An Update on Russia and Russian Corporate Bonds

As investors, we continually assess risks on the basis of the likelihood of various potential scenarios. We see three scenarios emerging from current tensions.

• Uneasy Stability – Crimea is annexed, the West delivers a face-saving wrist slap, and tensions die down but don’t severely dent the economic interests of either side.

• Prolonged Chess Match – Tensions rise and fall but remain relatively elevated in the coming months. Some economic pain is experienced on both sides, as fundamentals particularly in Russia and Ukraine show further deterioration. The risk premium built into Russian assets fades slowly and the ruble depreciates as the Russian Central Bank partially reverses its temporary interest rate hike to support growth.

• Significant Escalation – The prospect that tensions escalate via further Russian incursions into Ukraine increases the potential for a policy mistake between the West and Russia. At present, this is the biggest risk that markets are trying to react to each day. The understanding that significant economic consequences are likely to result for both sides mitigates this risk. But there is some danger that economic considerations might be superseded by Russia’s desire for increased influence in the former Soviet republics.

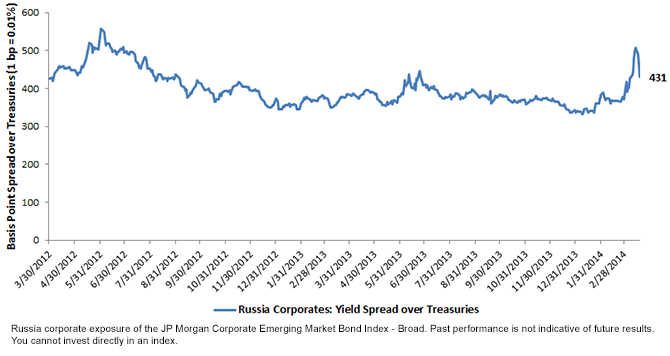

In our view, the market is currently wrestling with uneasy stability and a prolonged chess match as the most likely options. Risk premiums are still high, but the risk of a full-scale military conflict has faded. While the West has said that more sanctions may be forthcoming, the U.S. and EU allies are struggling to impose meaningful punitive measures without threatening their own economic interests, particularly in Europe. As many analysts have noted, Europe receives 30% of its natural gas from Gazprom, the state-controlled Russian gas giant. For Western European consumers, a near-term alternative supplier is nonexistent. However, even before Putin decided to get involved in Crimea, Russia has seen a gradual deterioration in its economic fundamentals. Its current account surplus has dissipated rapidly and its trajectory for growth has faded as well. In light of the current political situation, most analysts believe the Russian economy will grow by less than 1% this year.1

Amid continued volatility, we believe that Russian risks will fade slowly and the ruble is likely to experience a modest depreciation. As for corporate bonds, the situation suggests that investors should gravitate to sectors and issuers that are strategically important and largely export focused. Sectors such as oil & gas, metals & mining and chemical issuers are neutral or positively disposed to a falling ruble, particularly against the euro. Corporations that are more domestically focused and derive a larger portion of their revenues in ruble will potentially come under pressure as their revenues depreciate relative to their foreign currency-denominated debt. To summarize, we prefer outward looking to inward looking, and strategically important to discretionary.

As investors continue to monitor developments in Russia, it is important to remember that a majority of EM corporate bonds are Euroclear eligible, custodied outside Russia and governed by U.S. or UK rule of law. Many of the well-known, export driven issuers have management teams that have weathered past bouts of volatility successfully. Ultimately, the essential question for credit investors is whether the companies have the ability and willingness to pay. For the patient investor, we believe they will.

1Source: Bloomberg, as of 03/20/14.

As investors, we continually assess risks on the basis of the likelihood of various potential scenarios. We see three scenarios emerging from current tensions.

• Uneasy Stability – Crimea is annexed, the West delivers a face-saving wrist slap, and tensions die down but don’t severely dent the economic interests of either side.

• Prolonged Chess Match – Tensions rise and fall but remain relatively elevated in the coming months. Some economic pain is experienced on both sides, as fundamentals particularly in Russia and Ukraine show further deterioration. The risk premium built into Russian assets fades slowly and the ruble depreciates as the Russian Central Bank partially reverses its temporary interest rate hike to support growth.

• Significant Escalation – The prospect that tensions escalate via further Russian incursions into Ukraine increases the potential for a policy mistake between the West and Russia. At present, this is the biggest risk that markets are trying to react to each day. The understanding that significant economic consequences are likely to result for both sides mitigates this risk. But there is some danger that economic considerations might be superseded by Russia’s desire for increased influence in the former Soviet republics.

In our view, the market is currently wrestling with uneasy stability and a prolonged chess match as the most likely options. Risk premiums are still high, but the risk of a full-scale military conflict has faded. While the West has said that more sanctions may be forthcoming, the U.S. and EU allies are struggling to impose meaningful punitive measures without threatening their own economic interests, particularly in Europe. As many analysts have noted, Europe receives 30% of its natural gas from Gazprom, the state-controlled Russian gas giant. For Western European consumers, a near-term alternative supplier is nonexistent. However, even before Putin decided to get involved in Crimea, Russia has seen a gradual deterioration in its economic fundamentals. Its current account surplus has dissipated rapidly and its trajectory for growth has faded as well. In light of the current political situation, most analysts believe the Russian economy will grow by less than 1% this year.1

Amid continued volatility, we believe that Russian risks will fade slowly and the ruble is likely to experience a modest depreciation. As for corporate bonds, the situation suggests that investors should gravitate to sectors and issuers that are strategically important and largely export focused. Sectors such as oil & gas, metals & mining and chemical issuers are neutral or positively disposed to a falling ruble, particularly against the euro. Corporations that are more domestically focused and derive a larger portion of their revenues in ruble will potentially come under pressure as their revenues depreciate relative to their foreign currency-denominated debt. To summarize, we prefer outward looking to inward looking, and strategically important to discretionary.

As investors continue to monitor developments in Russia, it is important to remember that a majority of EM corporate bonds are Euroclear eligible, custodied outside Russia and governed by U.S. or UK rule of law. Many of the well-known, export driven issuers have management teams that have weathered past bouts of volatility successfully. Ultimately, the essential question for credit investors is whether the companies have the ability and willingness to pay. For the patient investor, we believe they will.

1Source: Bloomberg, as of 03/20/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Russia, Crimea and Ukraine are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.