Is Managed Futures Getting Its Groove Back?

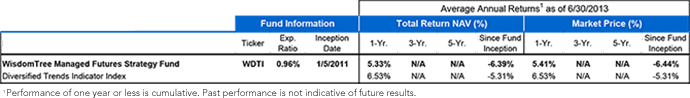

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, maybe be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Unlike traditional stock and bond exposures, managed futures strategies can take long or short positions using commodity, currency or interest rate futures. The particular strategy that the WisdomTree exchange-traded fund (ETF) track sets long or short positions at the end of each month based on price trends over the prior seven months. In June, the strategy was to short both U.S. 10-year notes and U.S. 30-year bonds; it thus benefitted from falling bond prices. The strategy was to short six foreign currencies against the U.S. dollar in June, and it is positioned to benefit, should foreign currencies, including the Japanese yen and British pound, continue to decline in 2013 against the U.S. dollar.

WDTI has also been short gold and silver futures for all of 2013 and thus has benefitted from their precipitous decline over the last few months.

Many managed futures strategies did not perform well in 2011 and 2012. One reason was a lack of profitable multi-month price trends for the strategies to follow. Another was the lack of interest income generated in a low-interest rate environment. Given that interest rates are coming off historically low levels, a rising interest rate environment could serve as a driver for these strategies going forward.

Unless otherwise noted, data source is Bloomberg, as of June 2013.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, maybe be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Unlike traditional stock and bond exposures, managed futures strategies can take long or short positions using commodity, currency or interest rate futures. The particular strategy that the WisdomTree exchange-traded fund (ETF) track sets long or short positions at the end of each month based on price trends over the prior seven months. In June, the strategy was to short both U.S. 10-year notes and U.S. 30-year bonds; it thus benefitted from falling bond prices. The strategy was to short six foreign currencies against the U.S. dollar in June, and it is positioned to benefit, should foreign currencies, including the Japanese yen and British pound, continue to decline in 2013 against the U.S. dollar.

WDTI has also been short gold and silver futures for all of 2013 and thus has benefitted from their precipitous decline over the last few months.

Many managed futures strategies did not perform well in 2011 and 2012. One reason was a lack of profitable multi-month price trends for the strategies to follow. Another was the lack of interest income generated in a low-interest rate environment. Given that interest rates are coming off historically low levels, a rising interest rate environment could serve as a driver for these strategies going forward.

Unless otherwise noted, data source is Bloomberg, as of June 2013.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. An investment in this Fund is speculative and involves a substantial degree of risk. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise (or short-only indexes decline). The Fund’s investment objective is based on historical price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed, thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.