Why We're Bullish on Cloud Computing

The Information Technology industry has grown to become the largest exposure in the S&P 500 Index over the last two decades.1 When combined with the Communications Services sector, companies in these two sectors comprise nearly one-third of the total market.2

For investors seeking to generate excess returns, this can create a challenging mix of slower-growing, mature businesses with faster-growing, emerging ones.

For growth-oriented investors, we believe cloud computing represents a compelling alternative to broad tech-sector strategies.

To capitalize on this trend, we are excited to announce the launch of the WisdomTree Cloud Computing Fund (WCLD), which provides pure-play exposure to fast-growing cloud-based businesses.

Demystifying the Cloud

Cloud computing has become ingrained in nearly every aspect of our lives by fundamentally altering how we consume, process, and share information.

But what exactly is this technology that has transformed our everyday lives?

- Technical Definition: The “cloud” refers to the aggregation of information online that can be accessed from anywhere, on any device. Cloud companies provide on-demand access to a centralized pool of information technology (IT) resources via a network connection.

- Real-World Application: Cloud computing allows us to access the same e-mail inbox that we have at our desktop computers from our mobile phones. Our e-mails are stored in the cloud, and not remotely on our computers, allowing access from any location via internet connection.

Although cloud computing already has a significant impact on our daily lives, we believe the industry will eventually overtake the traditional software market.

In the near term, cloud growth is poised to accelerate for two key reasons: 1) cloud computing is powering technological advancements in areas like artificial intelligence and the internet of things 2) many enterprises and organizations (including the U.S. government) are shifting to a cloud-based workflow.

The Cloud Software Advantage

Cloud computing is transforming the software industry. Over the last decade, cloud Software-as-a-Service (SaaS) businesses have eclipsed traditional software companies as the new industry standard for deploying and updating software.3 Cloud-based SaaS companies provide software applications and services via a network connection from a remote location, whereas traditional software is delivered and supported on-premise. This key difference in distribution leads to several distinct fundamental advantages for cloud versus traditional software:

Product Advantages4

- Speed, Ease and Low Cost of Implementation – cloud software is installed via a network connection; it doesn’t require the higher cost of on-premise infrastructure setup and installation.

- Efficient Updates – upgrades and support are deployed via a network connection, which shifts the burden of software maintenance from the client to the software provider.

- Easily Scalable – deploying via a network connection allows cloud SaaS businesses to grow as their clients grow, with the ability to expand services to more users or add product enhancements with ease. Client acquisition can happen 24/7; cloud SaaS companies have much lower barriers to entry into foreign markets.

Business Model Advantages

- High Recurring Revenue – cloud SaaS companies employ a subscription-based revenue model with smaller and more frequent transactions, while traditional software businesses rely on a single, large, upfront transaction. This model can result in more predictable, annuity-like revenue streams for cloud software providers.

- High Client Retention with Longer Revenue Periods – cloud software becomes embedded in client workflow, typically resulting in higher switching costs and client retention. Importantly, many clients prefer the pay-as-you-go transaction model, which can lead to longer periods of recurring revenue, as upselling product enhancements does not require an additional sales cycle.

- Lower Expenses – cloud SaaS companies can have lower research and development costs because they don’t need to support multiple types of networking infrastructure at each client location.

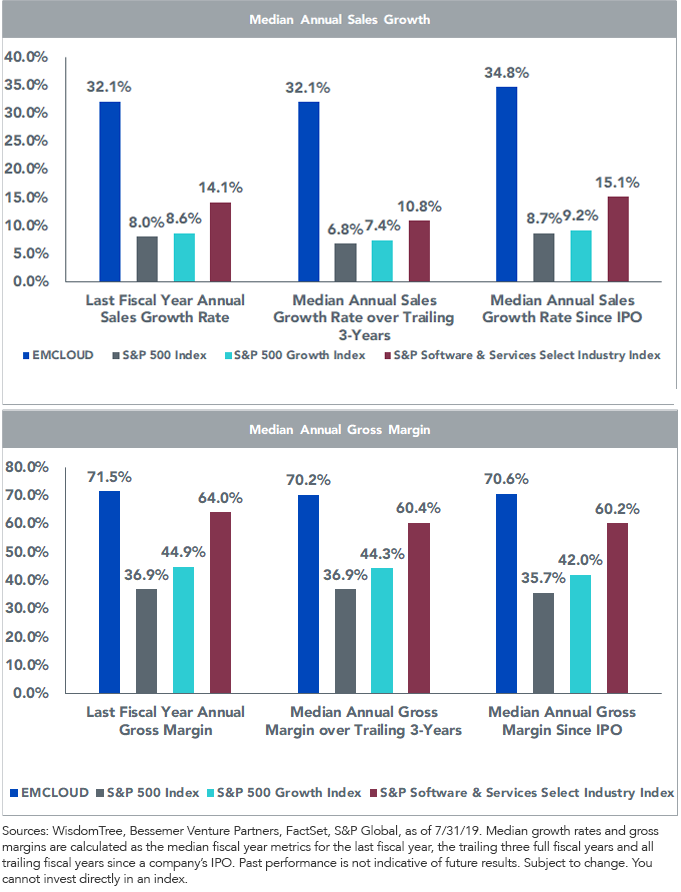

In our view, the product and business model advantages of cloud SaaS companies have historically led to better margins, growth, free cash flow and efficiency characteristics as compared to non-cloud software companies.

Understanding Our Approach

The WisdomTree Cloud Computing Fund (WCLD) leverages the expertise of Bessemer Venture Partners (BVP), a leading venture capital firm with over 10 years of investment success in the cloud industry.

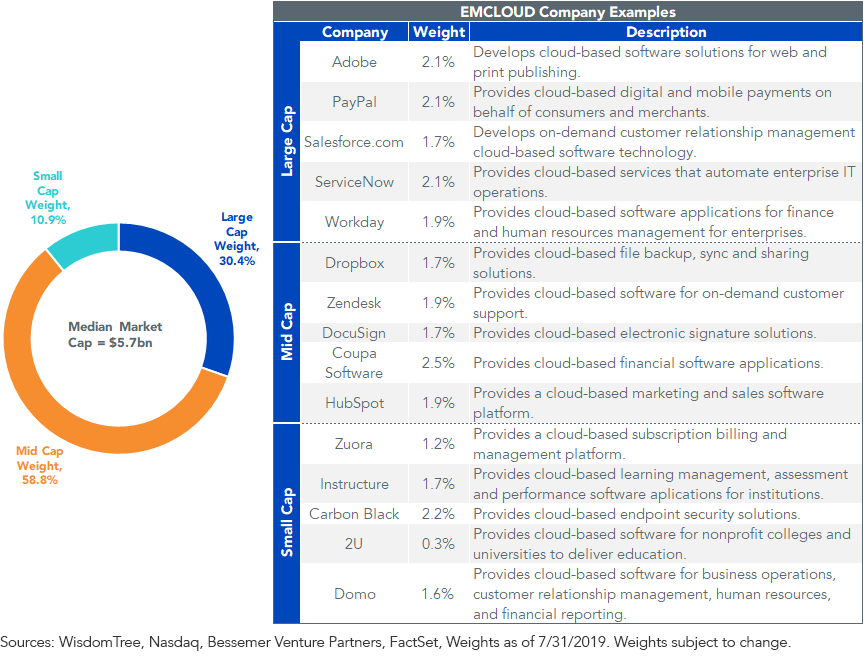

WCLD seeks to track the price and yield performance—before fees and expenses—of the BVP Nasdaq Emerging Cloud Index (EMCLOUD), an equally weighted Index jointly created by Nasdaq and BVP. EMCLOUD is comprised of cloud companies that are selected by BVP based on a transparent, rules-based methodology that is suited to the rapid growth of emerging cloud companies.

Importantly, EMCLOUD has delivered an annualized return of +34% since its inception, significantly outpacing the returns of the S&P 500 Software & Services Index (+19%), the S&P 500 Information Technology Index (+10%) and the Nasdaq 100 Index (+5%), as well as broader benchmarks like the S&P 500 Growth Index and the S&P 500 Index (both +4%).5

Adopting Cloud in Your Portfolio

Cloud adoption is taking place across the broader economy, and we believe investors may want to make the “shift to cloud” in their portfolios. The WisdomTree Cloud Computing Fund (WCLD) seeks to provides exposure to a basket of high-growth, emerging cloud software companies with industry- leading operating leverage.

1Sources: WisdomTree, FactSet, 1/31/1990–8/30/2019.

2Sources: WisdomTree, FactSet as of 8/30/2019

3Sources: Bessemer Venture Partners, WisdomTree, FactSet, 1/31/1990–8/30/2019.

4Please note the discussion regarding the growth potential of cloud computing is our opinion and there is no guarantee future high growth of the sector will continue or translate to positive fund performance. Factors inhibiting the growth of the cloud computing sector may include changes in business cycles, world economic growth, technological progress, and government regulation.

5For the period 10/2/2018-07/31/2019. Past performance is not indicative of future results. You cannot invest directly in an index. The inception date of the EMCLOUD Index is 10/2/2018. Double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. Performance, especially for very short time periods, should not be the sole factor in making your investment decisions.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilize a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Nasdaq® and BVP Nasdaq Emerging Cloud Index℠ are registered trademarks and service marks of Nasdaq, Inc. (which, with its affiliates, is referred to as the “Corporations”), and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISER TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX-RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.