Europe’s Earnings Cycle Just Getting Started

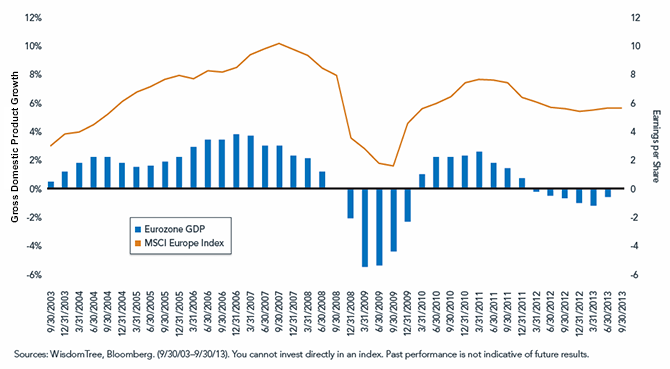

• Earnings Cycle Just Getting Started – It is important to remember that Europe’s economy is just starting to show signs of growth, and this recovery has not shown up in the earnings of corporations yet—at least on a trailing 12-month basis. Generally speaking, if an index has a lower estimated price-to-earnings (P/E) ratio compared to its trailing P/E ratio, the forecast is calling for earnings growth. This pickup in earnings expectations for the MSCI Europe Index can be witnessed in the difference between the estimated and trailing 12-month P/E ratios of 19.6x and 14.6x, respectively. But trailing 12-month earnings for MSCI Europe would have to grow approximately 80% to reach the highs of 2007, and grow around 35% to reach the most recent highs of 2011. Putting this in perspective, both the S&P 500 and MSCI Emerging Market indexes have already surpassed their pre-recession earnings highs.

• Economic Growth Expected to Turn Positive – The most recent quarter-over-quarter gross domestic product (GDP) print was positive 0.3%, and it marked the first positive growth in six quarters, but the year-over-year change was still negative 0.6%1. Since the second-quarter GDP reading, there have been improvements in the Purchasing Managers’ Index (PMI), with multiple readings above 50, typically a sign of economic expansion. As a result, many economists are forecasting the eurozone to return to positive economic growth early next year. A positive economic growth environment could be expected to flow through to better growth in earnings.

Small Caps for Recovery

If one believes Europe is recovering, I’d encourage a look at small-cap companies, which are more sensitive to trends in the economy because of their cyclical exposure and are typically more highly leveraged to economic growth. In other words, small caps often have higher beta—or market reactions—to both the ups and downs in the markets. As I previously wrote here, European small caps have outpaced large caps year-to-date, and some of the outperformance can be attributed to a stronger euro hurting the large-cap exporters. Small caps are more domestically sensitive, deriving more of their revenues from a particular region than their large-cap compatriots, which allows them to sidestep the drawbacks of the currency strength.

WisdomTree has designed the WisdomTree Europe SmallCap Dividend Index to focus solely on small-cap dividend-paying equities in Europe. To learn more, click here.

Read the full research here.

1As of 06/30/2013.

• Earnings Cycle Just Getting Started – It is important to remember that Europe’s economy is just starting to show signs of growth, and this recovery has not shown up in the earnings of corporations yet—at least on a trailing 12-month basis. Generally speaking, if an index has a lower estimated price-to-earnings (P/E) ratio compared to its trailing P/E ratio, the forecast is calling for earnings growth. This pickup in earnings expectations for the MSCI Europe Index can be witnessed in the difference between the estimated and trailing 12-month P/E ratios of 19.6x and 14.6x, respectively. But trailing 12-month earnings for MSCI Europe would have to grow approximately 80% to reach the highs of 2007, and grow around 35% to reach the most recent highs of 2011. Putting this in perspective, both the S&P 500 and MSCI Emerging Market indexes have already surpassed their pre-recession earnings highs.

• Economic Growth Expected to Turn Positive – The most recent quarter-over-quarter gross domestic product (GDP) print was positive 0.3%, and it marked the first positive growth in six quarters, but the year-over-year change was still negative 0.6%1. Since the second-quarter GDP reading, there have been improvements in the Purchasing Managers’ Index (PMI), with multiple readings above 50, typically a sign of economic expansion. As a result, many economists are forecasting the eurozone to return to positive economic growth early next year. A positive economic growth environment could be expected to flow through to better growth in earnings.

Small Caps for Recovery

If one believes Europe is recovering, I’d encourage a look at small-cap companies, which are more sensitive to trends in the economy because of their cyclical exposure and are typically more highly leveraged to economic growth. In other words, small caps often have higher beta—or market reactions—to both the ups and downs in the markets. As I previously wrote here, European small caps have outpaced large caps year-to-date, and some of the outperformance can be attributed to a stronger euro hurting the large-cap exporters. Small caps are more domestically sensitive, deriving more of their revenues from a particular region than their large-cap compatriots, which allows them to sidestep the drawbacks of the currency strength.

WisdomTree has designed the WisdomTree Europe SmallCap Dividend Index to focus solely on small-cap dividend-paying equities in Europe. To learn more, click here.

Read the full research here.

1As of 06/30/2013.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.