Rosneft Deal Brings Dose of Optimism to Embattled Energy Sector

For definitions of indexes, please visit our Glossary.

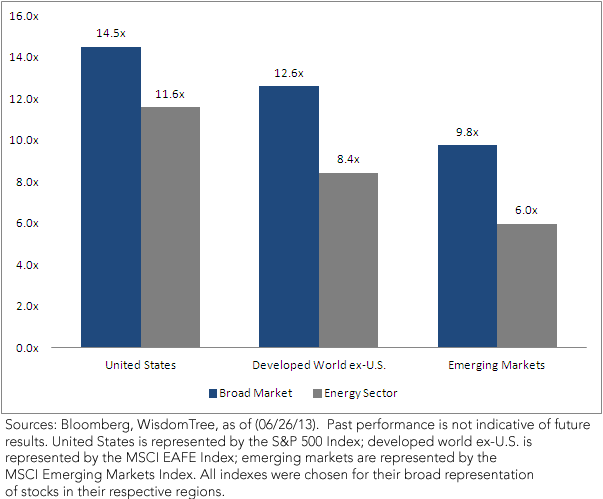

• Energy Sector Shows Low Price-to-Earnings Ratio – The Energy sector currently has a lower price-to-earnings ratio than the respective broad market indexes. This potentially signals, for each region, that the Energy sector is trading at a discount compared to the broad market-based earnings.

• Emerging Market Energy Has Most Attractive Valuations – On an absolute basis, the emerging market Energy sector is trading at the lowest valuation, illustrated by the lowest price-to-earnings ratio. The emerging market Energy sector is trading at approximately a 50% discount to the U.S. Energy sector, and a 30% discount to the developed world ex-U.S. Energy sector.

• Emerging Market Energy Shows Largest Valuation Discount Within Respective Markets – Looking at the price-to-earnings discount of the Energy sector compared to the broad market within each region, the emerging market Energy sector appears to be the most discounted—approximately 39% lower than the respective broad market. The developed world ex-U.S. Energy sector is trading at a 33% discount, and the U.S. Energy sector at a 20% discount.

Further Catalysts

It is impossible to know what will eventually close the valuation gap between the Energy sector and the broad markets across different regions; we believe that buying assets at low prices is a profitable investment strategy over the long term. The deal between China and Rosneft should serve as an important signal that long-term appetite for raw materials is not abating and the growth prospects of emerging markets still appear much better than those of the developed world, based simply on demographics. There should be little question that these countries need natural resources to fuel their growth and think the discounts in emerging market energy stocks are attractive.

For definitions of indexes, please visit our Glossary.

• Energy Sector Shows Low Price-to-Earnings Ratio – The Energy sector currently has a lower price-to-earnings ratio than the respective broad market indexes. This potentially signals, for each region, that the Energy sector is trading at a discount compared to the broad market-based earnings.

• Emerging Market Energy Has Most Attractive Valuations – On an absolute basis, the emerging market Energy sector is trading at the lowest valuation, illustrated by the lowest price-to-earnings ratio. The emerging market Energy sector is trading at approximately a 50% discount to the U.S. Energy sector, and a 30% discount to the developed world ex-U.S. Energy sector.

• Emerging Market Energy Shows Largest Valuation Discount Within Respective Markets – Looking at the price-to-earnings discount of the Energy sector compared to the broad market within each region, the emerging market Energy sector appears to be the most discounted—approximately 39% lower than the respective broad market. The developed world ex-U.S. Energy sector is trading at a 33% discount, and the U.S. Energy sector at a 20% discount.

Further Catalysts

It is impossible to know what will eventually close the valuation gap between the Energy sector and the broad markets across different regions; we believe that buying assets at low prices is a profitable investment strategy over the long term. The deal between China and Rosneft should serve as an important signal that long-term appetite for raw materials is not abating and the growth prospects of emerging markets still appear much better than those of the developed world, based simply on demographics. There should be little question that these countries need natural resources to fuel their growth and think the discounts in emerging market energy stocks are attractive.

Important Risks Related to this Article

You cannot invest directly in an index. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.