Australia: Higher Yield Potential and Faster Economic Growth

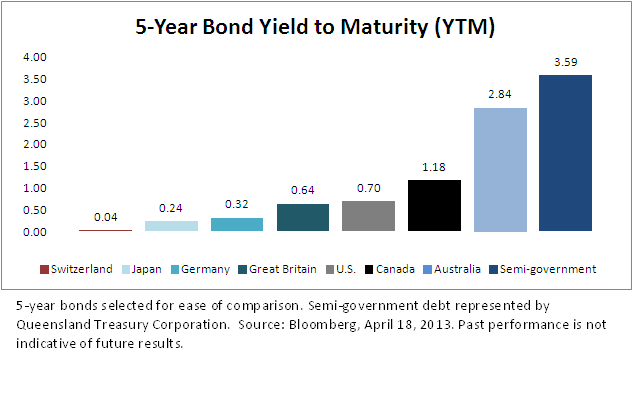

Australian Yields Compare Favorably to Other Reserve Currencies

As shown by the chart above, Australian government debt continues to offer a significant yield premium compared to other reserve currencies. Despite the rally in yields last year, Australian markets still provide attractive levels of income compared to most developed market peers. Among reserve currencies, Australian yields are significantly higher than those of Germany, Switzerland or Canada (the only countries rated AAA or equivalent by all three major ratings agencies). In addition to Australian government debt, a deep and liquid market of high-credit quality semi-government debt can offer additional opportunities for yield enhancement. Last year, we touched on the possibility of Chinese sovereign wealth funds increasing allocations to semi-government debt to take advantage of these higher yields. As of March 31, 2013, 89% of the US$648 billion in Australian debt outstanding was rated AA+ or better by S&P, Moody’s and Fitch.4

Direct Currency Trading with China

As Australia’s largest trading partner, China and its economic growth can have a significant impact on the Australian economy. Recently, Chinese economic growth moderated to 7.7%, disappointing many investors. While some believe this announcement supports the case for a broader slowdown, we are not so pessimistic. A development we believe to be beneficial for both countries has to do with how they trade with one another. On April 11, 2013, direct trade between the Australian dollar and the Chinese yuan occurred for the first time in history. Previously, trade between the two countries required an intermediate trade in U.S. dollars. By eliminating this step, trade should become more efficient due to lower transaction costs and slippage.

Australian Yields Compare Favorably to Other Reserve Currencies

As shown by the chart above, Australian government debt continues to offer a significant yield premium compared to other reserve currencies. Despite the rally in yields last year, Australian markets still provide attractive levels of income compared to most developed market peers. Among reserve currencies, Australian yields are significantly higher than those of Germany, Switzerland or Canada (the only countries rated AAA or equivalent by all three major ratings agencies). In addition to Australian government debt, a deep and liquid market of high-credit quality semi-government debt can offer additional opportunities for yield enhancement. Last year, we touched on the possibility of Chinese sovereign wealth funds increasing allocations to semi-government debt to take advantage of these higher yields. As of March 31, 2013, 89% of the US$648 billion in Australian debt outstanding was rated AA+ or better by S&P, Moody’s and Fitch.4

Direct Currency Trading with China

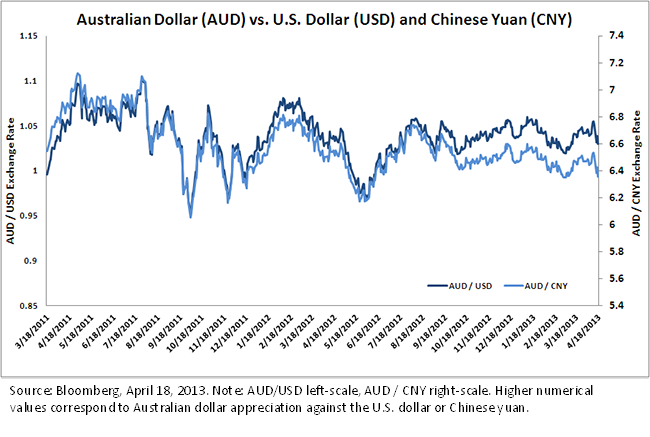

As Australia’s largest trading partner, China and its economic growth can have a significant impact on the Australian economy. Recently, Chinese economic growth moderated to 7.7%, disappointing many investors. While some believe this announcement supports the case for a broader slowdown, we are not so pessimistic. A development we believe to be beneficial for both countries has to do with how they trade with one another. On April 11, 2013, direct trade between the Australian dollar and the Chinese yuan occurred for the first time in history. Previously, trade between the two countries required an intermediate trade in U.S. dollars. By eliminating this step, trade should become more efficient due to lower transaction costs and slippage.

More efficient trade is a clear positive for both economies, but what effects could this have on investor portfolios? For the past six months, many analysts have voiced concern about the strength of the Australian dollar against the U.S. dollar. However, the United States is only Australia’s third-largest trading partner.5 Interestingly, the Australian dollar is trading 11% below its two-year high against the Chinese yuan. While the value of the Australian dollar may not be as attractive as it was this time last year (5% higher than the two-year low), we do not believe we are approaching a period of prolonged currency weakness. With many economists in Australia concerned about the effects of currency strength on exports, it is interesting that the currency’s strength is near its two-year average when compared to the currency of Australia’s largest export market, China. Putting these figures in perspective, it is worth noting that even in the face of currency strength, Australia’s economy expanded at the fastest pace of any developed market in 2012.6

Regional Economic Leadership and the Potential for Interest Rate Cuts

Despite recent concerns about a continuation of recession in the eurozone, economies in Asia are projected to grow at the fastest rates in the world. For 2013, economists at the IMF currently expect the Australian economy to expand by approximately 3%, a by-product of strong intra-Asian trade. However, should exports unexpectedly cool, Australian policymakers have a higher degree of flexibility compared to central banks in Europe and the U.S. With short-term rates currently at 3.0%, the Reserve Bank of Australia could cut rates to lower borrowing costs. Recently, Prime Minister Julia Gillard signaled this option, should global economic growth slow.

Ultimately, we believe that investors will continue to search for higher-yielding opportunities around the world. Given the current environment, we believe allocations to Australian debt could provide investors with attractive levels of income combined with diversification away from the U.S. dollar.

1Standard & Poor’s, March 31, 2013

2Source: Bloomberg, March 31, 2013.

3Source: Wall Street Journal, March 6, 2013.

4Proxied by the Citigroup Australia Broad Investment Grade (AusBIG) Index, March 31, 2013.

5Source: Australian Government Department of Foreign Affairs and Trade, October 2012.

6Source: IMF, April 16, 2013.

More efficient trade is a clear positive for both economies, but what effects could this have on investor portfolios? For the past six months, many analysts have voiced concern about the strength of the Australian dollar against the U.S. dollar. However, the United States is only Australia’s third-largest trading partner.5 Interestingly, the Australian dollar is trading 11% below its two-year high against the Chinese yuan. While the value of the Australian dollar may not be as attractive as it was this time last year (5% higher than the two-year low), we do not believe we are approaching a period of prolonged currency weakness. With many economists in Australia concerned about the effects of currency strength on exports, it is interesting that the currency’s strength is near its two-year average when compared to the currency of Australia’s largest export market, China. Putting these figures in perspective, it is worth noting that even in the face of currency strength, Australia’s economy expanded at the fastest pace of any developed market in 2012.6

Regional Economic Leadership and the Potential for Interest Rate Cuts

Despite recent concerns about a continuation of recession in the eurozone, economies in Asia are projected to grow at the fastest rates in the world. For 2013, economists at the IMF currently expect the Australian economy to expand by approximately 3%, a by-product of strong intra-Asian trade. However, should exports unexpectedly cool, Australian policymakers have a higher degree of flexibility compared to central banks in Europe and the U.S. With short-term rates currently at 3.0%, the Reserve Bank of Australia could cut rates to lower borrowing costs. Recently, Prime Minister Julia Gillard signaled this option, should global economic growth slow.

Ultimately, we believe that investors will continue to search for higher-yielding opportunities around the world. Given the current environment, we believe allocations to Australian debt could provide investors with attractive levels of income combined with diversification away from the U.S. dollar.

1Standard & Poor’s, March 31, 2013

2Source: Bloomberg, March 31, 2013.

3Source: Wall Street Journal, March 6, 2013.

4Proxied by the Citigroup Australia Broad Investment Grade (AusBIG) Index, March 31, 2013.

5Source: Australian Government Department of Foreign Affairs and Trade, October 2012.

6Source: IMF, April 16, 2013.Important Risks Related to this Article

S&P and Fitch ratings assist investors by evaluating the credit worthiness of many bond issues. AAA to BBB ratings are typically issued to those securities considered investment grade. The rating is not a recommendation to buy or sell a particular bond. For information on S&P rating agency’s methodology go to: http://www.standardandpoors.com/home/en/us. For information on Fitch rating agency's methodology go to: http://www.fitchratings.com Diversification does not eliminate the risk of experiencing investment losses.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.