Global Small Caps Deliver Strong Returns: Will Your Index Rebalance?

For definitions of indexes in the charts, please visit our Glossary.

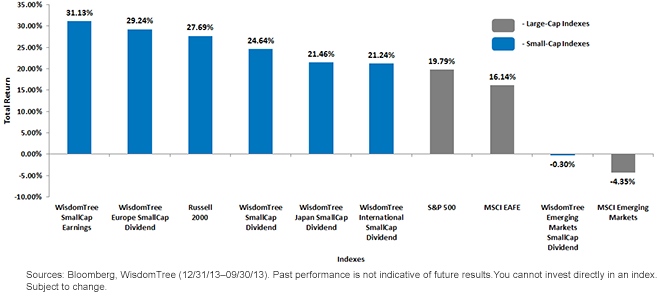

• Small Caps Outperformed Large Caps – All but one of the small-cap indexes above outperformed domestic, international and emerging market large-cap indexes mentioned. The chart illustrates the importance of looking beyond the large-cap market. The Russell 2000 Index, a market barometer for small caps, outperformed the S&P 500, MSCI EAFE and MSCI EM indexes by 7.90%, 11.55% and 32.04%, respectively.

• WisdomTree SmallCap Earnings Index – This was the best performer over the reviewed period, outperforming the Russell 2000 Index by 3.44%. The WisdomTree SmallCap Earnings Index includes only companies that demonstrate a prior four quarters of cumulative positive earnings and then weights those companies based on their relative earnings. On the other hand, the Russell 2000 Index is weighted by market capitalization and may include companies that are not profitable. After such strong performance in small-cap stocks, we believe a focus on a disciplined rebalancing process gains significant importance.

• International Small-Cap Strategies Also Leading Large Caps – Both in the developed international and the emerging markets, small-cap indexes are outperforming their large-cap peers, as demonstrated by the WisdomTree International SmallCap Dividend Index leading the MSCI EAFE by over 5 percentage points and the WisdomTree Emerging Markets SmallCap Dividend Index leading the MSCI Emerging Markets Index by over 4 percentage points.

• Looking Abroad to Diversify Small Caps – Many investors incorporate small-cap strategies for the United States as part of their portfolio but have yet to expand these allocations internationally. The relatively strong returns in the United States may indicate a useful time to diversify some of the U.S. small caps to some of the foreign small-cap indexes, such as the emerging markets, that have not experienced such large gains.

The Importance of Valuations

From a valuation standpoint, we think it is important to be mindful of the strong performance these indexes have displayed and what that means for current portfolio allocations. With market capitalization-weighted indexes, when constituents increase in price compared to other stocks, they are gaining a greater weight and impact on the performance of the index. At WisdomTree, we believe a focus on fundamentals is necessary, but that it is even more important after periods of such strong short-term performance.

WisdomTree Indexes employ a rules-based rebalancing mechanism that adjusts relative weights based on underlying fundamentals. During the rebalancing process, which occurs once per year for each Index, the relationship between share price performance and either dividend growth or earnings growth is measured.

• Firms that increased their earnings or dividends but whose share prices have remained constant or declined will typically see increases in weights.

• Firms whose earnings or dividends decreased but whose share prices have remained constant or risen will typically see decreases in weights.

Conclusion

Adding exposure to small caps can offer increased diversification and return potential, but there are critical differences in investment strategies. In our opinion, a rules-based approach that focuses and rebalances based on underlying fundamentals may enable investors to better capitalize on the small-cap segment, especially given the large performance run small caps have experienced recently.

Read the full research here.

For definitions of indexes in the charts, please visit our Glossary.

• Small Caps Outperformed Large Caps – All but one of the small-cap indexes above outperformed domestic, international and emerging market large-cap indexes mentioned. The chart illustrates the importance of looking beyond the large-cap market. The Russell 2000 Index, a market barometer for small caps, outperformed the S&P 500, MSCI EAFE and MSCI EM indexes by 7.90%, 11.55% and 32.04%, respectively.

• WisdomTree SmallCap Earnings Index – This was the best performer over the reviewed period, outperforming the Russell 2000 Index by 3.44%. The WisdomTree SmallCap Earnings Index includes only companies that demonstrate a prior four quarters of cumulative positive earnings and then weights those companies based on their relative earnings. On the other hand, the Russell 2000 Index is weighted by market capitalization and may include companies that are not profitable. After such strong performance in small-cap stocks, we believe a focus on a disciplined rebalancing process gains significant importance.

• International Small-Cap Strategies Also Leading Large Caps – Both in the developed international and the emerging markets, small-cap indexes are outperforming their large-cap peers, as demonstrated by the WisdomTree International SmallCap Dividend Index leading the MSCI EAFE by over 5 percentage points and the WisdomTree Emerging Markets SmallCap Dividend Index leading the MSCI Emerging Markets Index by over 4 percentage points.

• Looking Abroad to Diversify Small Caps – Many investors incorporate small-cap strategies for the United States as part of their portfolio but have yet to expand these allocations internationally. The relatively strong returns in the United States may indicate a useful time to diversify some of the U.S. small caps to some of the foreign small-cap indexes, such as the emerging markets, that have not experienced such large gains.

The Importance of Valuations

From a valuation standpoint, we think it is important to be mindful of the strong performance these indexes have displayed and what that means for current portfolio allocations. With market capitalization-weighted indexes, when constituents increase in price compared to other stocks, they are gaining a greater weight and impact on the performance of the index. At WisdomTree, we believe a focus on fundamentals is necessary, but that it is even more important after periods of such strong short-term performance.

WisdomTree Indexes employ a rules-based rebalancing mechanism that adjusts relative weights based on underlying fundamentals. During the rebalancing process, which occurs once per year for each Index, the relationship between share price performance and either dividend growth or earnings growth is measured.

• Firms that increased their earnings or dividends but whose share prices have remained constant or declined will typically see increases in weights.

• Firms whose earnings or dividends decreased but whose share prices have remained constant or risen will typically see decreases in weights.

Conclusion

Adding exposure to small caps can offer increased diversification and return potential, but there are critical differences in investment strategies. In our opinion, a rules-based approach that focuses and rebalances based on underlying fundamentals may enable investors to better capitalize on the small-cap segment, especially given the large performance run small caps have experienced recently.

Read the full research here.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Diversification does not eliminate the risk of experiencing investment losses. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.