Measuring Value on Draft Day

“In human behavior there was always uncertainty and risk. The goal of the Oakland front office was simply to minimize the risk. Their solution wasn’t perfect, it was just better than the hoary alternative, rendering decisions by gut feeling.”

–Michael Lewis, Moneyball1

Happy September! For many of us, there is one great solace to the end of summer and passage to colder weather: Football is BACK.

It is that time of year when people imagine they are the Billy Beane2 of their fantasy football leagues—a cold, calculated, quantitatively driven general manager (GM). These GMs feed on the so-called “suckers” who overvalue certain types of players, such as:

- Talented but unproven rookies over an established but perhaps past-his-prime veteran (growth vs. value)

- Someone from their favorite team or perhaps a rookie from their alma mater (home bias)

- Someone who they had on their team last year and now feel inclined to keep (the endowment effect)

In parentheses, we make some lighthearted analogies between the cognitive and behavioral biases of portfolio managers and a fantasy football team owner on draft day.

Many psychologists and behavioral economists have identified these as some of the common human tendencies that can cause suboptimal decision-making. But even when we know about these biases, it is extremely difficult to mitigate them.

Establishing Rules

For most investors, a U.S. large-cap core equity investment vehicle tends to meet two main criteria:

- Capture a broad, diverse cross-section of the available market-cap universe

- Use a low-fee3, cost-conscious vehicle

These two criteria typically point toward passive indexing within the ETF wrapper—it’s one-click diversification in a tax-efficient, and generally less expensive, fund.

These are the exact criteria that WisdomTree had in mind when launching the WisdomTree U.S. LargeCap Fund (EPS) in 2007—and we recently doubled down on the low-fee criteria by reducing the expense ratio for EPS from 28 basis points (bps) to 8 bps this past spring.

The goal was to offer a Fund that could anchor a portfolio while also offering the opportunity to outperform traditional market cap-weighted indexes with its rules-based investing approach.

By screening on an intuitive characteristic—profitability—the Fund maintains a broad and inclusive exposure to large-cap U.S. equities at lower multiples than major market cap-weighted indexes. Instead of owning more of a security because of a portfolio manager’s intuition, this Fund follows rules that make its investment process consistent and objective.

But the last few years have not been overly kind to the value stocks targeted by EPS. The past five years, particularly, have been a time when “expensive” higher-valuation stocks have led the market higher, while lower valuation ratio stocks lagged. With its value-tilted strategy, EPS has faced a challenging backdrop, causing it to underperform the S&P 500 Index by 86 bps annualized.4 For standardized performance of EPS, click here.

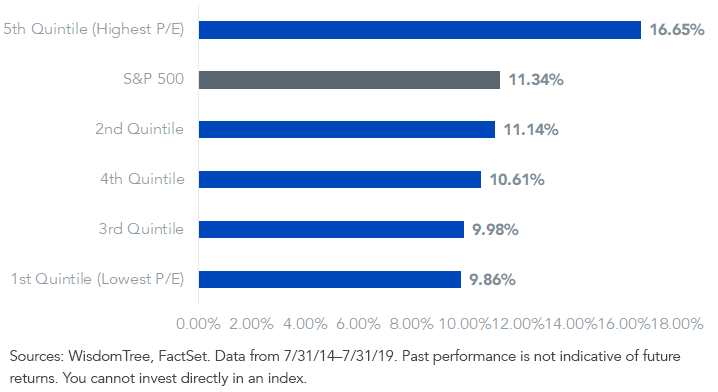

Sorting the S&P 500 into price-to-earnings (P/E) ratio quintiles, the highest P/E ratio stocks had the best performance at 16.65% annualized, over 500 bps ahead of the S&P 500. Every other quintile underperformed the market.

5-Year Average Annual Return

WisdomTree employs an earnings-weighted process to allocate toward a company’s earnings streams. That naturally tilts weight away from those stocks with the highest P/E ratios and toward stocks with the lowest P/E ratios. EPS had an underweight of about 8% to this high P/E quintile and an overweight of about 10% to the lowest P/E quintile.

This investment process is consistently repeated at each annual Fund rebalance, without any emotional or cognitive biases creeping into the investment process. Over time, this process is designed to mitigate valuation risks, particularly during a late-cycle, melt-up environment.

As of 7/31/19, the trailing P/E ratio of EPS was 16.0x, almost four turns lower than the 19.9x for the S&P 500 Index.5

The Longer-Term Picture

EPS can offer many attractive characteristics: broad-based exposure, a proven track record of success versus its active and passive peers, and a consistent approach that does not seek to chase the latest fads or risk the loss of a star portfolio manager.

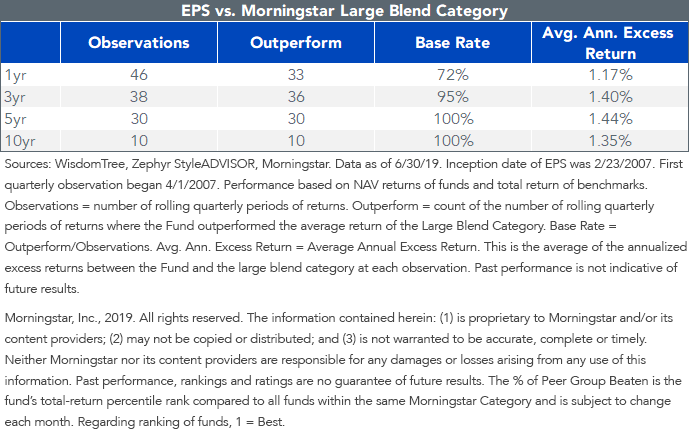

Despite value’s headwind, EPS has had some impressive real-time returns. The table below shows rolling quarterly observations of returns over 1-year, 3-year, 5-year, and 10-year time frames. If we take the 3-year return, for example, EPS has outperformed the average performance of the Morningstar Large Blend Category 95% of the time (i.e., the base rate), with an average annual excess return of 140 bps.

So, while your friends may be reaching for this year’s potential rookie sensation, a few under-loved and undervalued veterans might just do the trick.

1Pg. 136.

2General Manager of the Oakland Athletics, from the book Moneyball by Michael Lewis.

3Ordinary brokerage commissions apply.

4Sources: WisdomTree, Zephyr StyleADVISOR. Returns from 7/31/14–7/31/19. Fund returns based on net asset value. Index returns based on total returns.

5Sources: WisdomTree, FactSet.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.