Should Investors Hedge Exposure to the Indian Rupee?

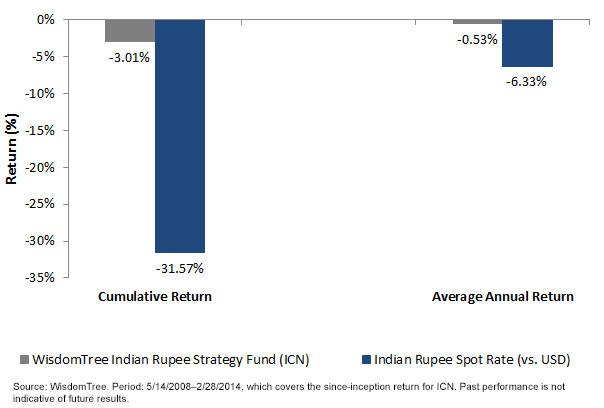

For definitions of terms in the chart, please visit our Glossary.

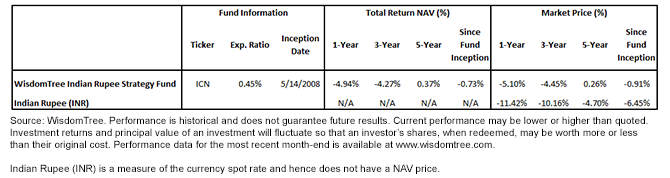

Average Annual Returns (as of December 31, 2013)

For definitions of terms in the chart, please visit our Glossary.

Average Annual Returns (as of December 31, 2013)

The Case for the Rupee: Currently at a Significant Discount

On a long-term basis, the Indian rupee is an emerging market currency selling at the greatest discount to purchasing power parity of all emerging market currencies. Some of this discount is warranted—the high inflation levels in India will likely be a headwind for the currency, as it erodes India’s purchasing power over time. But the convergence of India’s demographics and income growth potential with those of the rest of the world argues the long-term fundamental case for the country’s ability to catch up as money flows into its economy.

India’s Central Bank Establishing Credibility

There is no question India’s currency has been volatile. But the new head of its central bank, Raghuram Rajan, has been a very positive influence. By hiking interest rates during his early days in office, he made it more expensive for speculators and hedgers to short the rupee. He also re-established the inflation-fighting credibility of the central bank in the eyes of many investors. This has made it more attractive to get exposure to the rupee via a fund, such as ICN, that seeks to collect the interest rate differential after expenses.

Macroeconomic Tide May Be Turning

Additionally, India has been proactive in addressing its external vulnerabilities and fiscal corruption concerns. Its current account position has improved considerably, inflation has slowed— even though it remains high, specifically for core consumer prices—and slow but encouraging progress on fiscal reforms has been made.

There is also an emerging consensus that the opposing Bharatiya Janata Party (BJP) and its coalition for the upcoming national elections will have the potential to provide a boost for investor confidence in India.

From a valuation standpoint, long positions in the rupee against the dollar offer a high level of carry or potential interest return per unit of risk. The rupee ranks third in its measure of carry to its volatility amongst other emerging market currencies, behind the Peruvian new sol and the Brazilian real.4

Conclusion: Portfolio Perspective on the Rupee

If one is looking to get access to emerging markets, the high interest rates in India are an interesting way to achieve that exposure. We think allocations to ICN have broad applications within client portfolios, such as:

1) Augmenting emerging market fixed income portfolios: For many investors, assessing the pros and cons of exposure to rupee debt can be challenging; ICN can facilitate access to the Indian currency and its local short-term rates.

2) Blending in with Indian equities to help mitigate the risk profile of one’s overall Indian investments.

1Refers to the S&P BSE SENSEX Index hitting 21,934 as of 3/10/2014.

2Refers to the WisdomTree India Earnings Index and the Indian rupee’s cumulative returns from 12/3/2007 to 2/28/2014.

3Source: Bloomberg, as of 2/26/2014, effectively the last day of the month with viable data.

4Source: Bloomberg, as of 02/28/2014.

The Case for the Rupee: Currently at a Significant Discount

On a long-term basis, the Indian rupee is an emerging market currency selling at the greatest discount to purchasing power parity of all emerging market currencies. Some of this discount is warranted—the high inflation levels in India will likely be a headwind for the currency, as it erodes India’s purchasing power over time. But the convergence of India’s demographics and income growth potential with those of the rest of the world argues the long-term fundamental case for the country’s ability to catch up as money flows into its economy.

India’s Central Bank Establishing Credibility

There is no question India’s currency has been volatile. But the new head of its central bank, Raghuram Rajan, has been a very positive influence. By hiking interest rates during his early days in office, he made it more expensive for speculators and hedgers to short the rupee. He also re-established the inflation-fighting credibility of the central bank in the eyes of many investors. This has made it more attractive to get exposure to the rupee via a fund, such as ICN, that seeks to collect the interest rate differential after expenses.

Macroeconomic Tide May Be Turning

Additionally, India has been proactive in addressing its external vulnerabilities and fiscal corruption concerns. Its current account position has improved considerably, inflation has slowed— even though it remains high, specifically for core consumer prices—and slow but encouraging progress on fiscal reforms has been made.

There is also an emerging consensus that the opposing Bharatiya Janata Party (BJP) and its coalition for the upcoming national elections will have the potential to provide a boost for investor confidence in India.

From a valuation standpoint, long positions in the rupee against the dollar offer a high level of carry or potential interest return per unit of risk. The rupee ranks third in its measure of carry to its volatility amongst other emerging market currencies, behind the Peruvian new sol and the Brazilian real.4

Conclusion: Portfolio Perspective on the Rupee

If one is looking to get access to emerging markets, the high interest rates in India are an interesting way to achieve that exposure. We think allocations to ICN have broad applications within client portfolios, such as:

1) Augmenting emerging market fixed income portfolios: For many investors, assessing the pros and cons of exposure to rupee debt can be challenging; ICN can facilitate access to the Indian currency and its local short-term rates.

2) Blending in with Indian equities to help mitigate the risk profile of one’s overall Indian investments.

1Refers to the S&P BSE SENSEX Index hitting 21,934 as of 3/10/2014.

2Refers to the WisdomTree India Earnings Index and the Indian rupee’s cumulative returns from 12/3/2007 to 2/28/2014.

3Source: Bloomberg, as of 2/26/2014, effectively the last day of the month with viable data.

4Source: Bloomberg, as of 02/28/2014.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Investments focused in Europe and Japan may increase the impact of events and developments associated with those regions, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.