Sector Sensitivity to Rising Rates

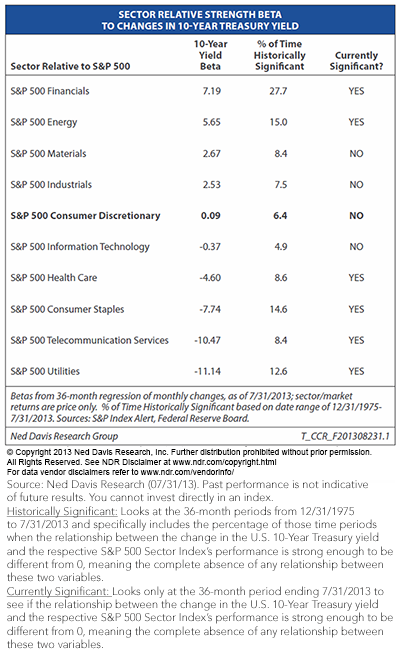

• Defensive Sectors Show Negative Relationship to Rising Yields – All of the defensive sectors displayed a negative relationship to rising yields, as shown through the 10-year yield beta metric. The Utilities and Telecommunication Services sectors showed the highest negative sensitivity over the period. Now, past performance does not guarantee future results, but if this relationship holds, you might expect these sectors to underperform the S&P 500 Index during a rising rate environment.

• Cyclical Sectors Show Positive Sensitivity to Rising Yields – Most of the cyclical sectors displayed a positive relationship to rising yields, as shown through the 10-year yield beta metric. The Financials and Energy sectors showed the highest positive sensitivity over the period. If this relationship were to hold, you might expect these sectors to outperform the S&P 500 Index during a rising rate environment.

S&P 500 Sector Performance

In the same market insight, I looked at the performance of the S&P 500 sectors over the most recent period of rising Treasury yields, from April 30 to August 20, 2013. This period was chosen because it exhibited a steady rise in the 10-Year Treasury yield, from 1.63% to 2.81%. Although the above research from Ned Davis looked at the relative sector performance over the past 36 months, we found similar results.

• The three sectors with the highest negative yield beta (Consumer Staples, Utilities and Telecommunications) were the three worst-performing sectors over the period. These sectors also exhibited the highest dividend yields over the period.

• Sectors with higher earnings growth expectations (and lower dividend yields) were in the upper part of the performance spectrum. Typically, these sectors fall into the cyclically sensitive category and perform well when the economy is expanding.

Conclusion and WisdomTree Solutions

The recent spike in Treasury yields has caused a reevaluation of many equity strategies and an underperformance for the sectors with the highest dividend yields—typically Utilities and Telecommunication sectors. Investors should potentially look to the higher-growing and lower-yielding sectors in order to lower their portfolios’ sensitivity to potential further increases in Treasury yields.

WisdomTree has launched a family of dividend growth-oriented ETFs that include a Fund each for U.S. large caps and U.S. small caps, and we believe they are particularly well suited for a rising interest rate environment, as they tend to be more cyclically exposed and less exposed to Telecommunication and Utilities (which typically are higher-yield sectors and less dividend growth oriented).

For more information on these new ETFs, please see:

1) Large Caps: WisdomTree U.S. Dividend Growth ETF (DGRW)

2) Small Caps: WisdomTree U.S. SmallCap Dividend Growth ETF (DGRS)

• Defensive Sectors Show Negative Relationship to Rising Yields – All of the defensive sectors displayed a negative relationship to rising yields, as shown through the 10-year yield beta metric. The Utilities and Telecommunication Services sectors showed the highest negative sensitivity over the period. Now, past performance does not guarantee future results, but if this relationship holds, you might expect these sectors to underperform the S&P 500 Index during a rising rate environment.

• Cyclical Sectors Show Positive Sensitivity to Rising Yields – Most of the cyclical sectors displayed a positive relationship to rising yields, as shown through the 10-year yield beta metric. The Financials and Energy sectors showed the highest positive sensitivity over the period. If this relationship were to hold, you might expect these sectors to outperform the S&P 500 Index during a rising rate environment.

S&P 500 Sector Performance

In the same market insight, I looked at the performance of the S&P 500 sectors over the most recent period of rising Treasury yields, from April 30 to August 20, 2013. This period was chosen because it exhibited a steady rise in the 10-Year Treasury yield, from 1.63% to 2.81%. Although the above research from Ned Davis looked at the relative sector performance over the past 36 months, we found similar results.

• The three sectors with the highest negative yield beta (Consumer Staples, Utilities and Telecommunications) were the three worst-performing sectors over the period. These sectors also exhibited the highest dividend yields over the period.

• Sectors with higher earnings growth expectations (and lower dividend yields) were in the upper part of the performance spectrum. Typically, these sectors fall into the cyclically sensitive category and perform well when the economy is expanding.

Conclusion and WisdomTree Solutions

The recent spike in Treasury yields has caused a reevaluation of many equity strategies and an underperformance for the sectors with the highest dividend yields—typically Utilities and Telecommunication sectors. Investors should potentially look to the higher-growing and lower-yielding sectors in order to lower their portfolios’ sensitivity to potential further increases in Treasury yields.

WisdomTree has launched a family of dividend growth-oriented ETFs that include a Fund each for U.S. large caps and U.S. small caps, and we believe they are particularly well suited for a rising interest rate environment, as they tend to be more cyclically exposed and less exposed to Telecommunication and Utilities (which typically are higher-yield sectors and less dividend growth oriented).

For more information on these new ETFs, please see:

1) Large Caps: WisdomTree U.S. Dividend Growth ETF (DGRW)

2) Small Caps: WisdomTree U.S. SmallCap Dividend Growth ETF (DGRS)Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Past performance is not indicative of future results. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in fund shares. Such fees, expenses and commissions could reduce returns. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on single sectors/and or small companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Funds’ prospectus for specific details regarding the Funds’ risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.