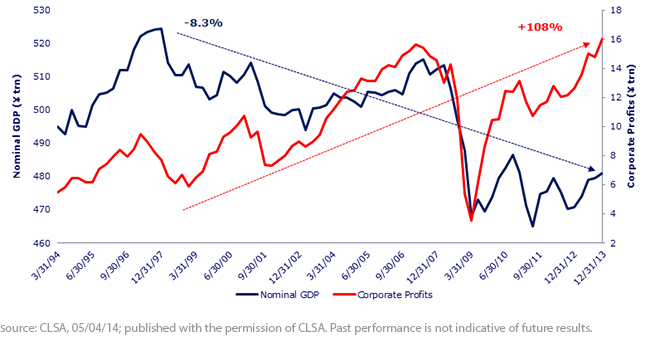

Are Japan’s Profits Tied to Growth in Japan’s Economy?

• Consumption Tax Fears May Be Exaggerated – Although raising the consumption tax was always expected to be a drag on Japan’s GDP, the effect might be more muted on corporate profits than originally feared. As the chart highlights, corporations succeeded in increasing profitability over past periods of declining GDP growth. CLSA also noted in its research that consensus earnings expectations have continued to increase despite the consumption tax hike.

• Overseas Production Helps Profitability, Not Necessarily GDP – One reason for the lack in correlation between profits and GDP is that a growing number of companies are shifting production overseas. Profit margins in these foreign operations can be two to three times the profit margins in Japanese operations. While this shift in overseas production does not show up in higher exports (despite the more competitive position from a weakening of the yen) and thus also does not translate to GDP growth, the gains on sales from overseas production do translate to higher corporate profits for Japanese firms. This is one reason the lack of a relationship between GDP growth and profits is especially important today.

Japan’s Profits Tied to Global Growth

At the CLSA conference that I attended in February, Nicholas made a point that really stood out for me: Japan’s economy and markets have one of the highest sensitivities to global economic growth—even more than most emerging markets export countries. The underperformance for Japan in 2014 could thus be ascribed less to concerns about what is happening in Japan’s local economy and more to concerns about slowdowns in U.S. and global economic growth.

As the market cuts through the noise of the consumption tax hike and its impact on Japan’s economy and starts to look to the underlying growth in profits for Japan’s companies, I believe there will be more support for Japan’s equity markets. Potential catalysts to reinvigorate this attractively priced market: further news from Abe on tangible steps for his third-arrow growth strategies, further monetary policy support from the Bank of Japan to reach its 2% inflation target and/or a pickup in global economic growth. I expect some combination of these factors in the latter half of 2014 to come to fruition.

1Source: Bloomberg (11/30/12–4/30/14)

2Source: “Abenomics Health Check”, CLSA, 5/04/14

• Consumption Tax Fears May Be Exaggerated – Although raising the consumption tax was always expected to be a drag on Japan’s GDP, the effect might be more muted on corporate profits than originally feared. As the chart highlights, corporations succeeded in increasing profitability over past periods of declining GDP growth. CLSA also noted in its research that consensus earnings expectations have continued to increase despite the consumption tax hike.

• Overseas Production Helps Profitability, Not Necessarily GDP – One reason for the lack in correlation between profits and GDP is that a growing number of companies are shifting production overseas. Profit margins in these foreign operations can be two to three times the profit margins in Japanese operations. While this shift in overseas production does not show up in higher exports (despite the more competitive position from a weakening of the yen) and thus also does not translate to GDP growth, the gains on sales from overseas production do translate to higher corporate profits for Japanese firms. This is one reason the lack of a relationship between GDP growth and profits is especially important today.

Japan’s Profits Tied to Global Growth

At the CLSA conference that I attended in February, Nicholas made a point that really stood out for me: Japan’s economy and markets have one of the highest sensitivities to global economic growth—even more than most emerging markets export countries. The underperformance for Japan in 2014 could thus be ascribed less to concerns about what is happening in Japan’s local economy and more to concerns about slowdowns in U.S. and global economic growth.

As the market cuts through the noise of the consumption tax hike and its impact on Japan’s economy and starts to look to the underlying growth in profits for Japan’s companies, I believe there will be more support for Japan’s equity markets. Potential catalysts to reinvigorate this attractively priced market: further news from Abe on tangible steps for his third-arrow growth strategies, further monetary policy support from the Bank of Japan to reach its 2% inflation target and/or a pickup in global economic growth. I expect some combination of these factors in the latter half of 2014 to come to fruition.

1Source: Bloomberg (11/30/12–4/30/14)

2Source: “Abenomics Health Check”, CLSA, 5/04/14

Important Risks Related to this Article

ALPS Distributors, Inc. is not affiliated with CLSA. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.