Corporate Versus Government Debt in Emerging Markets

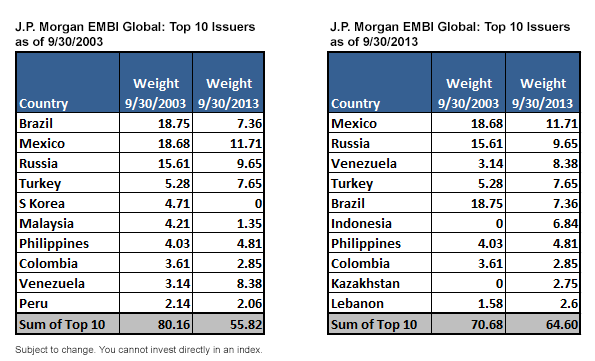

As shown in the table above, 10 years ago, the investable universe was dominated by Brazil, Mexico and Russia. Today, the index has become much broader, but is comprised of emerging economies that have much shorter borrowing histories and lower credit ratings. In our view, although more countries are currently represented in the index, smaller, more questionable issuers have risen in prominence relative to larger economies. For example, Venezuela is now the third-largest issuer in the index. This ranks them just behind Russia, a drastically different economy and risk profile. Given the broadening of the index, returns and yields are increasingly being influenced by smaller issuers. For many investors seeking to increase exposure to emerging markets, they generally tend to think about the larger, more widely followed economies, as opposed to the smaller, less established countries. In its current form, the top 10 issuers now account for only approximately two-thirds of the weight of the index.

Determinants of Interest Rates

Bond yields seek to compensate investors in a variety of ways. In an effort to pinpoint the potential drivers of return, we thought it might be helpful to decompose a bond’s yield into its various components:

1) Nominal Interest Rates – Perhaps the largest contributor of yield, this portion of a bond’s return seeks to compensate investors for the time value of money; it’s essentially compensation for taking interest rate risk.

2) Credit Spread – The additional income in excess of nominal interest rates that lenders demand for the risk that they may not be paid back.

3) Transfer Risk – Technically, this could be a portion of the credit spread, but by identifying it separately, we are able to compare the emerging market “premium” to similarly positioned businesses headquartered in developed markets.

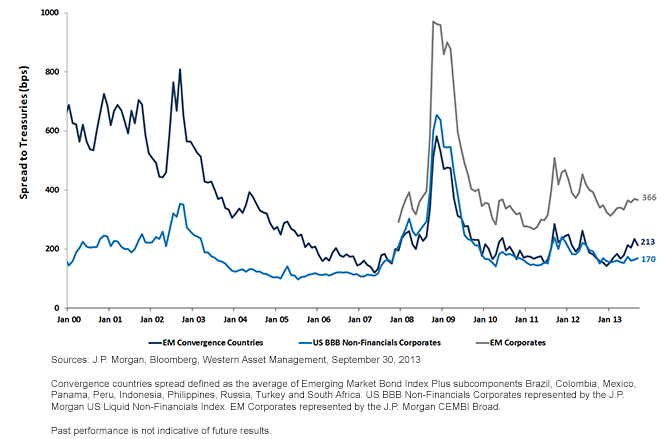

Relative Credit Spreads Between U.S. Corporates, EM Corporates, & EM Government Debt

As shown in the table above, 10 years ago, the investable universe was dominated by Brazil, Mexico and Russia. Today, the index has become much broader, but is comprised of emerging economies that have much shorter borrowing histories and lower credit ratings. In our view, although more countries are currently represented in the index, smaller, more questionable issuers have risen in prominence relative to larger economies. For example, Venezuela is now the third-largest issuer in the index. This ranks them just behind Russia, a drastically different economy and risk profile. Given the broadening of the index, returns and yields are increasingly being influenced by smaller issuers. For many investors seeking to increase exposure to emerging markets, they generally tend to think about the larger, more widely followed economies, as opposed to the smaller, less established countries. In its current form, the top 10 issuers now account for only approximately two-thirds of the weight of the index.

Determinants of Interest Rates

Bond yields seek to compensate investors in a variety of ways. In an effort to pinpoint the potential drivers of return, we thought it might be helpful to decompose a bond’s yield into its various components:

1) Nominal Interest Rates – Perhaps the largest contributor of yield, this portion of a bond’s return seeks to compensate investors for the time value of money; it’s essentially compensation for taking interest rate risk.

2) Credit Spread – The additional income in excess of nominal interest rates that lenders demand for the risk that they may not be paid back.

3) Transfer Risk – Technically, this could be a portion of the credit spread, but by identifying it separately, we are able to compare the emerging market “premium” to similarly positioned businesses headquartered in developed markets.

Relative Credit Spreads Between U.S. Corporates, EM Corporates, & EM Government Debt

Managing Risk

Emerging market investing is certainly not without risks. Even though emerging market corporate bonds have exhibited approximately half as much volatility as emerging market equities over the last five years, unforeseen events can and do occur. Ultimately, we believe that at current levels, emerging market corporate bonds provide investors with enough compensation relative to emerging market government debt for the potential risks.

1A principal risk is of issuing debt in a foreign currency is referred to as “original sin”. This term was made famous by economist Barry Eichengreen due to the inherent asset-liability mismatch from issuing debt in a foreign currency (assets are denominated in local currency, but liabilities are denominated in a foreign currency). The thinking goes that as the country comes under economic stress, the value of the its own currency is likely to decline. As its currency declines, the country’s debt burden is actually increasing in foreign currency terms at precisely the same time that it is less likely to be able to repay it.

2As represented by the JPMorgan EMBI Global.

3Source: J.P. Morgan, 9/30/13.

Managing Risk

Emerging market investing is certainly not without risks. Even though emerging market corporate bonds have exhibited approximately half as much volatility as emerging market equities over the last five years, unforeseen events can and do occur. Ultimately, we believe that at current levels, emerging market corporate bonds provide investors with enough compensation relative to emerging market government debt for the potential risks.

1A principal risk is of issuing debt in a foreign currency is referred to as “original sin”. This term was made famous by economist Barry Eichengreen due to the inherent asset-liability mismatch from issuing debt in a foreign currency (assets are denominated in local currency, but liabilities are denominated in a foreign currency). The thinking goes that as the country comes under economic stress, the value of the its own currency is likely to decline. As its currency declines, the country’s debt burden is actually increasing in foreign currency terms at precisely the same time that it is less likely to be able to repay it.

2As represented by the JPMorgan EMBI Global.

3Source: J.P. Morgan, 9/30/13.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.