Japan Real Estate in Focus After Large Capital Raise

For current holdings of DXJR, click here.

The week the share sale was announced, DXJR, which had $2.5 million in assets from its original seed capital, saw 630,000 shares trade on June 17 and corresponding inflows to the Fund of $15 million that week.7

There are a few lessons with this trading activity. Investors could have looked at the $2.5 million in assets under management and small daily trading volume and decided that they could not get involved in this ETF without impacting its relative price. Japan is also a market where purchasing in the U.S. adds another element to the pricing equation because Japan’s markets are closed—so the ETF also serves as a price-discovery vehicle for Japan’s markets. In other words, market participants involved in the U.S. ETF market, through the combination of their activities regarding ETFs of Japanese equities, influence prices such that the behavior of the ETFs functions to predict where Japanese markets will open on their next trading day.

Even though the Japanese equity market is closed, market makers can still create liquidity in this Fund. A lot of other Japanese equity trading vehicles are active during U.S. hours, including Japanese index futures, other Japanese ETFs and even Japanese American Depository Receipts (ADRs). Market makers would buy or sell DXJR to a customer and hedge themselves with something of similar exposure that has more volume. To demonstrate the depths of liquidity a trader can access, let’s look at one example from each of the two time zones.

• If the market maker is looking to access liquidity during the U.S. trading day, one Nikkei 225 (NKY) futures contract trades on average $1.2 billion a day.7

• If a market maker were to access liquidity during Japanese hours, the underlying basket of equities that make up DXJR trades about $2.5 billion a day.9

Bottom line: We believe enough liquidity can be had at any time.

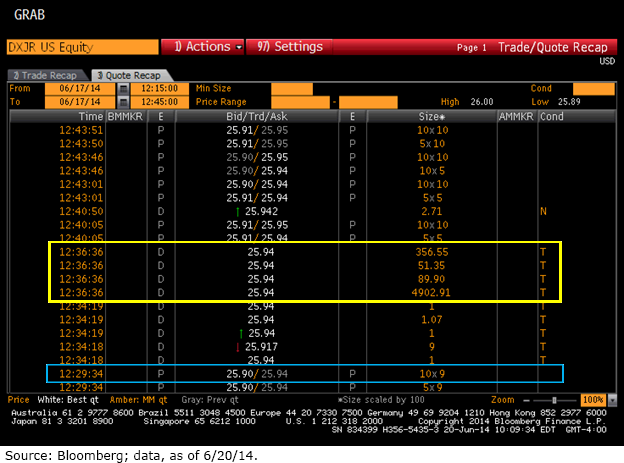

As testament to that, if you look at the Bloomberg screen shot below, in the highlighted yellow box you can see that four blocks of trades went off at 12:36:36:

• 490,291 shares of DXJR traded at $25.94.

• 5,135 shares of DXJR traded at $25.94.

• 8,990 shares of DXJR traded at $25.94.

• 35,655 shares of DXJR traded at $25.94.

In total, these trades aggregated to 540,071 shares trading at $25.94.

If you look farther down the page, in the highlighted blue box, you can see that the market was $25.90 bid at $25.94 offer right before the trades took place. A customer bought $14.0 million worth of DXJR on the offer while the Japanese market was closed. This is quite a demonstration of competitive liquidity that can be created in ETFs by the market makers.

For current holdings of DXJR, click here.

The week the share sale was announced, DXJR, which had $2.5 million in assets from its original seed capital, saw 630,000 shares trade on June 17 and corresponding inflows to the Fund of $15 million that week.7

There are a few lessons with this trading activity. Investors could have looked at the $2.5 million in assets under management and small daily trading volume and decided that they could not get involved in this ETF without impacting its relative price. Japan is also a market where purchasing in the U.S. adds another element to the pricing equation because Japan’s markets are closed—so the ETF also serves as a price-discovery vehicle for Japan’s markets. In other words, market participants involved in the U.S. ETF market, through the combination of their activities regarding ETFs of Japanese equities, influence prices such that the behavior of the ETFs functions to predict where Japanese markets will open on their next trading day.

Even though the Japanese equity market is closed, market makers can still create liquidity in this Fund. A lot of other Japanese equity trading vehicles are active during U.S. hours, including Japanese index futures, other Japanese ETFs and even Japanese American Depository Receipts (ADRs). Market makers would buy or sell DXJR to a customer and hedge themselves with something of similar exposure that has more volume. To demonstrate the depths of liquidity a trader can access, let’s look at one example from each of the two time zones.

• If the market maker is looking to access liquidity during the U.S. trading day, one Nikkei 225 (NKY) futures contract trades on average $1.2 billion a day.7

• If a market maker were to access liquidity during Japanese hours, the underlying basket of equities that make up DXJR trades about $2.5 billion a day.9

Bottom line: We believe enough liquidity can be had at any time.

As testament to that, if you look at the Bloomberg screen shot below, in the highlighted yellow box you can see that four blocks of trades went off at 12:36:36:

• 490,291 shares of DXJR traded at $25.94.

• 5,135 shares of DXJR traded at $25.94.

• 8,990 shares of DXJR traded at $25.94.

• 35,655 shares of DXJR traded at $25.94.

In total, these trades aggregated to 540,071 shares trading at $25.94.

If you look farther down the page, in the highlighted blue box, you can see that the market was $25.90 bid at $25.94 offer right before the trades took place. A customer bought $14.0 million worth of DXJR on the offer while the Japanese market was closed. This is quite a demonstration of competitive liquidity that can be created in ETFs by the market makers.

Conclusion

WisdomTree created a suite of Japan hedged sector ETFs for this specific type of exposure in demand for Japanese real estate companies. The largest holding in DXJR, Mitsui Fudosan, through its capital raise, has brought renewed focus on this segment of the market. For those looking at ways to get exposure to these types of companies, we believe DXJR represents a broad basket of real estate companies. Investors should look at the trades that occurred above as an example of the ample liquidity that is available.

1Source: “Introduction of the ‘Quantitative and Qualitative Monetary Easing,’” Bank of Japan, 4/4/13.

2Source: Bloomberg, for period 12/31/12 to 12/31/13.

3Source: Bloomberg, for period 12/31/13 to 5/31/14; refers to the TOPIX for the broad Japanese market and the TOPIX Real Estate Index for the real estate sector.

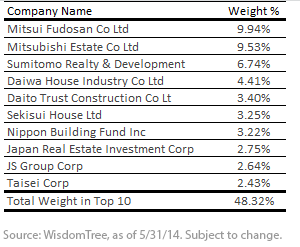

4Mitsui Fudosan Co. Ltd. was a 9.94% holding in the WisdomTree Japan Hedged Real Estate Fund (DXJR), a 0.76% holding in the WisdomTree Global ex-US Real Estate Fund (DRW) and a 0.06% holding in the WisdomTree DEFA Fund (DWM) as of 5/31/14.

5The public offering was for 100 million shares. On July 22 a potential 10 million more shares may be issued to the underwriters in connection with over-allotments. See http://www.4-traders.com/MITSUI-FUDOSAN-CO-LTD-6491315/news/Mitsui-Fudosan--Notice-regarding-Determination-of-Number-of-New-Shares-to-Be-Issued143KB-18613338/.

6Junko Fujita, “Mitsui Fudosan Gives Smallest Discount in $3.4 Bln Share Sale,” Reuters, 6/16/14.

7Sources: WisdomTree, Bloomberg, with data as of 6/20/14.

8Source: Bloomberg, as of 5/31/14.

9Source: Bloomberg, as of 5/31/14.

Conclusion

WisdomTree created a suite of Japan hedged sector ETFs for this specific type of exposure in demand for Japanese real estate companies. The largest holding in DXJR, Mitsui Fudosan, through its capital raise, has brought renewed focus on this segment of the market. For those looking at ways to get exposure to these types of companies, we believe DXJR represents a broad basket of real estate companies. Investors should look at the trades that occurred above as an example of the ample liquidity that is available.

1Source: “Introduction of the ‘Quantitative and Qualitative Monetary Easing,’” Bank of Japan, 4/4/13.

2Source: Bloomberg, for period 12/31/12 to 12/31/13.

3Source: Bloomberg, for period 12/31/13 to 5/31/14; refers to the TOPIX for the broad Japanese market and the TOPIX Real Estate Index for the real estate sector.

4Mitsui Fudosan Co. Ltd. was a 9.94% holding in the WisdomTree Japan Hedged Real Estate Fund (DXJR), a 0.76% holding in the WisdomTree Global ex-US Real Estate Fund (DRW) and a 0.06% holding in the WisdomTree DEFA Fund (DWM) as of 5/31/14.

5The public offering was for 100 million shares. On July 22 a potential 10 million more shares may be issued to the underwriters in connection with over-allotments. See http://www.4-traders.com/MITSUI-FUDOSAN-CO-LTD-6491315/news/Mitsui-Fudosan--Notice-regarding-Determination-of-Number-of-New-Shares-to-Be-Issued143KB-18613338/.

6Junko Fujita, “Mitsui Fudosan Gives Smallest Discount in $3.4 Bln Share Sale,” Reuters, 6/16/14.

7Sources: WisdomTree, Bloomberg, with data as of 6/20/14.

8Source: Bloomberg, as of 5/31/14.

9Source: Bloomberg, as of 5/31/14.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic, regulatory or sector-specific development. This may result in greater share price volatility. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. The Fund uses various strategies to attempt to minimize the impact of changes in the Japanese yen against the U.S. dollar, which may not be successful. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.