Potential for Dividend Growth Outside the United States

For definitions of terms and indexes, visit our Glossary.

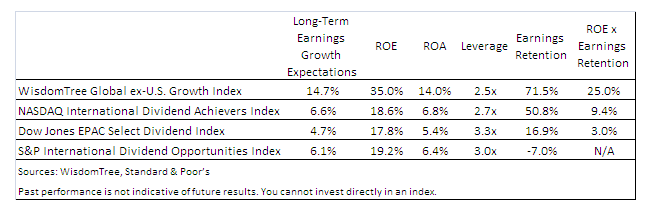

• Earnings Retention: The earnings retention rate of firms within the WisdomTree Global ex-U.S. Growth Index is significantly higher than that of the other indexes listed. All of these indexes focus solely on dividend payers, but we believe this result is a direct focus of weighting schemes focused on yield. One way to generate yield is to pay out a higher proportion of current earnings, but the fact is, this higher current payout (and lower earnings retention) may hurt future growth potential.

• ROE: ROE for firms within the WisdomTree Global ex-U.S. Growth Index is nearly two times that of the other indexes listed. Notably, all of these figures are quite strong, but the direct focus applied in WisdomTree’s methodology certainly emphasizes this attribute.

Conclusion

There is no one way to determine future equity valuation, but the dividend discount model has been around for a significant length of time. We also believe that it makes logical sense that potential dividend growth could be constrained by earnings reinvestment and profitability of those earnings—as it would be these two factors driving the potential generation of cash that could be used to pay higher future dividends. Dividend-focused indexes that employ a variety of yield-focused weighting methodologies may not be the strongest options for those looking for future growth potential.

Read our full research here.

1 William L. Silber & Jessica Wachter, “Equity Valuation Formulas,” New York University, 2013.

For definitions of terms and indexes, visit our Glossary.

• Earnings Retention: The earnings retention rate of firms within the WisdomTree Global ex-U.S. Growth Index is significantly higher than that of the other indexes listed. All of these indexes focus solely on dividend payers, but we believe this result is a direct focus of weighting schemes focused on yield. One way to generate yield is to pay out a higher proportion of current earnings, but the fact is, this higher current payout (and lower earnings retention) may hurt future growth potential.

• ROE: ROE for firms within the WisdomTree Global ex-U.S. Growth Index is nearly two times that of the other indexes listed. Notably, all of these figures are quite strong, but the direct focus applied in WisdomTree’s methodology certainly emphasizes this attribute.

Conclusion

There is no one way to determine future equity valuation, but the dividend discount model has been around for a significant length of time. We also believe that it makes logical sense that potential dividend growth could be constrained by earnings reinvestment and profitability of those earnings—as it would be these two factors driving the potential generation of cash that could be used to pay higher future dividends. Dividend-focused indexes that employ a variety of yield-focused weighting methodologies may not be the strongest options for those looking for future growth potential.

Read our full research here.

1 William L. Silber & Jessica Wachter, “Equity Valuation Formulas,” New York University, 2013.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.