Rising Rate Strategies: Core Plus Portfolio Performance During Tapering

For definitions of indexes in the chart, please visit our glossary.

Over the last 10 months, nominal interest rates have fallen and credit spreads have generally widened. With hindsight, we know that hedging interest rate risk cost investors performance. Additionally, even though high-yield bonds generated positive returns, risky debt underperformed investment grade credit by nearly 2%. However, we believe we can learn a great deal about portfolio construction from this experience:

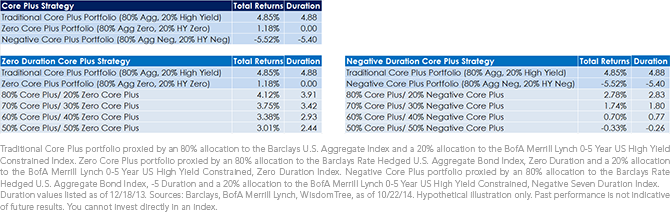

1) For most bond investors, the greatest determinant of a portfolio’s total return is the starting yield level. As shown in the table, over this period, the primary driver of returns was the amount of interest rate risk investors had in their portfolios. Unless investors believe that the risk of deflation is poised to increase, we continue to believe that hedging interest rate risk is a prudent course of action.

2) Although hedging over this period reduced total returns, a blended approach incorporating zero duration, core plus strategies provided positive returns while reducing risk. In the case of the 50% Core Plus / 50% Zero Core Plus blend, an investor who reduced their interest rate risk by 50% underperformed by 1.84%. With rates at some of the lowest levels since mid-2013, we continue to believe that the risk of higher rates far outweighs the risk of lower rates.

3) Negative duration strategies and blends underperformed as long-term interest rates fell more than short-term rates. Given that credit spreads also widened over this period, a more opportunistic trade may be to increase exposure to negative duration, high-yield strategies as a way to address rate and credit spread normalization.

While the ultimate evolution of the path of U.S. interest rates remains uncertain, we believe these new strategies for risk management give investors a powerful tool kit for refining their fixed income exposure. Even though rates have fallen over this period, the blended approaches shown above resulted in positive total returns for all but the most aggressive approach. In our view, the ability for investors to maintain traditional bond exposures while reducing interest rate risk can add value once rates begin to normalize.

For definitions of indexes in the chart, please visit our glossary.

Over the last 10 months, nominal interest rates have fallen and credit spreads have generally widened. With hindsight, we know that hedging interest rate risk cost investors performance. Additionally, even though high-yield bonds generated positive returns, risky debt underperformed investment grade credit by nearly 2%. However, we believe we can learn a great deal about portfolio construction from this experience:

1) For most bond investors, the greatest determinant of a portfolio’s total return is the starting yield level. As shown in the table, over this period, the primary driver of returns was the amount of interest rate risk investors had in their portfolios. Unless investors believe that the risk of deflation is poised to increase, we continue to believe that hedging interest rate risk is a prudent course of action.

2) Although hedging over this period reduced total returns, a blended approach incorporating zero duration, core plus strategies provided positive returns while reducing risk. In the case of the 50% Core Plus / 50% Zero Core Plus blend, an investor who reduced their interest rate risk by 50% underperformed by 1.84%. With rates at some of the lowest levels since mid-2013, we continue to believe that the risk of higher rates far outweighs the risk of lower rates.

3) Negative duration strategies and blends underperformed as long-term interest rates fell more than short-term rates. Given that credit spreads also widened over this period, a more opportunistic trade may be to increase exposure to negative duration, high-yield strategies as a way to address rate and credit spread normalization.

While the ultimate evolution of the path of U.S. interest rates remains uncertain, we believe these new strategies for risk management give investors a powerful tool kit for refining their fixed income exposure. Even though rates have fallen over this period, the blended approaches shown above resulted in positive total returns for all but the most aggressive approach. In our view, the ability for investors to maintain traditional bond exposures while reducing interest rate risk can add value once rates begin to normalize.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Non-investment-grade debt securities (also known as high-yield or “junk” bonds) have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The duration Funds seek to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The duration Funds may engage in “short sale” transactions of U.S. Treasuries, where losses may be exaggerated, potentially losing more money than the actual cost of the investment, and the third party to the short sale may fail to honor its contract terms, causing a loss to the duration Funds. While the duration Funds attempt to limit credit and counterparty exposure, the value of an investment in the duration Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of each Fund’s portfolio investments. Investors should anticipate that due to the negative duration target, those Funds will be highly sensitive to interest rate changes. The higher (whether positive or negative) a bond fund’s duration, the greater its sensitivity to interest rates changes, and fluctuations in value, whether positive or negative, will be more pronounced. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of certain funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding each Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.