Equities: Identifying the Best Opportunities on Earnings Yield Basis

For definitions of indexes in the chart, please visit our Glossary.

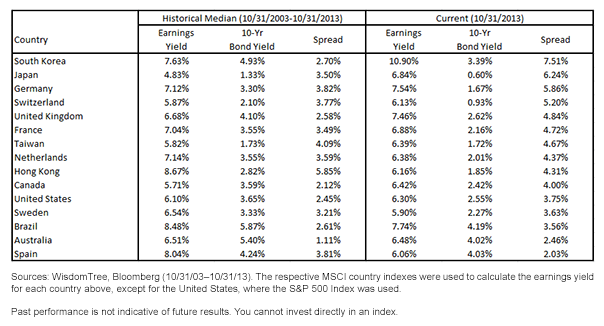

• South Korea Had Highest Earnings Yield – With an earnings yield over 10%, South Korea had the highest earning yield and the highest spread of all the countries listed above. It is also impressive that the current spread is almost three times larger than its own 10-year historical median spread. The equities are currently selling at lower valuations (higher earnings yield), and the bonds at higher valuations (lower yield), compared to their own history. For those looking to accentuate a focus on the earnings yield as a potential indicator of a valuation opportunity for South Korean firms, an earnings-weighted approach could be of particular interest when considering different ways to build an Index of these stocks.

• Japan Offers Attractive Spread – After so many years of deflation and bear markets, it is not surprising that Japanese citizens’ stockpiles of cash have driven government bond yields to such low levels, but I feel the sentiment is starting to change. Japanese households cannot be expected to shift into equities overnight, but as inflation expectations increase, they should start to view the much higher earnings yield offered by equities as a viable option. One possible incentive beside valuations are the newly created Nippon Individual Savings Accounts (NISA) , which allow Japanese citizens to invest up to 1 million yen per year for at least five years, free of capital gains and dividend taxes. These accounts were designed to encourage risk taking, so government bonds are not eligible for purchase in these accounts. At the end of the day, we believe that equities are attractive due to their potential earnings growth, and with the depreciation of the Japanese yen, this explosive earnings growth is particularly evident amongst exporters.

• Germany and the United Kingdom Round Out Five – Two of the largest European economies, Germany and the United Kingdom, currently have a higher earnings yield than most of their global peers. Compared to the United States, each has an earnings yield advantage of over 1%, and their current spread is 2% and 1%, respectively, higher than the U.S. With both countries being among the top economies for the European region, it is interesting they also have some of the lowest current valuations compared to U.S. and global peers. We feel this further confirms that there is opportunity in Europe. And for those looking to maintain diversification, it is important to recognize that many German and British firms are global in nature—meaning their revenues come from all different regions of the world.

Continued Rotation Back into Equities

Since the financial crisis, global interest rates around the world have remained low, ultimately driving down bond yields. Now that growth has stabilized and expectations are beginning to increase, investors are looking for options outside of fixed income to potentially participate in this growth. Unlike fixed income, which by definition offers a fixed payment of interest over time and no growth potential, equities have the potential to see earnings or dividends grow over time. I would point investors looking for equity exposure to countries with higher earnings yields compared to their historical medians and also toward countries with high earnings yield spreads.

1Excluding China.

For definitions of indexes in the chart, please visit our Glossary.

• South Korea Had Highest Earnings Yield – With an earnings yield over 10%, South Korea had the highest earning yield and the highest spread of all the countries listed above. It is also impressive that the current spread is almost three times larger than its own 10-year historical median spread. The equities are currently selling at lower valuations (higher earnings yield), and the bonds at higher valuations (lower yield), compared to their own history. For those looking to accentuate a focus on the earnings yield as a potential indicator of a valuation opportunity for South Korean firms, an earnings-weighted approach could be of particular interest when considering different ways to build an Index of these stocks.

• Japan Offers Attractive Spread – After so many years of deflation and bear markets, it is not surprising that Japanese citizens’ stockpiles of cash have driven government bond yields to such low levels, but I feel the sentiment is starting to change. Japanese households cannot be expected to shift into equities overnight, but as inflation expectations increase, they should start to view the much higher earnings yield offered by equities as a viable option. One possible incentive beside valuations are the newly created Nippon Individual Savings Accounts (NISA) , which allow Japanese citizens to invest up to 1 million yen per year for at least five years, free of capital gains and dividend taxes. These accounts were designed to encourage risk taking, so government bonds are not eligible for purchase in these accounts. At the end of the day, we believe that equities are attractive due to their potential earnings growth, and with the depreciation of the Japanese yen, this explosive earnings growth is particularly evident amongst exporters.

• Germany and the United Kingdom Round Out Five – Two of the largest European economies, Germany and the United Kingdom, currently have a higher earnings yield than most of their global peers. Compared to the United States, each has an earnings yield advantage of over 1%, and their current spread is 2% and 1%, respectively, higher than the U.S. With both countries being among the top economies for the European region, it is interesting they also have some of the lowest current valuations compared to U.S. and global peers. We feel this further confirms that there is opportunity in Europe. And for those looking to maintain diversification, it is important to recognize that many German and British firms are global in nature—meaning their revenues come from all different regions of the world.

Continued Rotation Back into Equities

Since the financial crisis, global interest rates around the world have remained low, ultimately driving down bond yields. Now that growth has stabilized and expectations are beginning to increase, investors are looking for options outside of fixed income to potentially participate in this growth. Unlike fixed income, which by definition offers a fixed payment of interest over time and no growth potential, equities have the potential to see earnings or dividends grow over time. I would point investors looking for equity exposure to countries with higher earnings yields compared to their historical medians and also toward countries with high earnings yield spreads.

1Excluding China.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.