Japan vs. South Korea: What Should Investors Consider

For current holdings of the WisdomTree Japan Hedged Equity Index, please click here.

For current holdings of the WisdomTree Korea Hedged Equity Index, please click here.

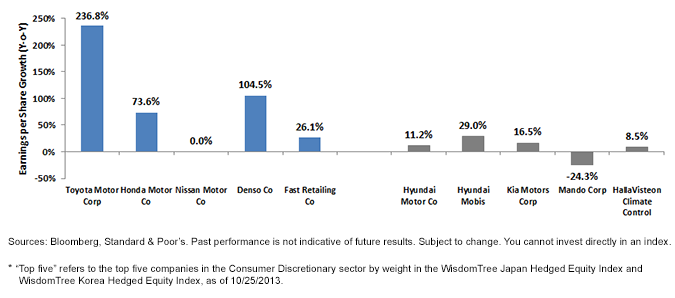

• The top five Japanese consumer discretionary companies have recorded an average EPS growth of 88.2% on a year-over-year basis, with a range of 0% to 236.8%.

• In comparison, the top five Korean consumer discretionary companies recorded a much lower average EPS growth of 8.2% on a year-over-year basis, with a range of -24.3% to 29%.

Below are a few anecdotes that speak to the change in the competitive landscapes of major Korean and Japanese exporters:

• Hyundai vs. Toyota:

Given that Hyundai earns over 50% of its revenue outside South Korea, sells 87% of its vehicles abroad and ships auto parts to facilities internationally, a Hyundai executive has recently named the simultaneous weakness of the yen accompanied by won appreciation “…a double torture situation.”7 Hyundai estimates that its balance sheet sensitivity to a 5% appreciation in the Korean won sets it back by approximately 32 billion won.8

Meanwhile, Toyota Motor Corporation (TMC) in its latest quarterly earnings release reported a net revenue increase of 13.7% and a 93.6% net income increase from ¥290 billion to ¥562 billion from one year ago. TMC’s managing officer Takuo Sasaki attributed the company’s operating income increase in part to “…the impact of foreign exchange rates and our global efforts for profit improvement, through cost reduction activities such as companywide value analysis…”9

To be more precise, TMC attributed ¥260 of its ¥271.8 billion net income increase (95% of total) to effects of foreign exchange (forex) rates or yen depreciation against most of its trading partners.

• Samsung Electronics vs. Sony:

With over 85% of Samsung’s total revenue coming from abroad, the company suffered approximately 350 billion won in foreign exchange losses in the fourth quarter of last year.10 Further, Samsung estimates that the yen will cost it as much as 3 trillion won in 2013—estimates are that the firm lost 1.2 trillion won based on foreign exchange fluctuations in 2012.11

Sony on the other hand, has seen 3.5 billion yen in net income for the second quarter of 2013—a number that beat expectations of 2.6 billion yen over this period.12

While currency isn’t the only factor in the competitive mix, it can be an important headwind for South Korean exporters and a tailwind for Japanese exporters. If Abenomics continues to lead to further yen weakness, South Korea could have to respond in ways to weaken its currency to improve its export competitiveness. If Abenomics falters, these South Korean firms—many of which make very similar products as their Japanese counterparts—could be in a prime position to benefit as the winds of currency performance shift.

1Source: World Bank, 2012.

2Source: Korean International Trade Association, 2012.

3Source: World Bank, 2012.

4Cynthia Kim, “South Korea’s Hyun Says Yen Bigger Issue Than North Korea,” Bloomberg, April 19, 2013.

5Source: Bloomberg, as of 10/25/13.

6Computations based on the change in trailing 12-month earnings per share from 9/30/2012 to 9/30/2013.

7Investor Campus, 9/25/13.

8Hyundai Consolidated Financial Statements, 6/30/13.

8Toyota Motor Corporation Quarterly Financial Report 8/2/13.

10Source: Samsung IR Presentations, Annual Report 2013.

11Source: Kim Yoo-chul, “Samsung Expects Forex Losses to Reach W3 Tril. in 2013,” The Korea Times, 5/12/13.

12Source: Bloomberg, “Sony Rides Weak Yen to Beat Profit Estimates,” The Japan Times, 8/1/13.

For current holdings of the WisdomTree Japan Hedged Equity Index, please click here.

For current holdings of the WisdomTree Korea Hedged Equity Index, please click here.

• The top five Japanese consumer discretionary companies have recorded an average EPS growth of 88.2% on a year-over-year basis, with a range of 0% to 236.8%.

• In comparison, the top five Korean consumer discretionary companies recorded a much lower average EPS growth of 8.2% on a year-over-year basis, with a range of -24.3% to 29%.

Below are a few anecdotes that speak to the change in the competitive landscapes of major Korean and Japanese exporters:

• Hyundai vs. Toyota:

Given that Hyundai earns over 50% of its revenue outside South Korea, sells 87% of its vehicles abroad and ships auto parts to facilities internationally, a Hyundai executive has recently named the simultaneous weakness of the yen accompanied by won appreciation “…a double torture situation.”7 Hyundai estimates that its balance sheet sensitivity to a 5% appreciation in the Korean won sets it back by approximately 32 billion won.8

Meanwhile, Toyota Motor Corporation (TMC) in its latest quarterly earnings release reported a net revenue increase of 13.7% and a 93.6% net income increase from ¥290 billion to ¥562 billion from one year ago. TMC’s managing officer Takuo Sasaki attributed the company’s operating income increase in part to “…the impact of foreign exchange rates and our global efforts for profit improvement, through cost reduction activities such as companywide value analysis…”9

To be more precise, TMC attributed ¥260 of its ¥271.8 billion net income increase (95% of total) to effects of foreign exchange (forex) rates or yen depreciation against most of its trading partners.

• Samsung Electronics vs. Sony:

With over 85% of Samsung’s total revenue coming from abroad, the company suffered approximately 350 billion won in foreign exchange losses in the fourth quarter of last year.10 Further, Samsung estimates that the yen will cost it as much as 3 trillion won in 2013—estimates are that the firm lost 1.2 trillion won based on foreign exchange fluctuations in 2012.11

Sony on the other hand, has seen 3.5 billion yen in net income for the second quarter of 2013—a number that beat expectations of 2.6 billion yen over this period.12

While currency isn’t the only factor in the competitive mix, it can be an important headwind for South Korean exporters and a tailwind for Japanese exporters. If Abenomics continues to lead to further yen weakness, South Korea could have to respond in ways to weaken its currency to improve its export competitiveness. If Abenomics falters, these South Korean firms—many of which make very similar products as their Japanese counterparts—could be in a prime position to benefit as the winds of currency performance shift.

1Source: World Bank, 2012.

2Source: Korean International Trade Association, 2012.

3Source: World Bank, 2012.

4Cynthia Kim, “South Korea’s Hyun Says Yen Bigger Issue Than North Korea,” Bloomberg, April 19, 2013.

5Source: Bloomberg, as of 10/25/13.

6Computations based on the change in trailing 12-month earnings per share from 9/30/2012 to 9/30/2013.

7Investor Campus, 9/25/13.

8Hyundai Consolidated Financial Statements, 6/30/13.

8Toyota Motor Corporation Quarterly Financial Report 8/2/13.

10Source: Samsung IR Presentations, Annual Report 2013.

11Source: Kim Yoo-chul, “Samsung Expects Forex Losses to Reach W3 Tril. in 2013,” The Korea Times, 5/12/13.

12Source: Bloomberg, “Sony Rides Weak Yen to Beat Profit Estimates,” The Japan Times, 8/1/13.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.