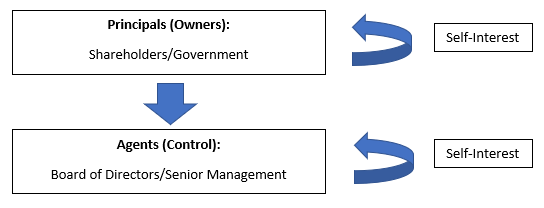

Having multiple owners—shareholders and the government—significantly exacerbates what is referred to as the principal-agent problem. This refers to the challenges of aligning the self-interests of the owners of capital (i.e., shareholders) with those of the agents who are employed on behalf of the principals.

The varying self-interests in the multi-principal model of SOEs makes it difficult for the agent to act in the interests of both principals when they have potentially competing goals and objectives.

Principal-Agent Problem

Operation Car Wash

In November 2014, just a few weeks before WisdomTree launched the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE), the offices of the state-owned oil-giant Petrobras were raided by Brazilian police. The cause was the firm’s involvement in a vast money-laundering scheme dubbed Operation Car Wash.

This example of corruption, coupled with lackluster profits and performance from other state-owned giants in countries like Russia and China, led The Economist to quip that perhaps the scariest words for investors to hear are “I’m from a state-owned firm and I want your capital.”3

What did they argue was behind the poor performance? A “huge” misallocation of capital—again, because of poor corporate governance structures in which minority shareholder interests were superseded by political motive.

China’s Red Flags

As a percent of total market-capitalization, no country has more SOEs than China. And under current Chinese Premier Xi Jinping, the government control over SOEs is only getting tighter, writes the Financial Times in a June article titled “Chinese governance raises red flags.”4 They write that many foreign investors are now hesitant to invest in Chinese SOEs because of these concerns.

As MSCI continues to incrementally add A-shares to its flagship emerging markets index, investors should keep this stat in mind: MSCI says SOEs make up 58% of the constituents of its MSCI China A International Index.

SOEs: Value Opportunity or Trap?

In a May 2018 note, UBS wrote that the return-on-equity (ROE) of emerging markets SOEs was about 11.05%, compared to 13% for non-SOEs. In addition to higher profitability, UBS also found significantly lower leverage and better performance in favor of non-SOEs, going back a decade.5

But the valuation opportunity in emerging markets was decidedly in the favor of SOEs, in part due to sector differences, but also because of the greater risks to shareholder interests.

This brings us back to a quote from The Economist: “Who are SOEs run for? The public good, as interpreted by politicians? Or shareholders?”

This question is an important one for investors to contemplate as they assess the various risks inherent in investing in emerging markets.

1“Reassessing the Role of State-Owned Enterprises in Central, Eastern, and Southeastern Europe,” International Monetary Fund, 6/18/19, pp 15–23.

2“Corporate Governance of State-Owned Enterprises,” World Bank, 2014, pp 11–12.

3“Government-Controlled Firms: State Capitalism in the Dock,” The Economist, 11/20/14.

4“Chinese Governance Raises Red Flags,” Financial Times, 6/1/19.

5“SOEs – 2018 Update: Still Lagging the Market,” UBS Equity Strategy, 5/31/18, pp 9–14.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.