What to Do with Huge Gains in Mid Caps?

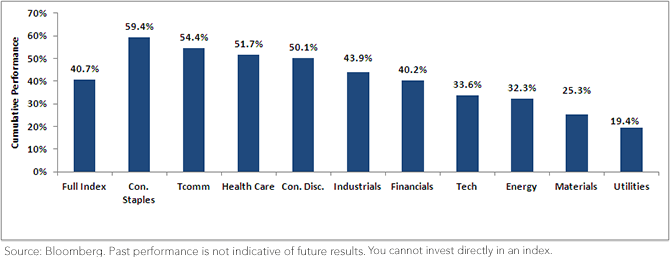

What we see (in this case on a sector basis) is that WTMEI delivered a greater than 40% return over the period, with strong returns spread across all 10 sectors.

• 50% Sectors: Consumer Staples, Telecommunication Services, Health Care and Consumer Discretionary led the way within WTMEI as the sectors with greater than 50% cumulative returns.

So, strong performance is well and good, but a potential issue with the traditional market capitalization-weighted indexes is that they simply hold what has run up in price instead of rebalancing based on any metric of relative value. In essence, there is no mechanism employed with a disciplined regularity that attempts to shift weight from what has performed strongly in the past to what may have potential to perform strongly in the future.

How WTMEI Delivers a Disciplined Rebalancing Process

Every year on November 30, WisdomTree runs a screen upon which a subsequent rebalance of WTMEI is based. The purpose of this screening and rebalancing process is simple:

• Looking to trim weight from stock positions whose prices have appreciated significantly but whose fundamentals may not have increased commensurately.

• Looking to add weight to stock positions whose prices have stagnated or even fallen but whose fundamentals may have actually exhibited positive growth.

It is in this way that WisdomTree looks to mitigate the risk of being exposed to firms that may have enjoyed strong momentum and price increases but whose price levels may be at a relatively higher risk of being classified as “expensive.”

Same Process as WTSEI

Some readers may be thinking that this synopsis of the Index methodology employed for WTMEI seems eerily similar to that of WTSEI, which we wrote about in a prior blog. Apart from their focus on a different size segment of the market capitalization spectrum, the approaches taken for the two Indexes are in fact exactly the same. This is worth noting, first because there may be some investors for whom the WTSEI process sounded interesting, and we’d like to also draw their attention to WTMEI. Second, many market participants may come to the table with strong opinions about how they like to focus on large-cap or small-cap stocks, but they may pay less attention to mid caps, so this could be a way to draw their focus to this size segment of the market.

Continual Focus on the Earnings Stream

Mechanically, WTMEI’s rebalancing process is based on the Earnings Stream (just as it is for WTSEI), which, simply put, is derived from a firm’s earnings per share multiplied by its number of shares outstanding. This ends up being much different than the process employed by market capitalization-weighted indexes, where the weights are determined by multiplying share price with the number of shares outstanding. In essence:

• WTMEI “rewards” (with greater weights) the firms that have generated the greatest levels of earnings.

• A market capitalization-weighted index “rewards” the firms with the greatest market capitalizations, which in many cases ends up being the firms whose share prices have increased the most.

Perhaps the most interesting element of WTMEI’s rebalance is the fact that each and every year companies must demonstrate profitability to maintain their eligibility for inclusion. Put another way; firms that on the screening date cannot demonstrate a prior four quarters of cumulative positive earnings are excluded from the Index.

Conclusion

After such strong performance in U.S. mid-cap stocks, we believe a focus on a disciplined rebalancing process gains significant importance. While market capitalization-weighted indexes may simply continue giving the greatest weights to the firms with the largest market caps, WTMEI focuses on fundamentals, specifically the Earnings Stream, to determine its constituent weights. We believe this gives WTMEI the potential to sell stocks that have become more expensive and buy stocks that have become less expensive relative to the earnings they have generated. In essence, this could be one way to manage risk after a market rally.

What we see (in this case on a sector basis) is that WTMEI delivered a greater than 40% return over the period, with strong returns spread across all 10 sectors.

• 50% Sectors: Consumer Staples, Telecommunication Services, Health Care and Consumer Discretionary led the way within WTMEI as the sectors with greater than 50% cumulative returns.

So, strong performance is well and good, but a potential issue with the traditional market capitalization-weighted indexes is that they simply hold what has run up in price instead of rebalancing based on any metric of relative value. In essence, there is no mechanism employed with a disciplined regularity that attempts to shift weight from what has performed strongly in the past to what may have potential to perform strongly in the future.

How WTMEI Delivers a Disciplined Rebalancing Process

Every year on November 30, WisdomTree runs a screen upon which a subsequent rebalance of WTMEI is based. The purpose of this screening and rebalancing process is simple:

• Looking to trim weight from stock positions whose prices have appreciated significantly but whose fundamentals may not have increased commensurately.

• Looking to add weight to stock positions whose prices have stagnated or even fallen but whose fundamentals may have actually exhibited positive growth.

It is in this way that WisdomTree looks to mitigate the risk of being exposed to firms that may have enjoyed strong momentum and price increases but whose price levels may be at a relatively higher risk of being classified as “expensive.”

Same Process as WTSEI

Some readers may be thinking that this synopsis of the Index methodology employed for WTMEI seems eerily similar to that of WTSEI, which we wrote about in a prior blog. Apart from their focus on a different size segment of the market capitalization spectrum, the approaches taken for the two Indexes are in fact exactly the same. This is worth noting, first because there may be some investors for whom the WTSEI process sounded interesting, and we’d like to also draw their attention to WTMEI. Second, many market participants may come to the table with strong opinions about how they like to focus on large-cap or small-cap stocks, but they may pay less attention to mid caps, so this could be a way to draw their focus to this size segment of the market.

Continual Focus on the Earnings Stream

Mechanically, WTMEI’s rebalancing process is based on the Earnings Stream (just as it is for WTSEI), which, simply put, is derived from a firm’s earnings per share multiplied by its number of shares outstanding. This ends up being much different than the process employed by market capitalization-weighted indexes, where the weights are determined by multiplying share price with the number of shares outstanding. In essence:

• WTMEI “rewards” (with greater weights) the firms that have generated the greatest levels of earnings.

• A market capitalization-weighted index “rewards” the firms with the greatest market capitalizations, which in many cases ends up being the firms whose share prices have increased the most.

Perhaps the most interesting element of WTMEI’s rebalance is the fact that each and every year companies must demonstrate profitability to maintain their eligibility for inclusion. Put another way; firms that on the screening date cannot demonstrate a prior four quarters of cumulative positive earnings are excluded from the Index.

Conclusion

After such strong performance in U.S. mid-cap stocks, we believe a focus on a disciplined rebalancing process gains significant importance. While market capitalization-weighted indexes may simply continue giving the greatest weights to the firms with the largest market caps, WTMEI focuses on fundamentals, specifically the Earnings Stream, to determine its constituent weights. We believe this gives WTMEI the potential to sell stocks that have become more expensive and buy stocks that have become less expensive relative to the earnings they have generated. In essence, this could be one way to manage risk after a market rally.Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.