Is the Euro the New Yen? Increasingly So.

Why Have Correlations Turned Negative and Japan-Like? Is This a Replay of the ’90s?

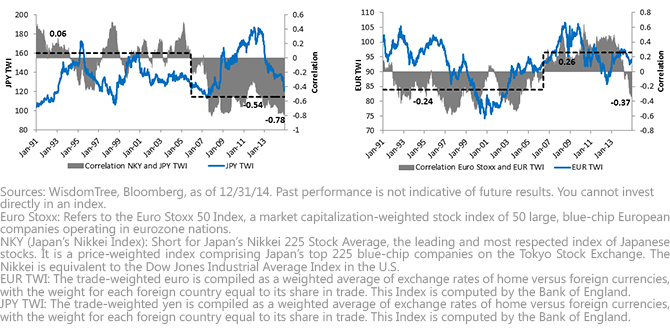

As the above chart shows, there was a nine-year stretch between September 1, 1992, and May 31, 2001, when European currencies in the MSCI EMU Index (EMU) depreciated 40.2% cumulatively versus the U.S. dollar, and EMU stocks in local currency terms had one of their best stretches ever, returning 19.8% per year. On a trade-weighted basis, European currencies declined 27.9% during the same period. This period alone suggests the European markets can perform well when the euro declines.

Per the charts above, in the 1,252 rolling 52-week periods examined from January 1991 through December 2014, the Euro Stoxx 50 had a negative correlation to the European currencies, measured on a trade-weighted index, 60% of the time. The Nikkei 225 Index had a negative correlation to the yen only 57% of the time, albeit with very highly negative correlations that began showing up in late 2007.

Below are two rationales for the euro becoming more negatively correlated:

• Quantitative Easing (QE) to Buoy Equity Markets and Simultaneously Weaken Euro: In light of the new policy measures announced by the European Central Bank (ECB) in 2014—and the anticipation of new measures in 2015—many expect more policy action on the asset-purchase front, particularly with sovereign bond buying, corporate bond buying and outright QE. The anticipation of more ECB action is underpinned by declining growth expectations and mounting disinflation fears in the eurozone. This could lead to currency weakness and simultaneous risk-asset (equity) market outperformance, which can result in an even more negative correlation.

• Aggressive Policy Action to Encourage Currency-Hedging Activity: In 2014 the ECB launched aggressive monetary policy easing, including verbal intervention, negative deposit rates and other liquidity infusions (targeted longer-term refinancing operations, TLTRO). As a result, the ECB has succeeded in guiding markets toward a weaker euro in 2014. We have already started to see an increase in asset flows to currency-hedged strategies for Europe in 2014 and expect this to continue if asset flows pick up for European investments1.

The Case for Euro Hedging

Given that many of the themes discussed above are likely to play out over the course of the next few years, negative correlations in the eurozone may very well persist and become even more negative. To illustrate the point, Goldman Sachs recently downgraded its EURUSD2 forecast to 1.08 in 12 months, 1.00 (parity) by the end of 2016 and 0.90 by the end of 2017.

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. While the ECB and the BOJ have newly embarked on aggressive easing measures, the U.S. Federal Reserve is largely expected to begin raising rates in the middle of 2015. This policy dichotomy could signal potential for a stronger dollar in the months ahead. From this standpoint, I believe we are in the very early stages of flows heading toward currency-hedged strategies—especially for Europe.

1Source: Bloomberg, as of 12/31/14.

2 EURUSD: Measures USD per unit of EUR, as of 1/9/14.

Why Have Correlations Turned Negative and Japan-Like? Is This a Replay of the ’90s?

As the above chart shows, there was a nine-year stretch between September 1, 1992, and May 31, 2001, when European currencies in the MSCI EMU Index (EMU) depreciated 40.2% cumulatively versus the U.S. dollar, and EMU stocks in local currency terms had one of their best stretches ever, returning 19.8% per year. On a trade-weighted basis, European currencies declined 27.9% during the same period. This period alone suggests the European markets can perform well when the euro declines.

Per the charts above, in the 1,252 rolling 52-week periods examined from January 1991 through December 2014, the Euro Stoxx 50 had a negative correlation to the European currencies, measured on a trade-weighted index, 60% of the time. The Nikkei 225 Index had a negative correlation to the yen only 57% of the time, albeit with very highly negative correlations that began showing up in late 2007.

Below are two rationales for the euro becoming more negatively correlated:

• Quantitative Easing (QE) to Buoy Equity Markets and Simultaneously Weaken Euro: In light of the new policy measures announced by the European Central Bank (ECB) in 2014—and the anticipation of new measures in 2015—many expect more policy action on the asset-purchase front, particularly with sovereign bond buying, corporate bond buying and outright QE. The anticipation of more ECB action is underpinned by declining growth expectations and mounting disinflation fears in the eurozone. This could lead to currency weakness and simultaneous risk-asset (equity) market outperformance, which can result in an even more negative correlation.

• Aggressive Policy Action to Encourage Currency-Hedging Activity: In 2014 the ECB launched aggressive monetary policy easing, including verbal intervention, negative deposit rates and other liquidity infusions (targeted longer-term refinancing operations, TLTRO). As a result, the ECB has succeeded in guiding markets toward a weaker euro in 2014. We have already started to see an increase in asset flows to currency-hedged strategies for Europe in 2014 and expect this to continue if asset flows pick up for European investments1.

The Case for Euro Hedging

Given that many of the themes discussed above are likely to play out over the course of the next few years, negative correlations in the eurozone may very well persist and become even more negative. To illustrate the point, Goldman Sachs recently downgraded its EURUSD2 forecast to 1.08 in 12 months, 1.00 (parity) by the end of 2016 and 0.90 by the end of 2017.

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. While the ECB and the BOJ have newly embarked on aggressive easing measures, the U.S. Federal Reserve is largely expected to begin raising rates in the middle of 2015. This policy dichotomy could signal potential for a stronger dollar in the months ahead. From this standpoint, I believe we are in the very early stages of flows heading toward currency-hedged strategies—especially for Europe.

1Source: Bloomberg, as of 12/31/14.

2 EURUSD: Measures USD per unit of EUR, as of 1/9/14.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Foreside Fund Services, LLC is not affiliated with Goldman Sachs.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.